No fireworks from Sensex this Diwali! The Indian inventory market has been experiencing a major downturn, with the Nifty falling almost 6% and the Sensex dropping over 4,800 factors within the final month. This October has been significantly harsh for traders, marking the worst month because the Covid-induced crash and probably the most disappointing pre-Diwali interval in a decade.

Because the market’s focus shifts from momentum to high quality and FII outflows persist, the buying and selling technique has modified from shopping for on dips to promoting on rallies. Analysts predict that this development could proceed till there are clear indications of progress in consumption and earnings.

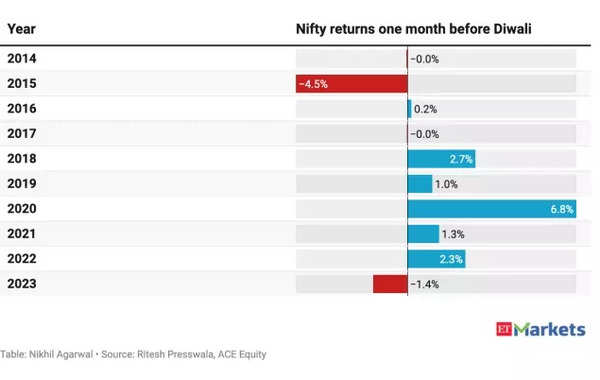

Since 2014, the Nifty has solely seen 4 situations of destructive returns within the month main as much as Diwali, with a median return of 0.84%, based on an ET report. The worst pre-Diwali section for Nifty was in 2015 when it fell 4.45%. Final yr, the index fell 1.36%, and this yr, it seems to be on observe to surpass the 2015 report.

Additionally Learn | ‘Mr Modi is improbable…’: Prem Watsa, often called ‘Canada’s Warren Buffett’, says India can develop at 10% beneath PM Modi

“The consensus for earnings progress for Nifty50 is barely in double digits. If earnings disappoint even these undemanding expectations may emerge as a key motive for market correction,” Sorbh Gupta, Senior Fund Supervisor – Equities, Bajaj Finserv AMC, advised ET.

Following a downgrade by Bernstein’s quant strategists, Goldman Sachs additionally downgraded India from chubby to impartial this week, citing slowing financial progress as the rationale.

Inventory Market Development Earlier than Diwali Over Years

The market is now carefully watching whether or not retail traders can keep their confidence in equities, as home flows have been a vital counterbalance to FII outflows in current instances.

Whereas FIIs have withdrawn Rs 86,000 crore from the market as a consequence of a shift in direction of China, issues about excessive valuations in India, and weak earnings outlook, DIIs have invested Rs 93,000 crore.

For long-term bulls, the present correction presents a positive entry level into the market, really feel analysts.

Veteran investor Hemang Jani believes that the inventory market is near forming a backside, though the precise timing stays unsure. He expects the bottom formation to begin throughout the subsequent few days or even weeks.

Additionally Learn | Neglect gold shopping for this festive season? Why it’s best to take into account silver for funding as costs cross Rs 1 lakh mark

The current market correction has hit smaller shares more durable, significantly these fashionable amongst retail traders. As an example, Cochin Shipyard, a PSU defence inventory, has fallen 52% from its 52-week excessive. Market specialists warning that the froth within the broader market has not but been utterly cleared.

“One must be particularly cautious of corporations with decrease free float as these shares can transfer sharply in both path as a consequence of their restricted liquidity. From a sector perspective, we nonetheless imagine PSU, defence and a few capex-driven companies are nonetheless within the overvaluation zone,” Gupta stated.

The inventory market often reveals a optimistic bias throughout Diwali, because the auspicious event typically aligns with optimism and renewed investor confidence. Amit Goel, Co-Founder and Chief World Strategist at Tempo 360, famous that this optimistic development just isn’t solely as a consequence of Diwali but in addition influenced by the company earnings season beginning in October and world macro elements.

Over the previous decade, the common return within the one month main as much as Diwali has been optimistic. Goel expects Indian equities to reclaim their all-time highs by the tip of subsequent month, given the nation’s long-term progress story.

Just lately, UBS really helpful “shopping for the dip,” stating that the smooth patch in India’s progress and earnings seems short-term.

Christopher Wooden from Jefferies, recognized for his bullish stance on India in rising market circles, believes that India stays probably the most enticing inventory marketplace for the following decade, primarily as a consequence of its earnings outlook.