NEW DELHI: The variety of people disclosing over Rs 1 crore taxable earnings of their returns soared 5 occasions from 44,078 in evaluation yr (AY) 2013-14 (monetary yr 2012-13) to simply beneath 2.3 lakh in AY2023-24 (FY2022-23), which can be a pointer to greater incomes and improved compliance. Through the interval, the variety of tax returns filed by people rose greater than 2.2 occasions from 3.3 crore to over 7.5 crore, based on the newest tax division knowledge.

The share of salaried people declaring over Rs 1 crore earnings neared 52% within the final evaluation yr, in contrast with 49.2 per cent in AY2022-23, and 51 per cent in AY2013-14.

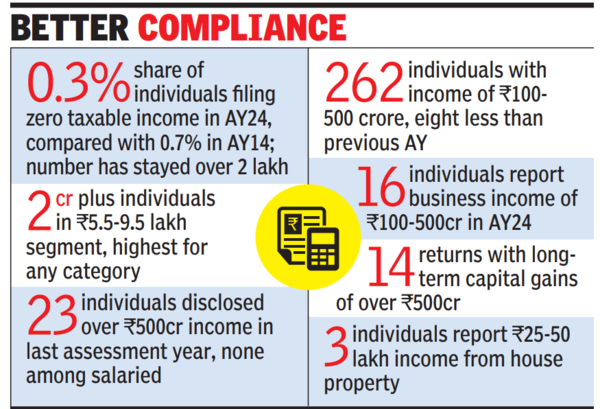

The share of salaried people within the Rs 1-5 crore section was as a lot as 53%, however because the earnings ranges rose there have been fewer salaried, pointing to the presence of extra businessmen and professionals. As an illustration, not one of the 23 who declared over Rs 500 crore annual taxable earnings have been salaried people, whereas 19 of the 262 within the Rs 100-500 crore section have been salaried.

In AY2013-14, just one particular person had declared over Rs 500 crore earnings, whereas there have been two within the Rs 100-500 crore group.

In comparison with AY2022-23, nonetheless, there was a marginal fall within the variety of people disclosing earnings of over Rs 25 crore – from 1,812 in to 1,798 within the final evaluation yr. Among the many salaried too, the pattern was seen within the over Rs 10 crore section – a 4.7 per cent decline from 1,656 to 1,577.

Reflecting the expansion in earnings ranges, people within the Rs 4.5 lakh to Rs 9.5 lakh earnings brackets accounted for 52% of the earnings tax returns filed throughout AY2023-24, in comparison with the 54.6 coming from Rs 1.5-3.5 lakh segments in AY 2013-14. One in each 4 returns filed was within the Rs 5.5-9.5 lakh section, in contrast with one in each 5 coming from the Rs 2.5-3.5 lakh bracket, the day confirmed.

When it comes to the gross complete earnings, Rs 5.5-9.5 lakh group has strengthened its dominance, accounting for over 23% share, in contrast with 18% in AY2013-14. However, there are different adjustments. As an illustration, when it comes to earnings, Rs 10-15 lakh was the second greatest contributor with a share of over 12%, adopted by 10% within the Rs 25-50 lakh vary. In distinction, throughout AY2013-14, it was the Rs 2.5-3.5 lakh group which got here second (12.8 per cent share).