The monetary markets in India and elsewhere on Monday had been rattled by developments within the US and Japan, two of the world’s main economies with vital ties to the worldwide monetary system.

Considerations a few potential recession within the US, pushed by disappointing jobs knowledge, and the unwinding of yen carry trades, prompted by an rate of interest hike in Japan, triggered sharp reactions by traders throughout equities, bonds, and currencies.

The Sensex fell as a lot as 2,686 factors, or 3.3 per cent, earlier than ending the session at 78,759 — down 2,223 factors, or 2.7 per cent than Friday’s shut. Equally, the Nifty 50 dropped 670 factors, or 2.7 per cent, to shut at 24,048. For each indices, this was the sharpest single-day decline for the reason that Lok Sabha election outcomes day on June 4.

The market rout resulted in a big erosion of investor wealth, with a loss amounting to Rs 15.3 trillion. The whole market capitalisation of BSE-listed firms now stands at Rs 442 trillion ($5.27 trillion), having decreased by over Rs 20 trillion over the previous three buying and selling classes.

Authorities bonds, nevertheless, noticed beneficial properties as they tracked the autumn in US Treasury yields, in keeping with market members. The ten-year authorities bond yield settled at 6.86 per cent, the bottom since March 31, 2022, in comparison with 6.90 per cent on Friday.

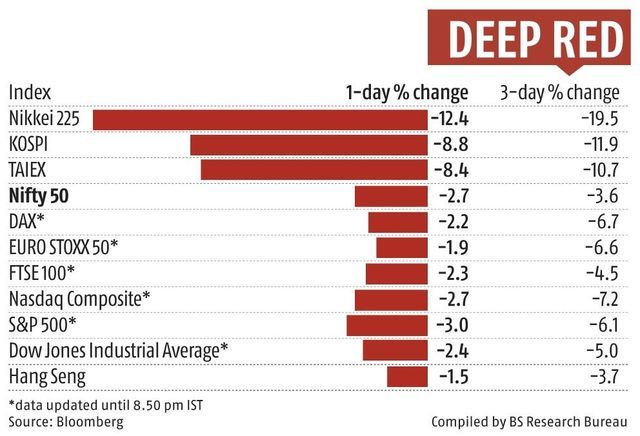

Regardless of the sharp decline in home equities, the autumn was much less extreme in comparison with different Asian markets resembling Japan (down 12.4 per cent), South Korea (down 9 per cent), and Australia (down 3.7 per cent). In Japan and South Korea, circuit breakers that mechanically halt buying and selling had been activated to stem the bleeding. Wall Road’s fundamental indices, too, had been buying and selling within the purple in early commerce.

Bitcoin, too, was down over 7 per cent to commerce at $54,616.62 (at 9.30 pm IST), in order was Brent crude, which was buying and selling barely within the purple at $76.37 a barrel.

International portfolio traders (FPIs) bought shares price Rs 10,073 crore, whereas home institutional traders (DIIs) had been web patrons to the tune of Rs 9,156 crore. If not for the home shopping for help, the Indian markets might need witnessed a extra extreme collapse. Monday’s FPI web promoting was the third-largest single-day outflow ever recorded and the most important since June 4, 2024.

A US jobs report on Friday revealed a slowdown in hiring, with the unemployment fee rising to 4.3 per cent, the best in three years, marking the fourth consecutive month-to-month improve. The rising jobless fee has heightened fears of an impending recession. Considerations a few slowdown within the US financial system have intensified bets that the Federal Reserve would possibly go for an emergency fee reduce or a 50-basis level discount at its subsequent assembly. Some market members have additionally criticised the Fed for being behind the curve in easing financial coverage.

)

Analysts counsel that the sell-off in equities might turn into extra pronounced as assumptions of a mushy touchdown — which had underpinned latest market beneficial properties — come beneath scrutiny.

“We now have moved from expectations of a mushy touchdown to recession fears inside per week. It might’t be that excessive. We have to see whether or not the Fed panics and takes fast motion. Add to that the anxiousness surrounding the unwinding of yen carry trades. The rout additionally exhibits considerations concerning the excessive valuations of US tech firms and earnings not matching up,” stated Andrew Holland, CEO of Avendus Capital Public Markets Alternate Methods.

The reversal of yen carry trades after Japan’s central financial institution raised rates of interest additionally raises considerations about potential outflows from main fairness markets. Carry trades contain traders borrowing from the markets with decrease rates of interest (Japan, on this case) to buy higher-yielding equities and different monetary belongings in overseas markets.

“The yen has appreciated considerably, making carry trades a shedding proposition that should be unwound. This will affect India, too, as we’ve got substantial investments from Japanese traders, both immediately or not directly. Till there’s some enchancment within the international state of affairs, one mustn’t contemplate shopping for on dip,” stated U R Bhat, co-founder of Alphaniti Fintech.

The Nifty VIX surged by 42 per cent — probably the most in 9 years — to finish at 20.4, indicating that traders are bracing for extra volatility within the coming days. The CBOE Volatility index, also called Wall Road’s “worry gauge”, breached its long-term common stage of 20 factors final week and was presently at 40.63.

“What the markets are saying is we would like an emergency Fed reduce and the Financial institution of Japan to reverse its coverage, however central banks do not act that shortly simply because the markets are falling,” stated Holland.

Market breadth was notably weak, with over 5 shares declining for each advancing one on the BSE. All Sensex parts ended within the purple, aside from FMCG giants Hindustan Unilever and Nestlé India. Tata Motors skilled probably the most vital drop at 7.3 per cent, adopted by Adani Ports and Tata Metal, each falling over 5 per cent. All BSE and NSE sectoral indices closed with losses, with realty and metals indices witnessing the steepest decline of over 4 per cent every.

First Revealed: Aug 05 2024 | 11:34 PM IST