NEW DELHI: Overseas traders have turned web sellers in Oct, offloading shares value Rs 27,142 crore in simply the primary three days of the month on account of intensifying battle between Israel and Iran, a pointy rise in crude oil costs, and improved efficiency of Chinese language inventory markets.

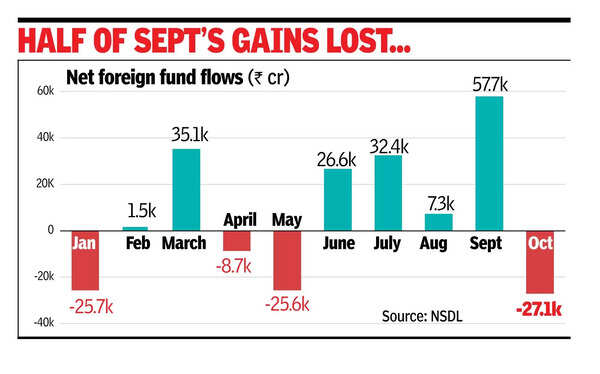

The outflow got here after FPI funding reached a nine-month excessive of Rs 57,724 crore in Sept.

Since June, overseas portfolio traders (FPIs) have constantly purchased equities after withdrawing Rs 34,252 crore in April-Might. General, FPIs have been web patrons in 2024, apart from Jan, April, and Might, knowledge with the depositories confirmed.

Wanting forward, world elements like geopolitical developments and the long run course of rates of interest will play an important position in figuring out the move of overseas investments into the Indian fairness markets, Himanshu Srivastava of Morningstar Funding Analysis India, mentioned.

In line with the information, FPIs made a web withdrawal of Rs 27,142 crore from equities between Oct 1 and 4, with Oct 2 being a buying and selling vacation. “The promoting has been primarily triggered by the outperformance of Chinese language shares,” V Okay Vijayakumar of Geojit Monetary Companies, mentioned.

Hong Kong’s Dangle Seng index shot up by 26% within the earlier month, and this bullishness is predicted to proceed since valuations of Chinese language shares are very low and the financial system is predicted to do effectively in response to the financial and financial stimulus being applied by the Chinese language authorities, he added.

“Escalating geopolitical tensions, pushed by the intensifying battle between Israel and Iran, a pointy rise in crude oil costs, and the improved efficiency of the Chinese language markets, which presently seem extra enticing when it comes to valuations, had been the first causes behind the current exodus of overseas investments from Indian equities,” Morningstar’s Srivastava mentioned.

This, in flip, has contributed to the current sharp correction within the Indian fairness markets. When it comes to sector, FPI promoting in financials, particularly frontline banking shares, has made their valuations enticing. Lengthy-term home traders might utilise this chance to purchase high-quality banking shares, Vijayakumar mentioned.

To this point this yr, FPIs have invested Rs 73,468 crore in equities and Rs 1.1 lakh crore within the debt market.