Now Reading: Bitfinex Margin Longs, Positions Funded With Borrowed Cash, Increase by 60K BTC

-

01

Bitfinex Margin Longs, Positions Funded With Borrowed Cash, Increase by 60K BTC

Bitfinex Margin Longs, Positions Funded With Borrowed Cash, Increase by 60K BTC

[ad_1]

As bitcoin’s (BTC) value wilts, merchants on crypto change Bitfinex live as much as their fame of being dip patrons, providing some hope to battered crypto bulls given their monitor file of predicting market peaks and troughs.

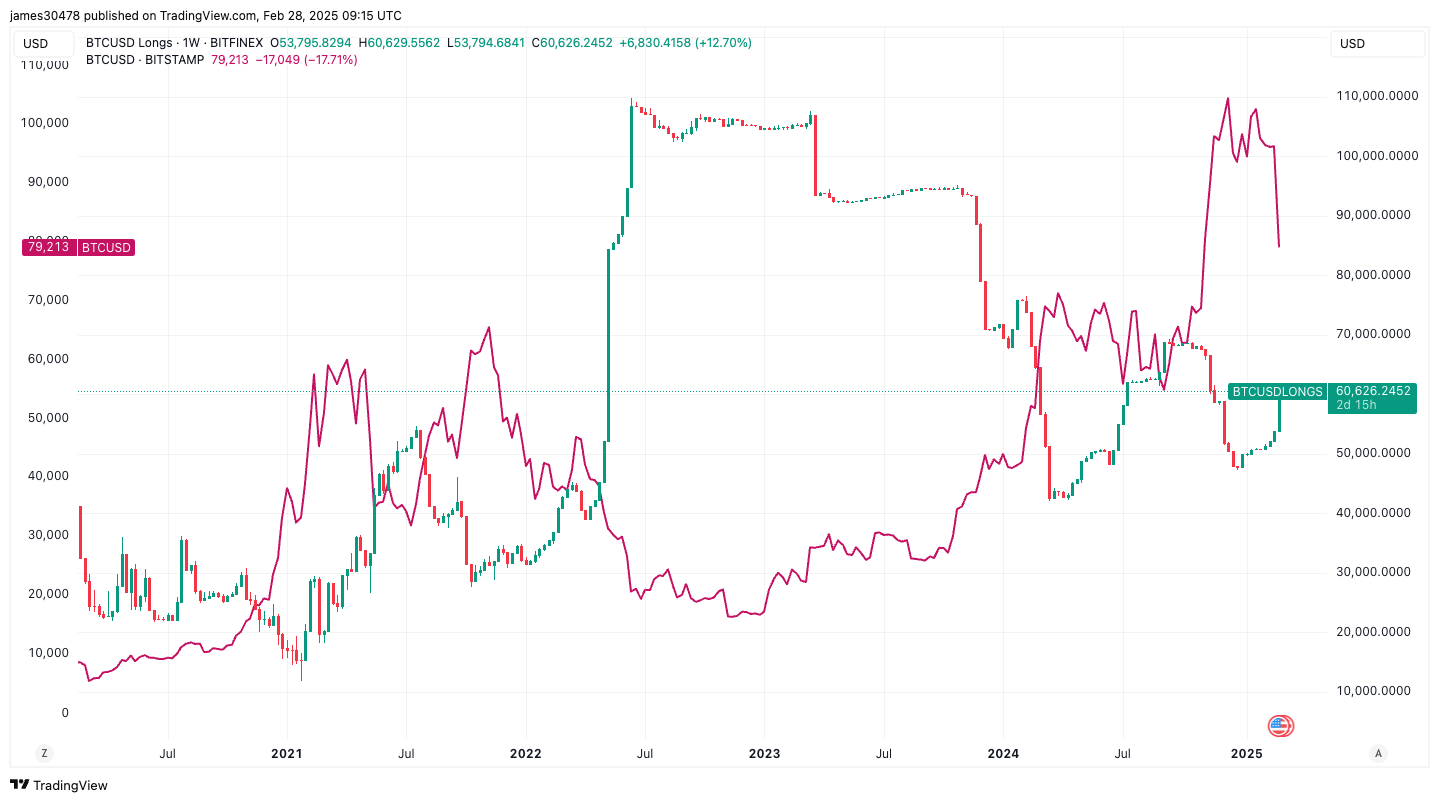

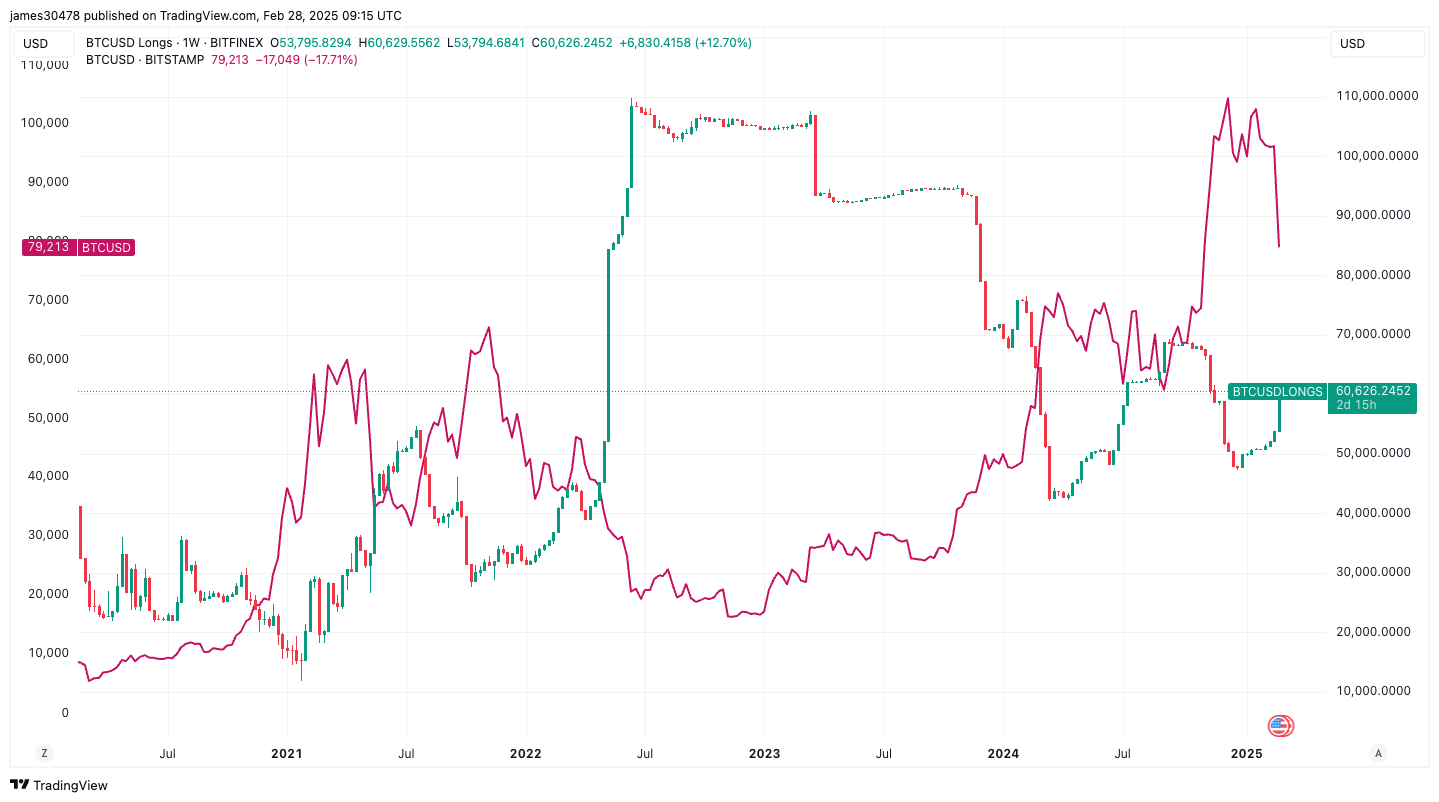

The variety of bitcoin purchased on Bitfinex with borrowed money, a wager that the BTC value will rise and go away the investor with a revenue as soon as they’ve repaid the mortgage, has risen to greater than 60,000 BTC from 50,773 this month. It’s jumped 2% previously 24 hours alone, based on information from Coinglass and TradingView.

The improve in so-called margin lengthy positions is a vote of confidence within the largest cryptocurrency, which has misplaced greater than 20% this month and is on monitor for its worst month-to-month efficiency since June 2022.

Bitfinex merchants are primarily whales — or holders of enormous quantities of bitcoin — who dabble with margin longs. They are identified for precisely signaling bitcoin tops and bottoms and have a tendency to build up throughout downtrends or rangebound markets, as they did in the midst of final 12 months.

Looking at a five-year timeframe, margin longs have persistently elevated holdings throughout value swoons and decreased publicity close to market peaks. This sample was evident throughout the 2021 and 2024 market tops.

As the crypto market tumbles, crypto market sentiment is in a state of maximum concern, based on Coinglass’ Crypto Fear & Greed Index. Over the previous 12 months, the market has solely seen 4 days of maximum concern. It’s been dominated by greed and excessive greed for over 230 days.

[ad_2]