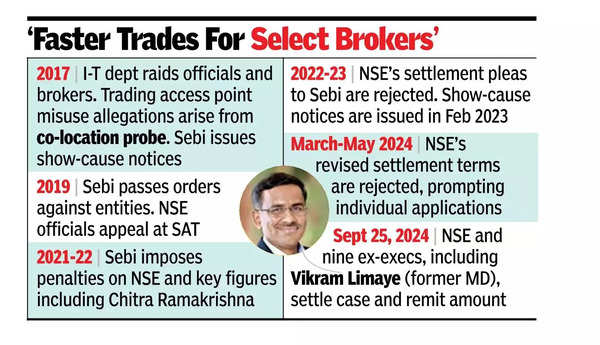

MUMBAI: NSE and 9 of its former senior executives, together with earlier MD Vikram Limaye, have settled a case with Sebi over allegations that brokers bypassed a buying and selling entry level to allow quicker trades for Rs 643 crore. That is the biggest settlement order in Sebi’s 36-year historical past. Along with the settlement quantity, eight officers have been requested to carry out not less than 14 days of professional bono neighborhood service.

Sebi has been investigating NSE’s buying and selling entry level (TAP) structure and community connectivity for practically a decade. The probe centered on whether or not buying and selling members bypassed TAP, the dealing with of a 2013 grievance, and whether or not NSE’s lapses led to securities legislation violations. Based on the order, NSE, on behalf of the candidates, remitted the settlement quantity on Sept 25, 2024.

The previous executives concerned embody NSE’s ex-chief technical officer Umesh Jain, GM Shenoy, chief info safety officer Narayan Neelakantan, chief regulatory officer V R Narasimhan, head of regulatory affairs Kamala Okay, VP of the enterprise options group Nilesh Tinaikar, former senior VP of operations Mayur Sindhwad, and former key worker R Nandakumar. Shenoy has been excluded from the neighborhood service order.

The important thing cost was that NSE didn’t take satisfactory measures to forestall buying and selling members from bypassing TAP. The grievance and TAP deficiencies weren’t reported to NSE’s Standing Committee on Know-how, even after Sebi’s 2015 round on cybersecurity. Extra allegations included delays in appointing a chief info safety officer, failure to implement encryption in TAP, and the omission of the chief expertise officer as key administration personnel, probably violating Sebi’s round.

TAP was an IT system deployed by NSE on buying and selling members’ servers to handle connections and trades. Regardless of the introduction of alternate options like ‘Trimmed TAP’ in 2013 and ‘Direct Join’ in 2016, TAP remained in use till 2019 for fairness and 2020 for securities lending and borrowing.