Now Reading: BTC Volatility Wakes Up Signaling Calm Before the Storm

-

01

BTC Volatility Wakes Up Signaling Calm Before the Storm

BTC Volatility Wakes Up Signaling Calm Before the Storm

[ad_1]

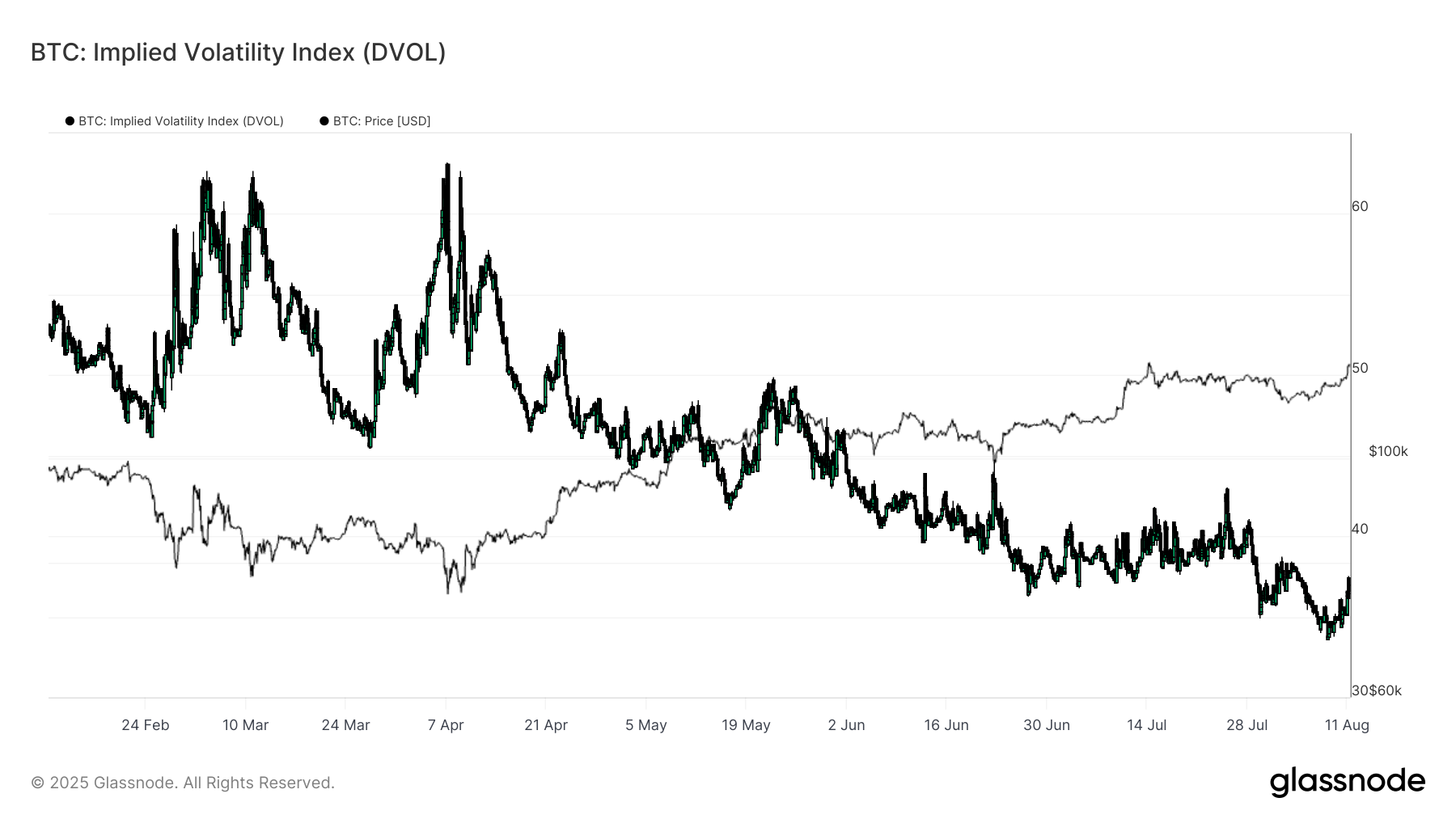

Bitcoin’s (BTC) implied volatility (IV) has moved from 33 to 37 on Monday, a notable uptick from multi-year lows and a attainable sign that the market’s lengthy stretch of calm is nearing an finish.

The Deribit Volatility Index (DVOL), modeled after the VIX in conventional markets, tracks the 30-day implied volatility of bitcoin choices and now sits at its highest degree in weeks.

Implied volatility represents the market’s forecast for value swings, calculated from possibility costs. In formal phrases, IV measures the one-standard-deviation vary of an asset’s anticipated motion over a 12 months. Tracking at-the-money (ATM) IV affords a normalized view of sentiment, typically rising and falling alongside realized volatility.

Last week, BTC’s short-term IV fell to round 26%, one among the lowest readings since choices information started being recorded, earlier than rebounding sharply. The final time volatility sat this low was August 2023, when bitcoin hovered close to $30,000 shortly earlier than a pointy transfer greater.

Over the weekend, bitcoin jumped from $116,000 to $122,000, hinting at what can occur when volatility begins to increase. August is historically a interval of low volumes and muted market exercise, however rising IV suggests merchants could also be positioning for bigger strikes forward.

Checkonchain information reveals this newest rally was a spot-driven transfer, which is a more healthy market construction than a purely leverage-fueled surge. Open curiosity has been declining by way of August, that means a sudden inflow of leverage might amplify value swings if sentiment shifts.

Read extra: Bitcoin Bulls Take Another Shot at the Fibonacci Golden Ratio Above $122K as Inflation Data Looms

[ad_2]