NEW DELHI: The commerce division has stepped in to work out a long-term resolution to the credit score woes of exporters, particularly the smaller gamers, who’re complaining of lack of entry to finance with banks and RBI remaining mere spectator.

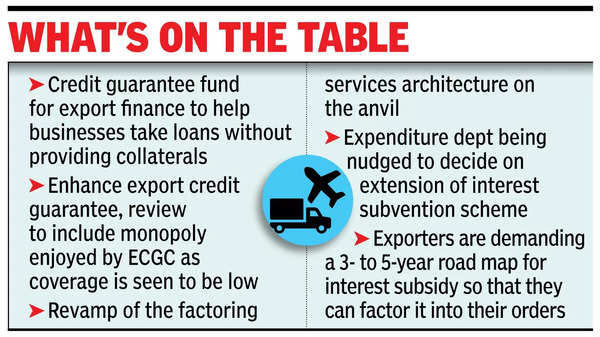

Among the many choices being mentioned is a credit score assure fund for export finance, modelled on the strains of the post-Covid mortgage package deal, that may free companies from the requirement of offering collaterals.Issues with entry to credit score are along with the price of credit score, which has soared and is a serious trigger for concern at a time when freight charges have already surged within the wake of pressure in West Asia, forcing ships to alter their course and take an extended and dearer route.

Knowledge shared by exporters with commerce and trade minister Piyush Goyal confirmed that excellent export credit score has declined from round Rs 2.3 lakh crore on the finish of March 2022 to below Rs 2.2 lakh crore final March, regardless of a 15% rise in exports in rupee phrases throughout this era. Exporters are already complaining of the expenditure division’s reluctance to not simply prolong the curiosity subsidy scheme past Sept, however its failure to supply future steerage as it could assist them worth their merchandise accordingly.

The fixed credit-related complaints have prompted the directorate common of overseas commerce (DGFT) to rope in consulting agency EY to evaluate a deep evaluation because it considers a number of choices.

The plan is to launch a multi-pronged assault on varied points associated to monetary companies that exporters should take care of. For example, there’s a rising view that the Export Credit score Assure Company is unable to fulfill your entire necessities of enterprise and commerce. The protection of the monopoly service supplier is $80-90 billion when the protection for merchandise exports must be of the order of $450 billion. “Why is it not increasing its footprint, could also be, the time has come to assessment its monopoly,” a policymaker steered.

Equally, factoring stays on the periphery though the service ought to allow companies to fulfill their money necessities by permitting them to promote their account receivables to a 3rd celebration at a reduction.