Now Reading: Sebi eases norms for foreign traders, IPOs

-

01

Sebi eases norms for foreign traders, IPOs

Sebi eases norms for foreign traders, IPOs

[ad_1]

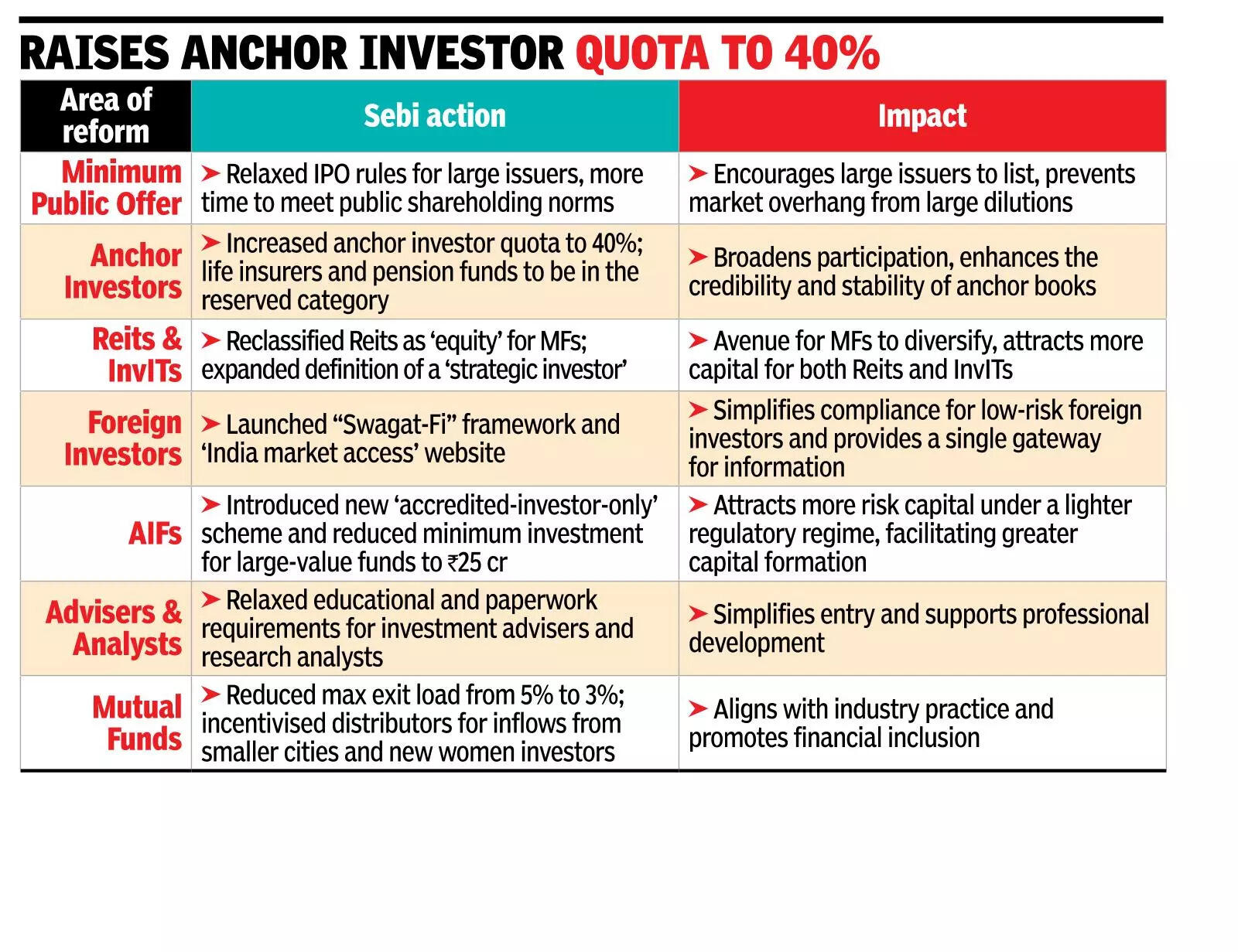

MUMBAI: Sebi on Friday unveiled reforms easing minimal dilution norms for IPO-bound firms, and making a single-window system for low-risk foreign traders like sovereign wealth funds, central banks, and retail funds, eliminating repeated paperwork.The leisure comes amid rising foreign outflows, pushed by steep US tariffs, weak earnings and wealthy valuations. Overseas traders have withdrawn $11.7 billion from Indian shares and debt in 2025.It additionally tightened governance at inventory exchanges by mandating two govt administrators, splitting critical-operations (buying and selling, clearing, settlement) and regulatory-compliance (danger, investor grievances) roles.For issuers with a market cap of Rs 1-5 lakh crore, the minimal public supply has been raised to Rs 6,250 crore and at the least 2.8% of post-issue market cap, in contrast with Rs 5,000 crore and 5% earlier. Companies itemizing with lower than 15% public float will now have 10 years to satisfy the 25% minimal public shareholding requirement, whereas these beginning with 15% or extra will get 5 years. The relaxed timelines, as soon as notified by govt, may also apply to companies but to conform beneath present guidelines.

Anchor investor guidelines have been liberalised. The general quota has gone as much as 40% from one-third, with life insurers and pension funds having a share within the reserved pool. One-third will stay earmarked for mutual funds, and any shortfall in subscriptions from insurers and pension funds will revert to them. The variety of permissible anchor traders has additionally been expanded, with a minimal allotment dimension of Rs 5 crore.To make India extra engaging for abroad capital, Sebi accepted the Swagat-FI framework that offers “trusted” foreign portfolio and enterprise traders – comparable to sovereign funds, central banks and controlled retail funds – single-window entry with a 10-year registration and KYC cycle, in opposition to 3 years. They may also be exempt from the 50% combination contribution cap on NRIs, OCIs and resident Indians. Complementing this, Sebi and market infrastructure establishments launched the India Market Access portal to supply step-by-step steering on FPI registration, documentation and compliance.In the mutual fund house, the regulator lowered the utmost exit load to three% from 5% and revised distributor incentives to encourage inflows from smaller cities and girls traders. Distributors can earn as much as 1% of the primary software quantity or Rs 2,000 for new traders from past the highest 30 cities, whereas further commissions might be paid for onboarding new ladies traders.Sebi has simplified laws for related-party transactions, introducing a scale-based method for shareholder approval. High-value offers now require a vote, whereas low-value transactions are exempt from disclosure. For firms with a turnover of Rs 20,000 crore, approval is required for transactions exceeding 10% of turnover. The threshold for companies with a turnover over Rs 40,000 crore has been raised considerably from Rs 1,000 crore to Rs 5,000 crore.

[ad_2]