NEW DELHI: The ministerial panel on GST price rationalisation is weighing decrease charges for a number of mass-use objects, together with medicines and tractors, to five%, whereas leaving the tax on merchandise, similar to cement, unchanged.

Decrease income from tractors, which at present face 12% or 28% GST relying on their classification, could partly be compensated by a rise in GST on high-end EVs, that value upwards of Rs 40 lakh and are imported, from the present 5%, a supply conversant in the discussions instructed TOI.

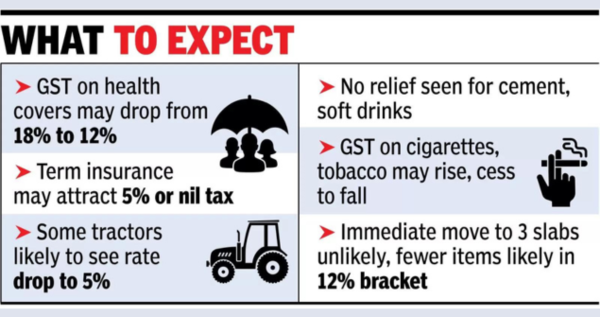

A discount in GST on well being and time period insurance coverage is, nevertheless, imminent. The one query is what the speed shall be. Well being covers may see the tax price drop from 18% to 12%, whereas time period insurance coverage could entice 5% GST, amid solutions of placing within the ‘nil’ price phase. However a zero price would imply that those that provide items and providers to life insurance coverage firms could not get enter tax credit score, making it an unattractive proposition for them. Because of this, 5% GST on time period insurance coverage seems to be a safer wager.

Though a discount within the variety of slabs from 4 to a few is unlikely, the ministerial panel headed by Bihar deputy CM Samrat Chaudhary, is seeking to scale back the variety of objects within the 12% bracket. Which implies a number of the objects could also be pushed into the 5% slab, whereas there can be others that may transfer to 18% as a part of a sluggish transition to a three-rate construction.

Issues are more likely to be clearer by the month-end because the panel on insurance coverage, additionally headed by Chaudhary, is scheduled to satisfy on Oct 19, whereas the one on price rationalisation will talk about item-wise particulars a day later. By then the officers within the fitment committee would have additionally labored out the small print.

Whereas a number of state FMs within the GoM (group of ministers) have indicated their willingness for a three-rate construction, Kerala, Karnataka and West Bengal are backing a establishment. In actual fact, Kerala FM Okay N Balagopal is seen to be extra reluctant than his friends relating to decrease charges, regardless of the Opposition searching for responsible the BJP-led govt on the Centre for the levies. The southern state’s poor funds could also be a purpose for the reluctance.

Income loss goes to be a key consideration for the states and the GoM is cognizant of the pressures. As an example, reducing charges on medicines from 12% to five% will go away an over Rs 11,000 crore gap for the Centre and the states. Equally, medical insurance fetches over Rs 8,000 crore GST. The 18% and the 28% slabs are the principle income turbines, with the latter accounting for 72-73% of the collections.

However, fears of cartelisation in sure industries can also be coming to their drawback. As an example, cement is more likely to be left untouched at 28%, given the trade’s monitor file at fixing costs. Equally, income implications will even weigh on sin items, similar to cigarette, tender drinks and even packed namkeen.