Now Reading: Solana CME Futures Fall Short of Bitcoin (BTC) and Ethereum’s ETH Debut, But There’s a Catch

-

01

Solana CME Futures Fall Short of Bitcoin (BTC) and Ethereum’s ETH Debut, But There’s a Catch

Solana CME Futures Fall Short of Bitcoin (BTC) and Ethereum’s ETH Debut, But There’s a Catch

[ad_1]

If you blinked you could have missed it: Solana’s SOL futures began buying and selling on Monday on the Chicago Mercantile Exchange (CME), the go-to market for U.S. establishments, and in contrast to earlier, historic CME debuts for bitcoin (BTC) and ether (ETH), it acquired little fanfare.

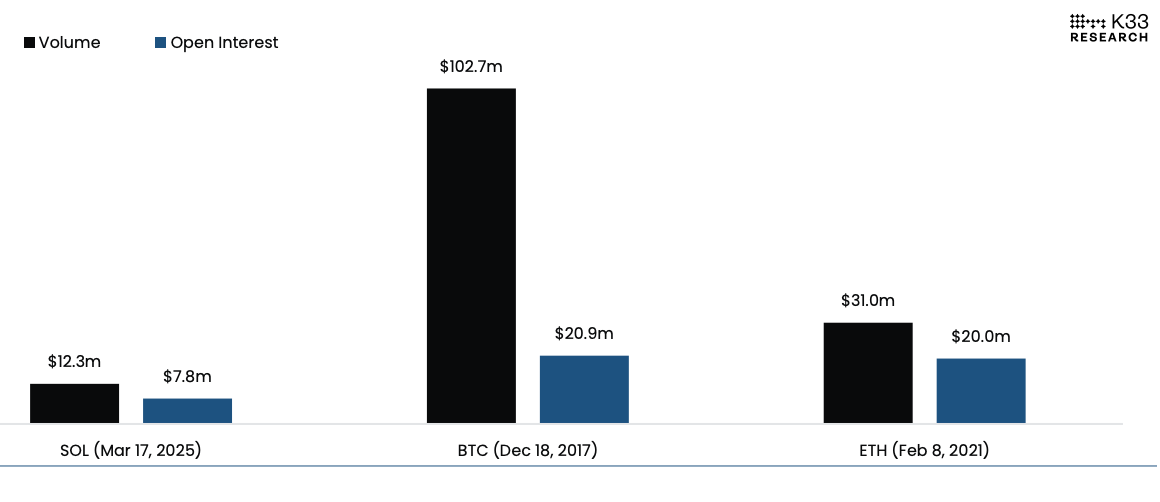

The product booked $12.3 million in notional each day quantity on day one and closed with $7.8 million in open curiosity, properly falling brief of related debuts of BTC and ETH merchandise, in line with K33 Research information. For context, BTC futures launched in December 2017 with $102.7 million first-day quantity and $20.9 million in open curiosity, whereas ETH futures debuted in February 2021 with $31 million in quantity and $20 million in open curiosity, per K33.

Already below stress by the implosion of speculative memecoin exercise, bearish crypto motion and even a botched business, SOL tumbled roughly 10% from its weekend excessive, underperforming bitcoin’s (BTC) and ether’s (ETH) 4.5% and 3.8% declines, respectively.

While SOL’s debut could seem lackluster in absolute phrases, it’s extra in stability with BTC’s and ETH’s first-day figures when adjusted to market worth, K33 analysts Vetle Lunde and David Zimmerman famous. Solana’s market capitalization stood at round $65 billion on Monday, a fraction of ETH’s $200 billion and BTC’s $318 billion at CME launch.

Solana’s CME launch additionally had unfavorable timing, as market situations play a essential function in futures exercise, K33 added.

Bitcoin’s CME futures arrived on the peak of the 2017 bull market as speculative fervor was pushing to the extremes, and ETH’s debut coincided with the early phases of the 2021 altcoin rally and Tesla’s BTC buy announcement, fueling institutional participation. In distinction, SOL futures began buying and selling as crypto markets turned bearish, with none hype or main catalyst driving fast demand for the product, in line with the K33.”It would appear that institutional demand for altcoins may be shallow, although we note that SOL’s launch has come in a comparatively risk-off environment,” K33 analysts mentioned.

Read extra: Multicoin’s Samani Explains Why SOL ETF Could Trounce ETH’s

Derivatives dealer Josh Lim, founder of Arbelos Markets that was lately acquired by prime dealer FalconX, mentioned that the CME product opens up new methods for establishments to handle their publicity to Solana, regardless of the first-day demand. FalconX executed the primary SOL futures block commerce on CME on Monday with monetary companies agency StoneX.

“There’s enthusiasm for this new CME product launch,” Lim mentioned in a Telegram message. Liquid funds will have the ability to handle round their SOL holdings, together with those who purchased locked tokens within the FTX liquidation course of, he mentioned. Additionally, exchange-traded fund issuers with plans to introduce SOL merchandise might begin with CME futures-based ETFs.

“People are missing the big picture on the new CME products,” Lim mentioned. “It’s going to change the access that hedge funds have into altcoins.”

[ad_2]