MUMBAI: Report development in gold loans sanctioned by banks and non-banking finance firms is seen to be the set off for RBI to step in and ask lenders to repair gaps in accounting for these loans to keep away from a build-up of unhealthy debt on their books.

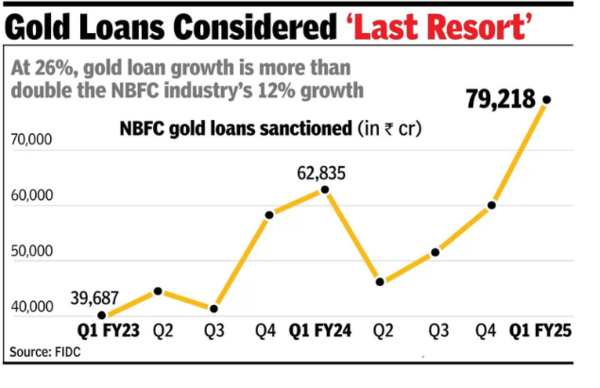

Gold mortgage sanctions in Q1 FY25 grew 26% year-on-year and 32% over the March quarter, with the entire sanctioned quantity equalling Rs 79,217 crore, knowledge by the Finance Trade Growth Council confirmed.The rise just isn’t a one-time prevalence however has been constant over a number of quarters. Throughout April-June 2023, the rise was 10%.

This enhance is regardless of stiff competitors from banks within the phase. Based on RBI’s sectoral knowledge on financial institution credit score for Aug 2024, gold loans grew practically 41% year-on-year to Rs 1.4 lakh crore.

On Monday, RBI had directed banks and finance firms to overview their gold mortgage insurance policies and procedures, and to rectify any deficiencies inside three months’ time. This adopted a overview that uncovered irregular practices corresponding to hiding unhealthy loans in addition to evergreening loans by way of top-ups and roll-overs with out correct appraisal.

Whereas gold loans are simple to entry, given the collateral, they’re handled because the final resort borrowing by those that unable to faucet into different sources of funding.

The expansion in gold loans is greater than double the general NBFC trade’s development, which noticed mortgage development of 12% year-on-year. Different segments which have grown at a excessive charge are loans for brand spanking new and used automobiles. The following largest phase when it comes to sanctions is private loans, which account for 14% of NBFC lending. That is adopted by dwelling loans that are 10% of trade loans. Property loans and unsecured enterprise loans stand at slightly over 8%.