Now Reading: Bitcoin (BTC) Mining Profitability Rose 2% in July, Jefferies Says

-

01

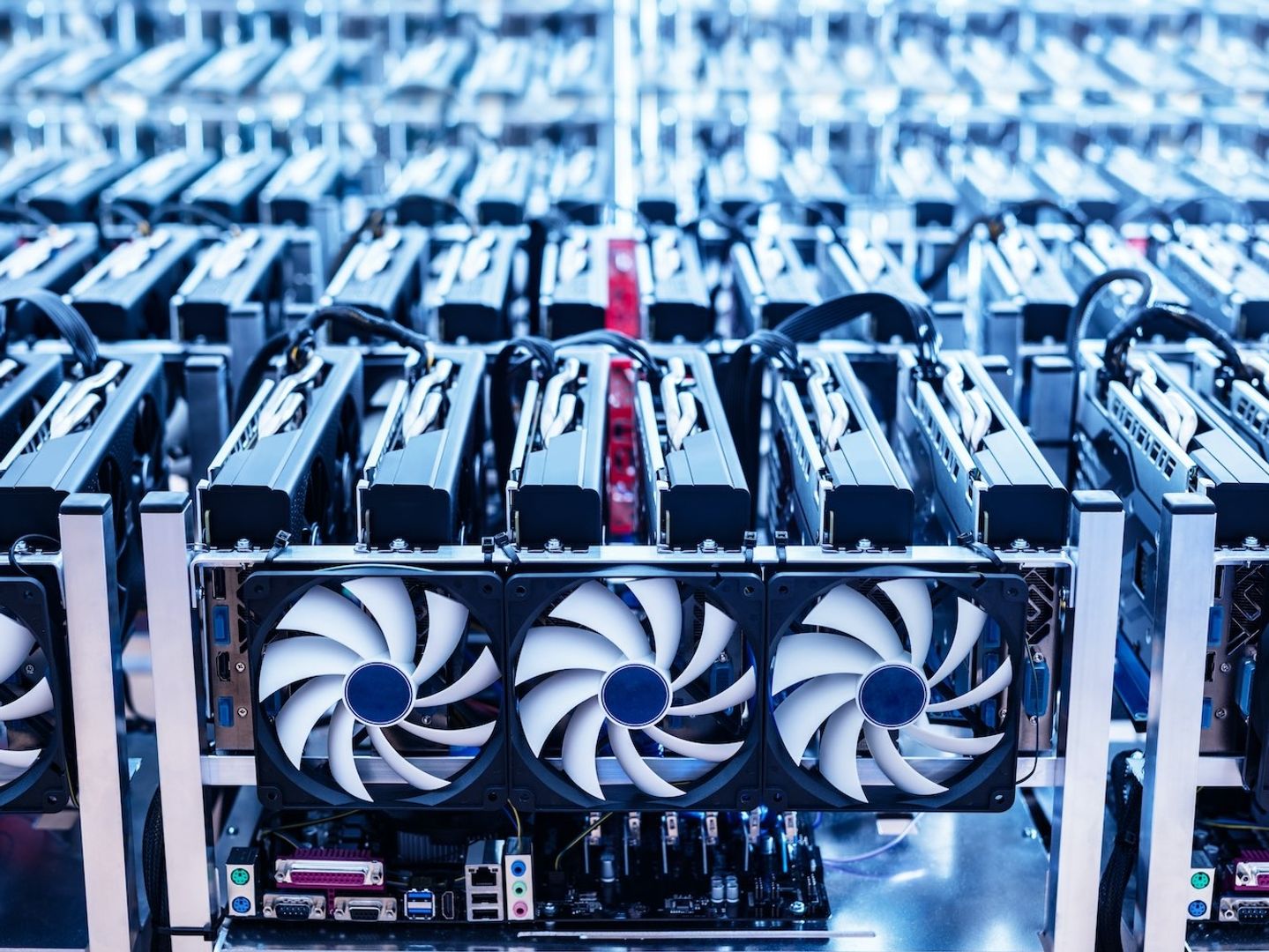

Bitcoin (BTC) Mining Profitability Rose 2% in July, Jefferies Says

Bitcoin (BTC) Mining Profitability Rose 2% in July, Jefferies Says

[ad_1]

Bitcoin

mining profitability elevated 2% in July as the worth of the world’s largest cryptocurrency rose 7% whereas the community hashrate jumped 5%, funding financial institution Jefferies mentioned in a analysis report on Friday.

“We see positive BTC price momentum as most favorable for Galaxy’s (GLXY) digital assets business, while miners fight a rising network hashrate,” analyst Jonathan Petersen wrote.

The hashrate refers back to the complete mixed computational energy used to mine and course of transactions on a proof-of-work blockchain, and is a proxy for competitors in the trade and mining issue. It is measured in exahashes per second (EH/s).

U.S.-listed mining corporations mined 3,622 bitcoin in July, versus 3,379 cash the month earlier than, the report mentioned, and these corporations accounted for 26% of the whole community in comparison with 25% in June.

IREN (IREN) mined essentially the most bitcoin, with 728 tokens, adopted by MARA Holdings (MARA) with 703 BTC, the financial institution famous.

Jefferies mentioned MARA’s energized hashrate stays the biggest of the sector, at 58.9 EH/s on the finish of July, with CleanSpark (CLSK) second with 50 EH/s.

Revenue per exahash/second additionally elevated. “A hypothetical one EH/s fleet of BTC miners would have generated ~$57k/day in revenue during July, vs ~$56k/day in June and ~$50k a year ago,” the analyst wrote.

Read extra: Bitcoin Miner MARA Steps Into HPC With Majority Stake in EDF Subsidiary: H.C. Wainwright

[ad_2]