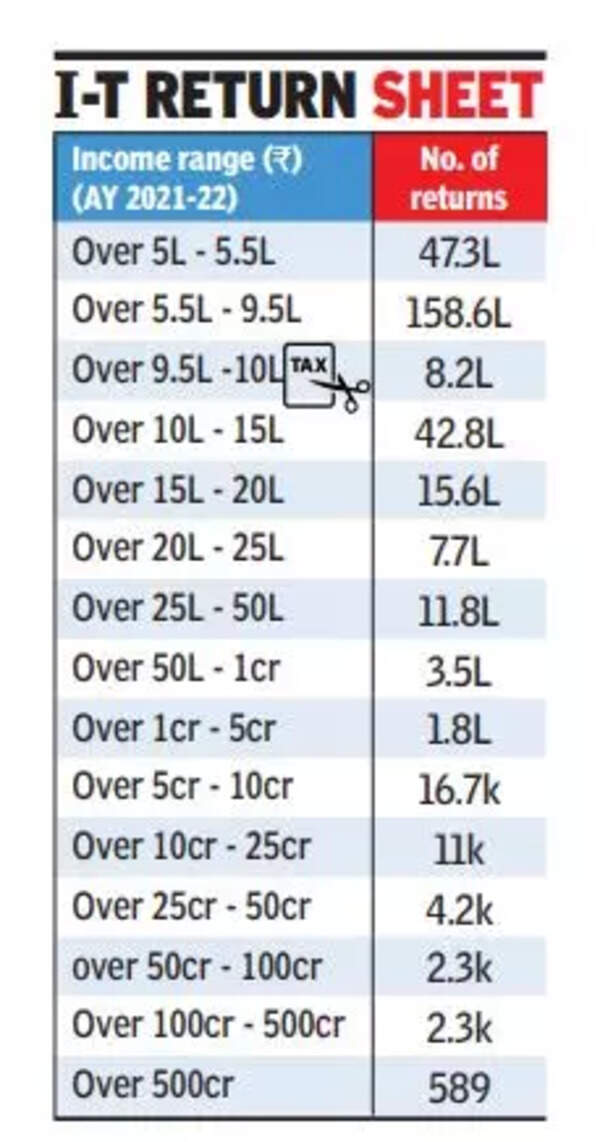

The quantity rose by practically 34% within the evaluation 12 months 2021-22 from the 441 such entities which filed returns of over Rs 500 crore.Roughly 1.6 crore taxpayers paid taxes however didn’t file returns for AY 2020-21, the information confirmed. Practically 6.7 crore returns had been filed throughout this era.

Direct taxes comprise earnings and company taxes with 554 of the 589 being corporations that filed returns of gross whole earnings of over Rs 500 crore. Within the earlier 12 months, there have been 413 such corporations. In distinction, the variety of people reporting over Rs 500 crore gross earnings fell from 12 in AY2020-21 to seven in AY2021-22. HUFs, companies, affiliation of individuals and others made up the remainder of the 589. The statistics had been generated from e-filed returns as much as March 31, 2023, the division stated.

Tax specialists attributed the surge in returns and incomes to strong financial development, rising company income, increased family incomes and higher use of massive information and expertise by tax authorities.

‘Tech utilization boosts development of direct tax collections’

There are two or three key causes for this. One is that company income have been strong they usually have grown previously few years. There has additionally been a rise within the variety of households with Rs 10 lakh earnings – actually they’ve grown 3 times over the previous 4 years,” stated Dinesh Kanabar, chief govt officer of Dhruva Advisors.

“Direct tax collections have additionally grown as a consequence of a better formalisation of the economic system and the tax division is utilizing expertise together with huge information. Each transaction is taxed and there’s now tax assortment at supply even for abroad journey,” stated Kanabar.

R Prasad, former chairman of the Central Board of Direct Taxes, attributed the advance to company income. He additionally stated that tax deducted at supply accounted for practically 45% of direct tax receipts.

The tax division has undertaken a string of measures to spice up receipts and plug loopholes. The usage of GST information has additionally helped the earnings tax division to match numbers.

Newest information confirmed that earnings tax returns filed by particular person taxpayers have elevated by 90% between 2013-14 and 2021-22. The information confirmed that returns filed by particular person taxpayers elevated from 3.4 crore within the evaluation 12 months 2013-14 to six.4 crore in 2021-22. Through the present fiscal too, 7.4 crore returns have been filed for evaluation 12 months (AY) 2023-24 until date, together with 53 lakh new filers.