In a landmark judgment, Supreme Court docket dominated in favour of the income-tax (I-T) division, upholding the validity of practically 90,000 reassessment notices issued after April 1, 2021, underneath the previous provisions. Over 9,000 writ petitions had been filed in numerous excessive courts difficult these notices, with most courts siding with taxpayers.

A bench of Chief Justice of India D Y Chandrachud and Justices J B Pardiwala and Manoj Misra responded to 727 I-T appeals.

These reassessment notices cowl evaluation years from 2013-14 to 2017-18, involving each people and companies. The estimated quantum concerned may run into hundreds of crores.

The SC needed to decide whether or not I-T can re-open assessments after April 1, 2021, as per the pre-amended provisions of the I-T Act.

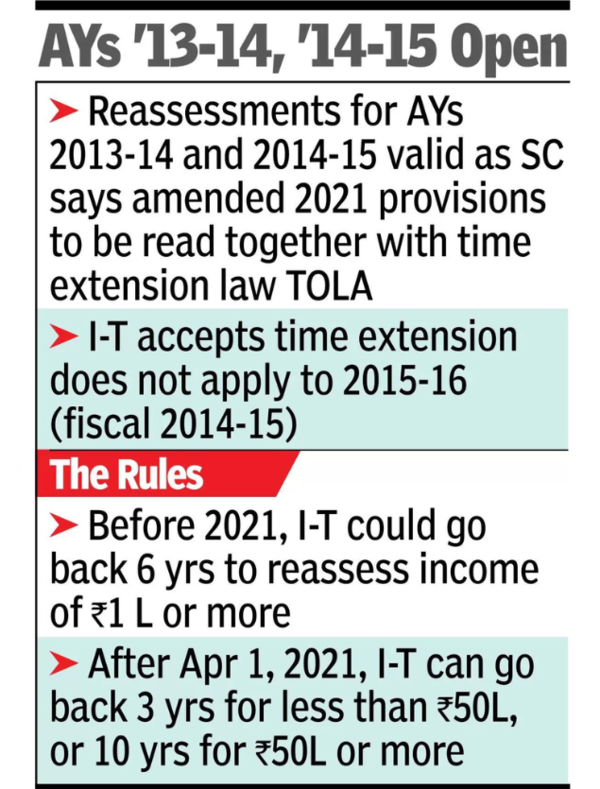

In accordance with the provisions of the I-T Act previous to April 1, 2021, instances could possibly be reopened for reassessment as much as six years earlier than the related evaluation 12 months (by which the discover was acquired) if the escaped revenue was Rs 1 lakh or extra.

The 2021 modification modified the timeline and the I-T authorities may re-open issues going again as much as three years, if the escaped revenue was lower than Rs 50 lakh. If the quantum was increased, the division may return as much as 10 years.

Extra vital, the 2021 modification inserted a brand new provision (Part 148A) which mandated the division ought to ship a preliminary (showcause) discover earlier than sending a reassessment discover. This gave the taxpayer the suitable to be heard and the I-T officer was duty-bound to think about the submissions made.

Nevertheless, in view of the COVID-19 pandemic, the federal government issued a notification to increase the time interval for issuance of notices underneath the previous regulation. Consequently, reassessment notices have been issued between April 1, 2021, and June 30, 2021, as per the provisions of the previous regulation.

In technical phrases, the SC needed to decide whether or not the advantage of ‘Taxation and Different Legal guidelines (Rest and Modification of Sure Provisions Act)’ – the TOLA Act, which allows leisure of closing dates underneath particular acts would govern the timeframe for reassessment. The moot problem was: would the manager powers – aka the notification prevail regardless of a brand new laws (new provisions)?

A number of excessive courts, comparable to Bombay HC, Gujarat HC, Allahabad HC quashed all of the reassessment notices on numerous grounds. Their important rivalry was the brand new provisions have been extra useful and have been meant to guard the rights and pursuits of taxpayers. These excessive courts had held TOLA wouldn’t prolong the time restrict for issuing reassessment notices.

Deepak Joshi, advocate, mentioned: “The I-T division has conceded the time extension underneath TOLA doesn’t apply to the evaluation 12 months 2015-16 (monetary 12 months 2014-15). Thus, proceedings for this specific monetary 12 months shall be invalid as being time barred.”

“Nevertheless, reassessments for AYs 2013-14 and 2014-15, which might in any other case be time barred underneath the brand new provisions shall be legitimate, because the SC has mentioned that the amended provisions are to be learn along with TOLA,” added Joshi.