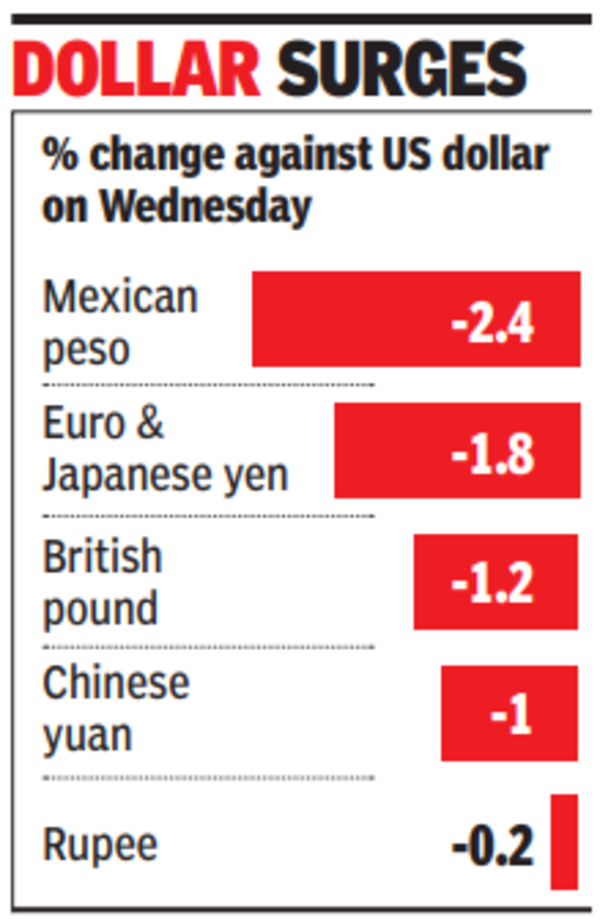

MUMBAI: The rupee suffered its largest decline in over 4 months, dropping 17 paise, or 0.2%, to shut at 84.28 towards the US greenback following Trump’s victory. Regardless of hitting a report low, the rupee carried out comparatively effectively in comparison with different currencies because the greenback strengthened considerably towards world counterparts.

Sellers stated that RBI’s intervention helped restrict the rupee’s decline. RBI governor Shaktikanta Das has stated that whatever the consequence of the US election and the potential spillover results on the worldwide financial system, the Indian financial system and monetary sector are well-positioned and resilient sufficient to deal with any exterior challenges. “We’re positively impacted by what’s occurring in the remainder of the world. However with regards to our home market as a regulator, we aren’t bystanders. We’re very a lot there out there,” stated Das.

Regardless of RBI’s reserve warfare chest of near $700 billion, sellers stated that the central financial institution won’t be able to carry the change price given the speed at which the greenback has appreciated towards different currencies. The greenback index gained 1.8% as fears of tariffs and sanctions despatched different currencies on a downslide.

The Mexican peso was the worst hit, depreciating to a two-year low. The euro dropped over 2% because the Eurozone was additionally seen as a major goal for commerce wars beneath a Trump administration. The Chinese language yuan declined 1.1%- its largest one-day drop since Oct 2022 – over fears that Trump would introduce steep tariffs. The South African rand was additionally among the many hardest hit, dropping 2.2% from its earlier shut.