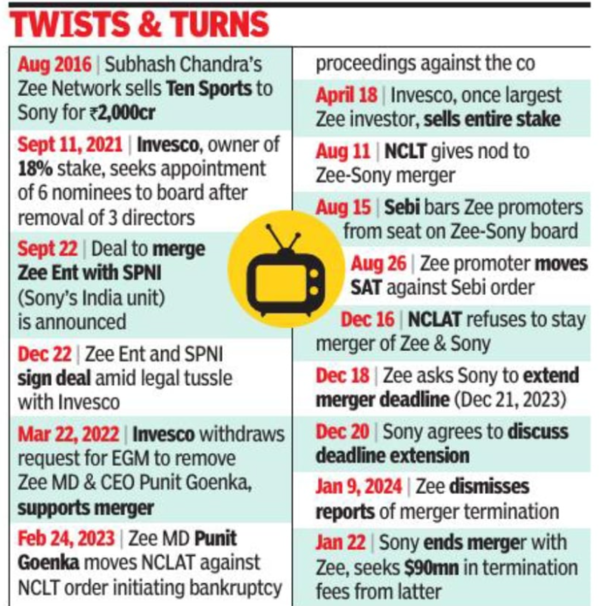

Sony Corp’s 62-page merger termination discover got here simply when Zee had requested it to increase the deal deadline.

Whereas Sony cited unmet merger circumstances as the rationale for the termination, the 2 firms have been wrangling over who will lead the mixed entity. Zee proposed MD Punit Goenka can be on the helm, however Sony disagreed within the gentle of a regulatory investigation in opposition to him and needed its nominee, India MD N P Singh, to run the present. The Japanese large has sought $90 million from Zee as termination charges for breaches of the merger pact and has invoked arbitration. Zee has refuted all of Sony’s assertions and stated it’ll take authorized motion in opposition to the latter in addition to contest its claims in arbitration proceedings.

The collapse of the merger is anticipated to have a adverse impression on each Sony and Zee.

Merger talks collapse amid market disruption

The collapse of the SonyZee merger negotiations comes at a time when the market goes by digital disruption and consolidation, the place Reliance Industries’ Viacom18 and the India unit of Walt Disney are planning a merger.

“After greater than two years of negotiations, we’re extraordinarily upset that closing circumstances to the merger weren’t glad… We stay dedicated to rising our presence in (India’s) vibrant and fast-growing market,” stated Sony. It, nevertheless, didn’t specify what circumstances have been unfulfilled. Sony additional stated that even after the two-year deal timeline ended on Dec 21, 2023, it was engaged in “good religion discussions” with Zee for 30 days to make the merger efficient however each “have been unable to agree upon an extension by the Jan 21 deadline”.

Zee stated Goenka had agreed to step down within the curiosity of the merger and had mentioned the appointment of a director on the board of the mixed firm. It additional stated it had proposed “protections for conduct of pending investigations and authorized proceedings in one of the best curiosity of its administrators and shareholders”.

Zee additionally stated that it had requested Sony to increase the merger deadline by six extra months after the 30-day grace interval lapsed. Nonetheless, Sony “didn’t present any counter proposal for extension”, it stated. “These discussions didn’t lead to any proposal from Sony however they fairly have chosen to terminate,” it said. Goenka, who was in Ayodhya for the Ram temple ceremony when he acquired the message that Sony had referred to as off the deal, posted on X that he sees the event as “an indication from the Lord”, including that he would transfer forward positively and work in direction of strengthening Zee for all its stakeholders.

Markets regulator Sebi is conducting investigation in opposition to Goenka for alleged diversion of funds from Zee to promoter entities. A closing order is but to come back. Earlier, Sebi had barred Goenka from holding directorships in any listed entity. However Securities Appellate Tribunal reversed the interim order and directed Sebi to finish the investigation.Zee, which spent Rs 176 crore on merger-related bills in FY23, stated it’ll proceed to “consider natural and inorganic alternatives for development, leveraging the intrinsic worth of its belongings”.

Zee is contending with falling earnings and money reserves in a extremely aggressive market the place streaming majors comparable to Netflix and Amazon Prime are combating for share. “With the merger terminated, Zee’s valuation will droop again to 12 occasions its value to incomes (PE) ranges seen previous to the merger announcement,” international brokerage CLSA stated. “The inventory had derated prior to now through the promoter share pledging disaster (in 2019) and fall in enterprise money conversion. We downgrade Zee from purchase to promote on a revised goal value of Rs 198 (prior value was Rs 3 00).”