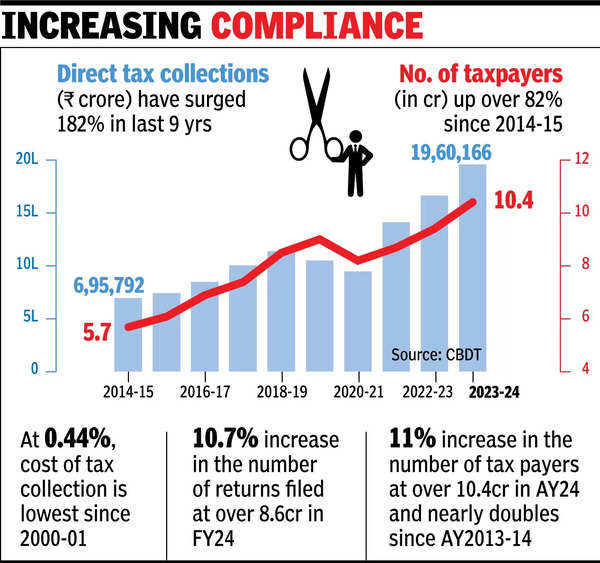

NEW DELHI: The variety of taxpayers rose 82% between 2014-15 and 2023-24, whereas direct tax receipts surged 182% prior to now 9 years, largely pushed by rising compliance, information launched by tax division on Thursday confirmed.

The time collection information launched by the Central Board of Direct Taxes (CDBT) confirmed the variety of taxpayers within the evaluation 12 months 2023-24 was at 10.4 crore, up from 5.7 crore in 2014-15.The tax division defines a “taxpayer” as an individual who both has filed a return of revenue for the related evaluation 12 months (AY) or in whose case tax has been deducted at supply within the related monetary 12 months however the taxpayer has not filed the return of revenue.

Led by progress in private revenue tax, complete direct tax receipts in 2023-24 had been at Rs 19.6 lakh crore, up 182% from almost Rs 7 lakh crore in 2014-15. Private revenue tax through the 9-year interval soared 293% to Rs 10,45,139 crore in 2023-24 from Rs 2,65,772 crore in 2014-15. For the second 12 months in a row, private revenue tax collections had been larger than company tax collections, which rose 112% to over Rs 9,11,055 crore in 2023-24 from Rs 4,28,925 crore in 2014-15, the information confirmed.

The contribution of direct tax to complete tax income in 2023-24 reached a 14-year excessive of 56.7%, up from 54.6% in 2022-23. Advance tax, paid each quarter, receipts rose 291% to Rs 12,77,868 crore in 2023-24 from Rs 3,26,525 crore in 2014-15, whereas tax deducted at supply (TDS) rose almost 152% through the 9-year interval to Rs 6,51,922 crore in 2023-24, from Rs 2,59,106 crore. Advance tax is a instrument meant to enhance compliance.

The price of assortment was the bottom since 2000-01 at 0.44% in 2023-24 from 1.36% in 2000-01. It has lowered over time as a consequence of higher tax administration and efforts mounted by the division.

Tax receipts have surged over time because of the sturdy financial progress and rising revenue ranges other than the measures rolled out by the division and using know-how to plug loopholes and develop the online. The division can also be utilizing instruments equivalent to synthetic intelligence, information analytics to spice up receipts and improve compliance.