MUMBAI: RBI has stated there was a brief slackening of the financial system through the second quarter on account of unseasonal heavy rains in August and September and ‘pitru paksha’ – a 16-day interval within the Hindu calendar the place new actions aren’t undertaken. Nevertheless, a sturdy home engine supported by pageant season consumption and personal funding is anticipated to gas an uptick within the financial system.

This ‘idiosyncratic’ slowdown is mirrored in GST collections, car gross sales, financial institution credit score development, merchandise exports and the buying managers index. “The slowing of pace can be mirrored in our nowcast of actual GDP development,” RBI’s state of the financial system report stated.

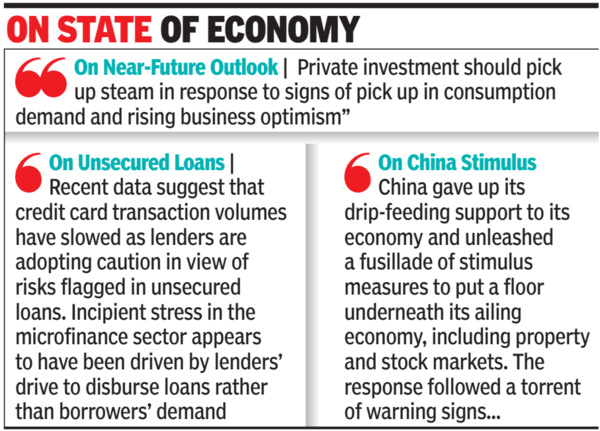

RBI expects India’s financial system to “shrug off” this non permanent slowdown as pageant demand picks up tempo and shopper confidence improves. Rural demand is anticipated to get a lift from the improved agricultural outlook, and personal funding ought to choose up steam in response to rising enterprise optimism, RBI stated.

“Personal funding ought to choose up steam in response to indicators of choose up in consumption demand and rising enterprise optimism,” the report stated.

It additionally took be aware of the stress in bank cards and unsecured loans. “Latest knowledge recommend that bank card transaction volumes have slowed as lenders are adopting warning in view of dangers flagged in unsecured loans. Incipient stress within the microfinance sector seems to have been pushed by lenders’ drive to disburse loans moderately than debtors’ demand,” the report stated.

In line with RBI, the end result of the China stimulus package deal is unsure. “China gave up its drip-feeding assist to its financial system and unleashed a fusillade of stimulus measures to place a flooring beneath its ailing financial system, together with property and inventory markets. The response adopted a torrent of warning indicators: shrinking tax income; falling costs of properties and industrial items; slowing retail gross sales; depressed shopper confidence; and weak industrial output and funding,” the report, whose authors embody RBI deputy governor Michael Patra, stated.

RBI additionally famous that India’s exterior sector is “displaying resilience” regardless of rising geopolitical tensions. The nation’s overseas alternate reserves have reached a historic excessive and web FDI inflows have “greater than doubled” from a 12 months in the past. The report highlighted RBI’s dedication to lively and adaptable liquidity administration.