The Taiex Index and Nifty 50 each commerce at about 20 occasions of ahead estimated earnings, in contrast with MSCI China at a bit above 9. (Photograph: Reuters)

By Abhishek Vishnoi and John Cheng

The race to exchange China’s prime spot in rising market fairness portfolios is heating up, with Taiwan and India working neck to neck as formidable rivals.

Due to document inventory rallies, Taiwan and India now command greater than 19 per cent weightings every within the MSCI EM Index. That compares to China’s 22.8 per cent, whose standing has steadily shrunk over the previous few years, Bloomberg-compiled knowledge present.

The rise of Taiwan and India is permitting traders to higher diversify by betting on synthetic intelligence chipmakers and the infrastructure growth coming from Modi’s applications to modernise the nation. Because the US charge cycle peaks out, having engaging choices in rising markets is prime to any pivoting of capital flows.

)

At its peak in 2020, China accounted for 40 per cent of the MSCI EM Index, with traders lured by thriving e-commerce to gross sales of costly liquor. That heavy weightage price cash managers dearly, with trillions of {dollars} worn out as Beijing launched into regulatory crackdowns and went on a deleveraging marketing campaign for its indebted property sector.

If current traits maintain, Taiwan or India might meet up with China’s standing in MSCI EM this yr, marking a shift right into a multi-polar rising markets world.

Taiwan’s ascent is all of the extra notable contemplating its market capitalisation — at $2.6 trillion — stands at lower than a 3rd of mainland China’s. The Taiex Index has risen 33 per cent this yr to turn out to be one of many world’s best-performing main benchmarks, bolstered by features in Nvidia Corp. provider Taiwan Semiconductor Manufacturing Co.

In the meantime, India’s Nifty 50 Index has superior greater than 12 per cent in 2024, hitting a contemporary excessive as Prime Minister Narendra Modi promised coverage continuity.

That’s in distinction to the sluggishness in Chinese language shares. Benchmarks have barely gained for the yr, highlighting an urgency for policymakers to unveil a roadmap on the Third Plenum to resolve woes just like the property disaster.

)

Earnings are a vital issue behind the allocation preferences. The 12-month ahead earnings estimates for the MSCI China Index have barely modified yr to this point, whereas these for Taiwan and India have elevated by at the very least 13 per cent every.

“EM ex-China appears stable from an earnings angle,” mentioned Kumar Gautam, a quantitative strategist with Bloomberg Intelligence. “The hole between China and EM ex-China earnings revision is at a historic excessive and China’s earnings revision are too gradual to select up.”

)

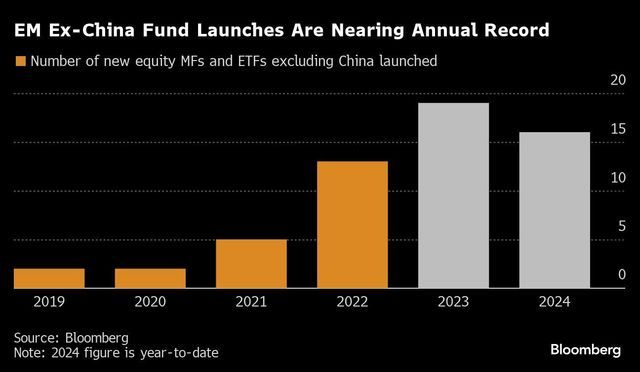

Nonetheless, cash continues to help the shift.

Rising Asia ex-China’s fairness markets recorded web inflows of almost $9 billion for the reason that begin of June, with South Korea, India and Taiwan among the many prime recipients, in response to knowledge compiled by Bloomberg. In the meantime, mainland China has seen outflows through the buying and selling hyperlinks with Hong Kong throughout the interval.

“Tech is consuming the world,” mentioned Pruksa Iamthongthong, deputy head of Asia equities at abrdn. “This solely compounds with AI, and we see the actual winners as Asian tech {hardware} and semiconductor provide chain names.”

First Printed: Jul 13 2024 | 8:03 AM IST

&w=696&resize=696,0&ssl=1)