Projections launched following their two-day assembly confirmed a slim majority, 10 of 19 officers, favoured reducing charges by at the least an extra half-point over their two remaining 2024 conferences.

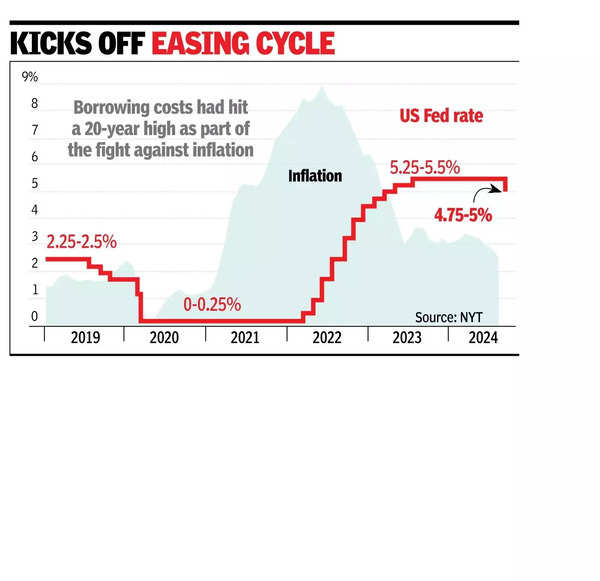

The Federal Open Market Committee voted 11 to 1 to decrease the federal funds price to a variety of 4.75% to five%, after holding it for greater than a 12 months at its highest degree in twenty years. Wednesday’s decisive transfer highlights the rising concern amongst policymakers over the employment panorama.

“The committee has gained higher confidence that inflation is transferring sustainably towards 2%, and judges that the dangers to reaching its employment and inflation objectives are roughly in steadiness,” the Fed stated in an announcement, including that officers are “strongly dedicated to supporting most employment” along with bringing inflation again to their purpose.

Policymakers pencilled in an extra share level of cuts in 2025, in keeping with their median forecast.

Governor Michelle Bowman dissented in favour of a smaller, quarter-point minimize, the primary dissent by a governor since 2005, and the primary dissent from any member of the FOMC since 2022.

Of their assertion, policymakers stated they may contemplate “extra changes” to charges based mostly on “incoming information, the evolving outlook and the steadiness of dangers.” Additionally they famous that inflation “stays considerably elevated” and job positive aspects have slowed. The central financial institution raised charges 11 instances, bringing its benchmark to a two-decade excessive in July 2023.

Since then, inflation has cooled significantly and – at 2.5% – is nearing the Fed’s 2% goal. And whereas the labour market has weakened, there isn’t any clear indication the US financial system is in recession or on the cusp of falling into one. Layoffs stay low, shoppers are nonetheless spending and financial development is powerful.

Nonetheless, there are rising indicators of pressure. Extra financial savings that helped assist People lately have run dry, and delinquency charges are rising. A rise in job losses might set off a pullback in spending and sluggish the financial system. The muddied financial image has elevated uncertainty and spurred divisions amongst Fed officers over the very best path ahead for coverage.

Some are anxious to curb labour-market weak spot earlier than it spirals into extra ache. Others fear that reducing charges too shortly might reignite demand and preserve inflation elevated.