Now Reading: Bitcoin (BTC) Price Set for Worst Month Since June 2022, Worst Week Since November 2022

-

01

Bitcoin (BTC) Price Set for Worst Month Since June 2022, Worst Week Since November 2022

Bitcoin (BTC) Price Set for Worst Month Since June 2022, Worst Week Since November 2022

[ad_1]

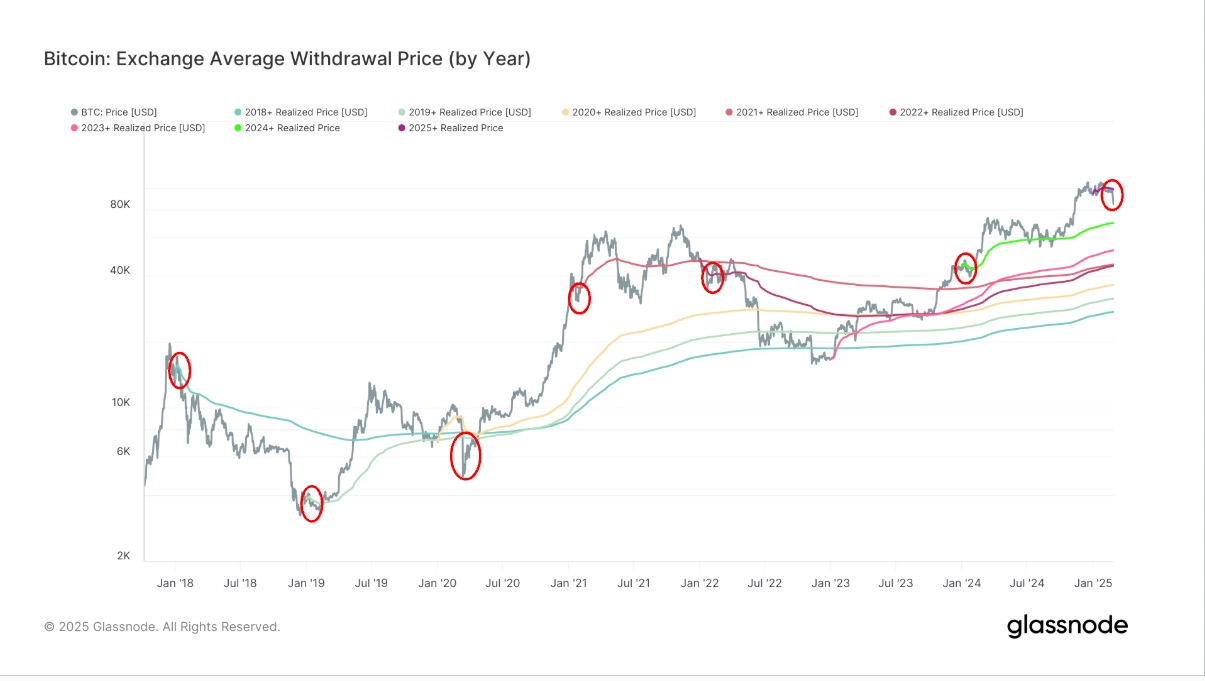

Bitcoin (BTC) is on monitor for its worst month in three years, falling 22% as President Donald Trump’s tariffs on main U.S. buying and selling companions elevate issues of quicker inflation, lowered probability of interest-rate cuts and lowered urge for food for dangerous investments.

The final time the most important cryptocurrency fell as a lot as June 2022, when it fell by greater than a 3rd. This week alone, BTC has dropped virtually 18%, the steepest slide because the week ended Nov. 13 of the identical yr.

The slide leaves traders who’ve purchased bitcoin this yr severely underwater. The common buy worth is because the begin of January $97,880, and BTC dropped beneath $80,000 earlier Friday, leaving common purchaser some 18% worse off.

Historically, this is not totally uncommon. Investors usually face some unrealized losses initially of the yr. It occurs when the worth of bitcoin falls beneath the fee foundation of the recipients earlier than recovering later within the yr.

On-chain knowledge signifies that realized losses escalated as the worth fell. Over the previous three days, about $1 billion in realized losses have been recorded each day — probably the most since August’s yen carry commerce unwind, when bitcoin fell to $49,000.

Additionally, a whopping $1.1 trillion has been wiped off the crypto market cap, taking the full to $2.59 trillion, in response to TradingView metric, Total.

[ad_2]