Now Reading: FPIs pull out Rs 59,000 crore from fairness in October

-

01

FPIs pull out Rs 59,000 crore from fairness in October

FPIs pull out Rs 59,000 crore from fairness in October

[ad_1]

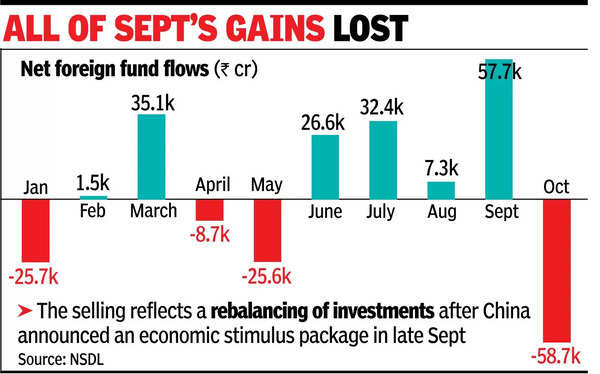

MUMBAI: International portfolio buyers have bought Rs 58,711 crore ($7 billion) value of fairness in Oct, being internet sellers in all eight buying and selling periods to this point. In Sept, FPI investments had reached a nine-month excessive of Rs 57,724 crore.

FPIs additionally offloaded Indian bonds, although internet bond gross sales have been modest at Rs 709 crore as a consequence of govt bond purchases. The gross sales mirror a rebalancing of investments after China introduced a serious financial stimulus package deal in late Sept.Whereas CLSA has elevated China’s weightage and diminished India’s obese publicity from 20% to 10%, Jefferies minimize India’s weightage by 1% and elevated China’s by 2% on Oct 2, 2024.

“This huge promoting did not affect the market a lot as home institutional buyers – supported by robust fund inflows – absorbed the promoting,” V Okay Vijayakumar of Geojit Monetary Providers, stated.

FPIs are anticipated to take a position round $2 billion (Rs 16,400 crore) in Hyundai’s Rs 27,810 crore IPO, however that won’t offset outflows if the Iran-Israel battle escalates. Moreover, the demand for Indian govt bonds following their inclusion within the JP Morgan Rising Market Bond Index would possibly gradual as expectations for a US Federal Reserve price minimize shift from 50 to 25 foundation factors.

In Oct, FPIs purchased Rs 3,755 crore of govt bonds below the absolutely accessible route (FAR), however bought Rs 1,634 crore below the overall restrict and Rs 950 crore below the voluntary retention route. FPIs additionally made internet purchases of Rs 1,797 crore in hybrid devices however bought Rs 300 crore in mutual funds. Up to now in 2024, FPIs have invested Rs 73,468 crore in equities and Rs 1.1 lakh crore in debt. “FPIs have adopted a ‘promote India, purchase China’ technique following China’s stimulus,” Vijayakumar stated.

[ad_2]

Supply hyperlink