Now Reading: D-St to trace US Fed’s fee resolution this week

-

01

D-St to trace US Fed’s fee resolution this week

D-St to trace US Fed’s fee resolution this week

[ad_1]

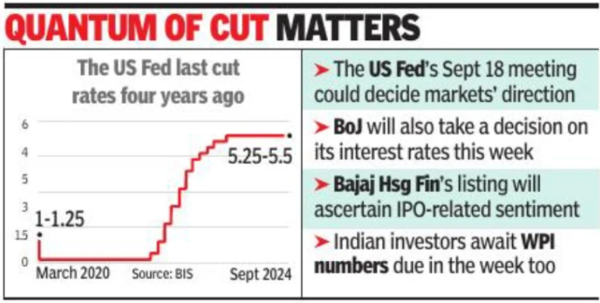

Within the new week, the Financial institution of Japan, too, will determine on whether or not to vary its rates of interest, which may even affect markets globally.The US Fed and BoJ are poised to maneuver in reverse instructions on charges.

As well as, the itemizing of Bajaj Housing Finance — which set a number of information for the IPO section of India — may even determine how buyers take a look at different presents within the pipeline.

The affect of the US Fed’s fee resolution on Sept 18 shall be felt within the Indian market on Thursday. “With a 25 foundation factors (100 foundation factors =1 share level) fee lower already priced in, a big market response is unlikely. The Fed’s steerage on inflation, progress, and future fee cuts shall be key in shaping broader market sentiment, notably concerning world liquidity and threat urge for food,” stated Ajit Mishra, SVP (analysis), Religare Broking. “A 50 bps lower may spark a constructive response, particularly in rising mar kets like India. Nevertheless, this impact could also be short-lived because it may additionally increase considerations in regards to the underlying energy of the US economic system.”

The choice on charges by BoJ is about for Friday, when Indian markets shall be open. Any resolution to hike charges may set off one other spherical of unwinding of speculative contracts primarily based on Japanese yen (referred to as yen carry commerce) and have the potential to set off excessive volatility in world markets, just like the one witnessed in early Aug, market gamers stated.

Indian buyers are additionally awaiting the WPI numbers due within the week. The home market can be impacted by how overseas funds place themselves after the choices by the US Fed and the BOJ.

The itemizing of Bajaj Housing Finance, set for Monday, would determine the Avenue’s path regarding IPOs. On Sunday night time, the gray market premium for the inventory — that offers some indications in regards to the itemizing of a inventory — was hovering round Rs 76 per share, whereas the IPO worth was set at Rs 70. Going by this, buyers are anticipated to double their cash on itemizing.

The week would additionally witness the itemizing of PN Gadgil Jewellers, which had a robust IPO as effectively. Traders can have the choice of investing in at the very least seven IPOs within the week, information on BSE and NSE confirmed.

[ad_2]

Supply hyperlink