Now Reading: Bitcoin (BTC) Price Drop Deepens as U.S.-China Trade War Escalates

-

01

Bitcoin (BTC) Price Drop Deepens as U.S.-China Trade War Escalates

Bitcoin (BTC) Price Drop Deepens as U.S.-China Trade War Escalates

[ad_1]

By Francisco Rodrigues (All instances ET until indicated in any other case)

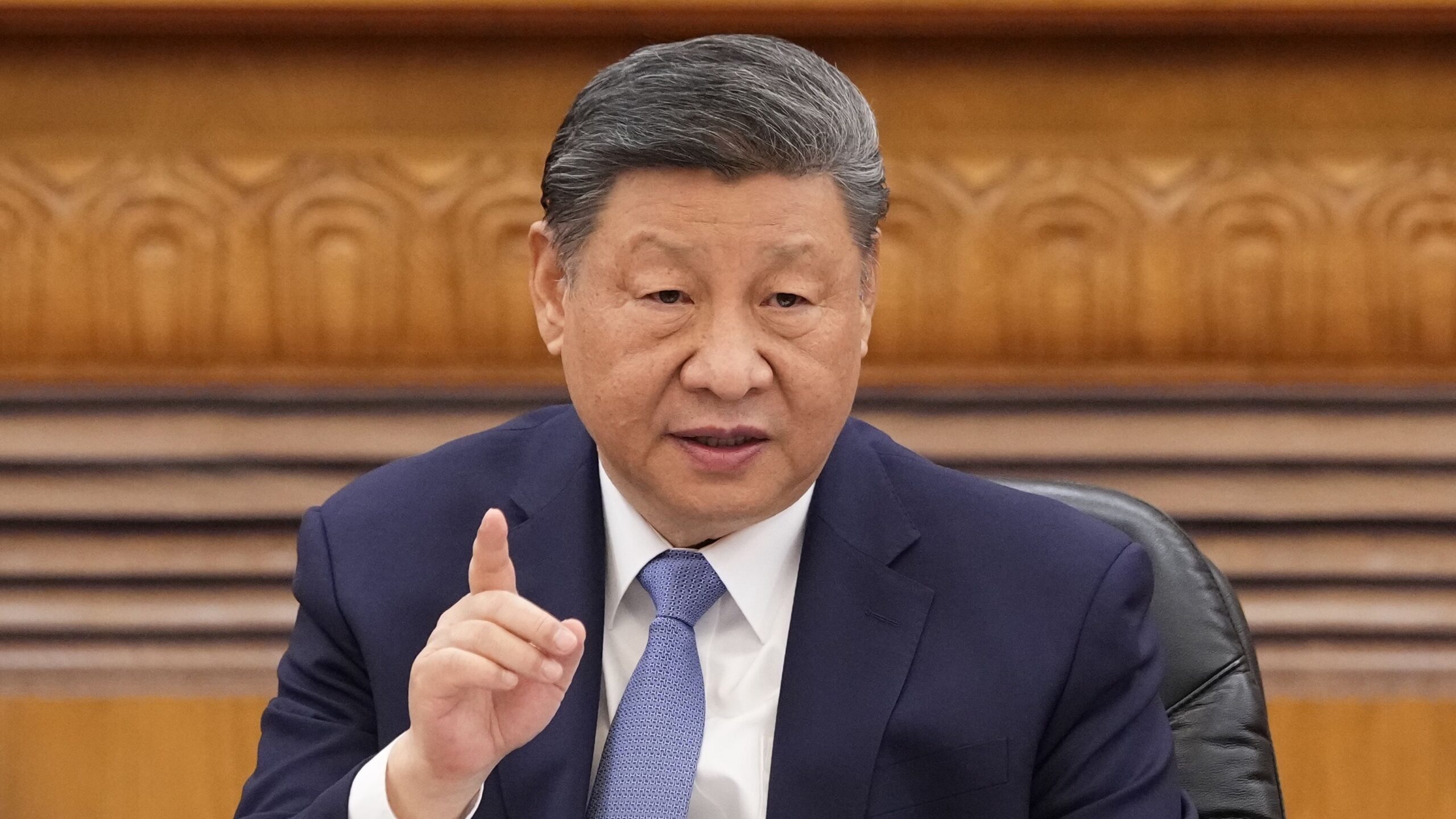

Cryptocurrency costs are down throughout the board during the last 24 hours amid a wider danger asset sell-off triggered by deepening U.S.-China commerce tensions.

The White House stated China now “faces up to a 245% tariff on imports” and imposed new restrictions on chip exports to the nation. Bitcoin (BTC) fell greater than 2.2% whereas the broader market, measured by the CoinDesk 20 (CD20) index, declined 3.75%.

Nasdaq 100 futures are additionally down, dropping greater than 1% whereas S&P 500 futures dropped 0.65%. While bitcoin has remained notably secure as the commerce battle escalated, some metrics recommend the bull run could have ended.

The largest cryptocurrency slipped under its 200-day easy transferring common on March 9, suggesting “the token’s recent steep decline qualifies this as a bear market cycle starting in late March,” Coinbase Institutional stated in a notice

A risk-adjusted efficiency measured in customary deviations identified as the Z-Score exhibits the bull cycle led to late February, with subsequent exercise seen as impartial, in keeping with Coinbase Institutional’s world head of analysis, David Duong.

Still, the resilience cryptocurrency costs have proven is “undoubtedly good for the market,” as it lets merchants “look more seriously at using premium to hedge — supporting the case for allocating into spot,” stated Jake O., an OTC dealer at crypto market maker Wintermute.

“In response, several prime brokers have shifted their short-term models from underweight to neutral on risk assets, noting that the next move will likely be driven by ‘real’ data,” Jake O. Said in an emailed assertion.

That “real data” is coming in quickly sufficient, with the U.S. Census Bureau set to launch March retail gross sales knowledge, and Fed Chair Jerome Powell delivering a speech on financial outlook. Tomorrow, the U.S. Department of Labor releases unemployment insurance coverage knowledge and the Census Bureau releases residential building knowledge, whereas the ECB is anticipated to chop rates of interest.

The shakiness in danger belongings has benefited gold. The treasured metallic is up round 26.5% year-to-date to above $3,300 per troy ounce, contrasting with the U.S. Dollar Index’s 9% drop. Stay alert!

What to Watch

- Crypto:

- April 16: HashKey Chain (HSK) mainnet improve enhances community stability and payment management capabilities.

- April 16, 9:30 a.m.: Spot solana (SOL) ETFs with help for staking rewards, from asset managers Purpose, Evolve, CI and 3iQ, are anticipated to start buying and selling on the Toronto Stock Exchange.

- April 17: EigenLayer (EIGEN) prompts slashing on Ethereum mainnet, implementing penalties for operator misconduct.

- April 18: Pepecoin (PEP), a layer-1, proof-of-work blockchain, undergoes its second halving, decreasing block rewards to fifteen,625 PEP per block.

- April 20, 11 p.m.: BNB Chain (BNB) — opBNB mainnet hardfork.

- April 21: Coinbase Derivatives will record XRP futures pending approval by the U.S. Commodity Futures Trading Commission (CFTC).

- Macro

- April 16, 8:30 a.m.: The U.S. Census Bureau releases March retail gross sales knowledge.

- Retail Sales MoM Est. 1.3% vs. Prev. 0.2%

- Retail Sales YoY Prev. 3.1%

- April 16, 9:45 a.m.: Bank of Canada releases its newest interest-rate resolution, adopted by a press convention 45 minutes later.

- Policy Interest Rate Est. 2.75% vs. Prev. 2.75%

- April 16, 1:30 p.m.: Fed Chair Jerome H. Powell will ship an “Economic Outlook” speech. Livestream hyperlink.

- April 17, 8:30 a.m.: U.S. Census Bureau releases March new residential building knowledge.

- Housing Starts Est. 1.42M vs. Prev. 1.501M

- Housing Starts MoM Prev. 11.2%

- April 17, 8:30 a.m.: The U.S. Department of Labor releases unemployment insurance coverage knowledge for the week ended April 12.

- Initial Jobless Claims Est. 225K vs. Prev. 223K

- April 17, 7:30 p.m.: Japan’s Ministry of Internal Affairs & Communications releases March shopper value index (CPI) knowledge.

- Core Inflation Rate YoY Est. 3.2% vs. Prev. 3%

- Inflation Rate MoM Prev. -0.1%

- Inflation Rate YoY Prev. 3.7%

- April 16, 8:30 a.m.: The U.S. Census Bureau releases March retail gross sales knowledge.

- Earnings (Estimates primarily based on FactSet knowledge)

Token Events

- Governance votes & calls

- Unlocks

- April 16: Arbitrum (ARB) to unlock 2.01% of its circulating provide price $25.77 million.

- April 18: Official Trump (TRUMP) to unlock 20.25% of its circulating provide price $323.14 million.

- April 18: Fasttoken (FTN) to unlock 4.65% of its circulating provide price $84 million.

- April 18: Official Melania Meme (MELANIA) to unlock 6.73% of its circulating provide price $11.25 million.

- April 18: UXLINK (UXLINK) to unlock 11.09% of its circulating provide price $17.19 million.

- April 18: Immutable (IMX) to unlock 1.37% of its circulating provide price $9.72 million.

- April 22: Metars Genesis (MRS) to unlock 11.87% of its circulating provide price $119.1 million.

- Token Launches

- April 16: Badger (BADGER), Balancer (BAL), Beta Finance (BETA), Cortex (CTXC), Cream Finance (CREAM), Firo (FIRO), Kava Lend (KAVA), NULS (NULS), Prosper (PROS), Status (SNT), TROY (TROY), UniLend Finance (UFT), VIDT DAO (VIDT), and aelf (ELF) to be delisted from Binance.

- April 22: Hyperlane to airdrop its HYPER tokens.

Conferences:

Token Talk

By Shaurya Malwa

- A file $12 billion price of stablecoins have been transferred on the Solana blockchain in March, a 445% enhance from the $2.2 billion reported in March 2024

- USDC is the dominant stablecoin at 75% of the ecosystem’s complete stablecoin market cap, in keeping with DefiLlama knowledge.

- Stablecoin provide doubled from $6 billion between early January and April 15, coinciding with a drop in speculative exercise (such as memecoin buying and selling) on the blockchain.

Derivatives Positioning

- Open curiosity in offshore BTC perpetuals and futures fell as costs retreated from $86K to just about $83K. The drop exhibits lack of participation within the value decline.

- ETH, XRP and SOL perpetual funding charges remained adverse in an indication of bias for brief, or bearish, positions.

- The annualized BTC and ETH CME futures foundation stays rangebound between 5% and eight%, showcasing warning amongst institutional gamers.

- Options tied to BlackRock’s spot bitcoin ETF confirmed bias for bullish directional publicity to the upside in longer maturity choices, however on the similar time, priced short-term draw back dangers extra aggressively.

- On Deribit, positioning stays defensive, exhibiting a bias for brief and near-dated choices.

Market Movements:

- BTC is down 0.26% from 4 p.m. ET Tuesday at $83,823.34 (24hrs: -2.7%)

- ETH is down 1.23% at $1,575.79 (24hrs: -3.31%)

- CoinDesk 20 is down 1.67% at 2,410.72 (24hrs: -3.75%)

- Ether CESR Composite Staking Rate is down 16 bps at 3.02%

- BTC funding charge is at 0.0079% (8.6494% annualized) on Binance

- DXY is down 0.59% at 99.63

- Gold is up 3.31% at $3,325.20/oz

- Silver is up 2.58% at $33.06/oz

- Nikkei 225 closed -1.01% at 33,920.40

- Hang Seng closed -1.91% at 21,056.98

- FTSE is down 0.44% at 8,212.76

- Euro Stoxx 50 is down 0.79% at 4,931.25

- DJIA closed on Tuesday -0.38% at 40,368.96

- S&P 500 closed -0.17% at 5,396.63

- Nasdaq closed unchanged at 16,823.17

- S&P/TSX Composite Index closed +0.84% at 24,067.90

- S&P 40 Latin America closed unchanged at 2,337.88

- U.S. 10-year Treasury charge is unchanged at 4.34%

- E-mini S&P 500 futures are down 0.6% at 5,395.75

- E-mini Nasdaq-100 futures are down 1.18% at 18,736.50

- E-mini Dow Jones Industrial Average Index futures are up 2% at 40,531.00

Bitcoin Stats:

- BTC Dominance: 63.95 (0.17%)

- Ethereum to bitcoin ratio: 0.1881 (-1.00%)

- Hashrate (seven-day transferring common): 890 EH/s

- Hashprice (spot): $44.7

- Total Fees: 6.33 BTC / $484,137

- CME Futures Open Interest: 135,635 BTC

- BTC priced in gold: 25.7 oz

- BTC vs gold market cap: 7.28%

Technical Analysis

- The Ichimoku cloud, a preferred momentum indicator, is capping upside as mentioned early this week.

- A flip decrease could embolden bears, probably yielding a re-test of the psychological help degree of $80K.

Crypto Equities

- Strategy (MSTR): closed on Tuesday at $310.72 (-0.23%), down 1.43% at $306.27 in pre-market

- Coinbase Global (COIN): closed at $175.57 (-0.57%), down 1.36% at $173.18

- Galaxy Digital Holdings (GLXY): closed at C$15.45 (-2.28%)

- MARA Holdings (MARA): closed at $12.58 (-2.86%), down 2.38% at $12.28

- Riot Platforms (RIOT): closed at $6.55 (-6.56%), down 1.37% at $6.46

- Core Scientific (CORZ): closed at $6.85 (-2.97%), down 2.19% at $6.70

- CleanSpark (CLSK): closed at $7.28 (-6.43%), down 1.65% at $7.16

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $11.98 (-5.67%)

- Semler Scientific (SMLR): closed at $34.40 (+0.41%), up 2.62% at $35.30

- Exodus Movement (EXOD): closed at $38.01 (-3.6%), up 5.21% at $39.99

ETF Flows

Spot BTC ETFs:

- Daily internet circulation: $76.4 million

- Cumulative internet flows: $35.5 billion

- Total BTC holdings ~ 1.11 million

Spot ETH ETFs

- Daily internet circulation: -$14.2 million

- Cumulative internet flows: $2.27 billion

- Total ETH holdings ~ 3.35 million

Source: Farside Investors

Overnight Flows

Chart of the Day

- Funding charges in perpetual futures tied to the privacy-focused token monero (XMR) stay deeply adverse, indicating a dominance of bearish quick positions.

- The notable bias for shorts means a possible upswing in costs, as recommended by technical charts, may set off a brief squeeze, resulting in bullish volatility growth.

While You Were Sleeping

- China’s First-Quarter GDP Tops Estimates at 5.4% as Growth Momentum Continues Amid Tariff Worries (CNBC): Despite a powerful first-quarter GDP, China’s statistics bureau urged insurance policies to spice up home demand, noting U.S. export share fell to 14.7% in 2024 from 19.2% in 2018.

- Cardano’s ADA Leads Majors Slide Amid Bitcoin Profit-Taking; ProShares Amends XRP ETF (CoinDesk): Bitcoin promoting by giant buyers has eased, with each day gross sales dropping from 800,000 BTC in February to about 300,000 BTC, as they understand losses, in keeping with CryptoQuant.

- Dogecoin Whales Accumulate, SOL Hints at Consolidation as Market Takes a Breather (CoinDesk): A crypto market rebound could help additional features, however affirmation seemingly hinges on consolidation above the 200-day transferring common close to $2.97 trillion, says FxPro analyst Alex Kuptsikevich.

- OKX to Expand to the U.S., Establish Regional Headquarters in California (CoinDesk): In February, the Seychelles-based change paid the DOJ $500 million to settle fees it had operated within the U.S. with out a cash transmitter license.

- Hongkong Post Suspends Goods Mail Services to US (Reuters): Hongkong Post will halt sea mail of products to the U.S. instantly and droop air mail from April 27, calling the top of duty-free remedy for low-value parcels a “bullying act.”

- Even Without Add-Ons, Trump’s 10% Tariffs Will Have a Sting (The New York Times): Trump’s 10% baseline tariff could appear modest, however Oxford Economics warns the complete package deal may shrink world commerce by 5% — a drop similar to 2020’s pandemic shock.

In the Ether

[ad_2]