Now Reading: Market watch: India’s equity valuations dip below long-term averages; but stay elevated versus peers

-

01

Market watch: India’s equity valuations dip below long-term averages; but stay elevated versus peers

Market watch: India’s equity valuations dip below long-term averages; but stay elevated versus peers

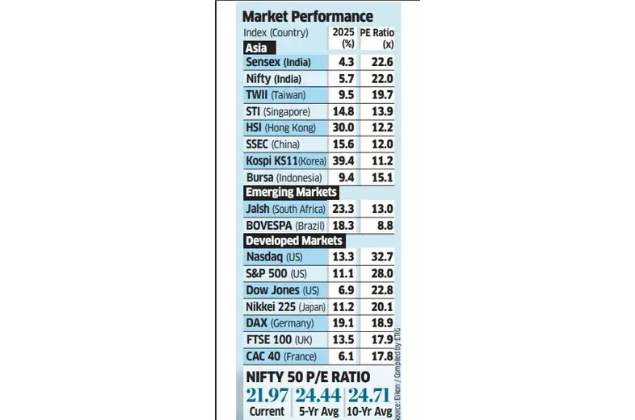

India’s equity valuations are buying and selling marginally below their historic averages but proceed to stay costly in contrast with regional peers, elevating considerations amid slowing earnings development.The benchmark Nifty at the moment trades at a price-to-earnings (PE) ratio of 21.97 instances, decrease than its five- and 10-year averages of 24.4 and 24.8, respectively. In distinction, Hong Kong’s Hang Seng is at 11.7, South Korea’s Kospi below 13, and South Africa at round 12.7, in response to an ET report.Valuations in India have historically traded at a premium to peers, supported by robust development prospects. However, with company earnings momentum weakening, international traders are paring publicity and holding again contemporary allocations.

“Valuations have begun mattering now because nominal GDP growth has slipped into single digits compared to around 12-13%,” mentioned Ritesh Jain, founding father of Pinetree Macro, a world macro asset allocation fund. “Corporate profitability is a function of nominal GDP. So, for an overseas fund manager looking at various markets, a country with slowing nominal growth and rich valuations is far less appealing despite its inherent strengths.”India is now the second-most costly main market after the US, with some international fund managers more and more shifting allocations to cheaper Chinese, European, and Japanese equities.Fund managers additionally famous that index composition performs a key function in valuation ranges. “The composition of Indian indices must be taken into account while looking at valuations,” mentioned Nilesh Shah, managing director, Kotak Mutual Fund. “If the Sensex and Nifty are full of expensive consumer names and there are fewer commodity players, it’s bound to push up valuation levels. If we were to remove some of the consumer names, our valuations are around averages on a historical basis.”