Now Reading: HBAR Advances 4% as ETF Speculation Drives Institutional Trading Activity

-

01

HBAR Advances 4% as ETF Speculation Drives Institutional Trading Activity

HBAR Advances 4% as ETF Speculation Drives Institutional Trading Activity

[ad_1]

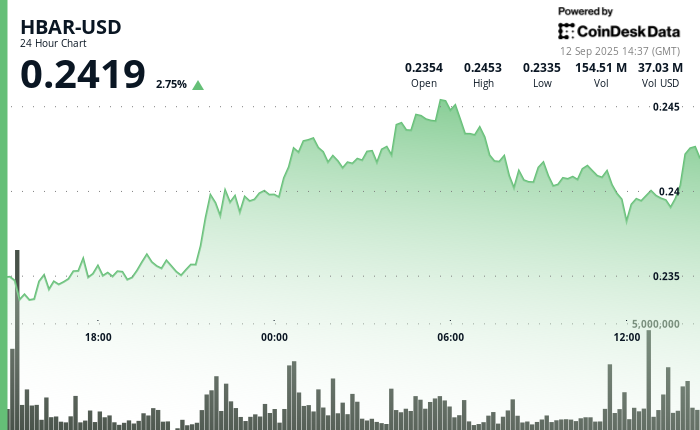

Hedera’s native token HBAR posted modest features in the course of the September 11–12 buying and selling window, climbing from $0.237 to as excessive as $0.245 earlier than closing at $0.240. The transfer mirrored a surge in institutional participation, with market exercise carefully tied to recent developments round potential exchange-traded merchandise.

Corporate momentum constructed after Grayscale Investments revealed plans for a possible HBAR belief and the Depository Trust and Clearing Corporation (DTCC) added a Canary HBAR ETF submitting to its regulatory database. The itemizing, below the proposed ticker HBR, accompanied related submissions for Solana and XRP, underscoring rising Wall Street urge for food for digital property past Bitcoin.

Traders reacted sharply to the information. Technical resistance at $0.245 triggered profit-taking, whereas $0.240 emerged as a key institutional assist degree, strengthened by late-session quantity spikes that topped 17 million tokens. Analysts say the hypothesis might arrange a check of the $0.25 psychological threshold if momentum continues.

Still, trade observers warning that DTCC inclusions characterize solely preliminary steps, not SEC approval. Regulators stay targeted on addressing market manipulation dangers and investor safety requirements for non-Bitcoin crypto property, leaving the timeline for any HBAR-based ETF unsure. For now, the filings have positioned Hedera firmly on Wall Street’s radar, driving institutional consideration even amid regulatory fog.

Market Data Reveals Institutional Trading Patterns

- Intraday buying and selling established a $0.012 vary representing 4.24% volatility between the session excessive of $0.2456 and low of $0.2335.

- Primary upward momentum occurred in the course of the 21:00-05:00 buying and selling window as HBAR superior from $0.235 to peak ranges close to $0.245.

- Volume exercise averaged 54.7 million throughout key breakout intervals, exceeding the 24-hour common of fifty.1 million and indicating institutional participation.

- The $0.240 worth degree demonstrated robust institutional assist with high-volume defensive buying and selling all through the session.

- Selling stress intensified close to $0.245 on elevated quantity, suggesting coordinated profit-taking by institutional holders.

- Late-session quantity surge of 17.08 million at 11:32 triggered systematic promoting and worth consolidation round assist ranges.

Disclaimer: Parts of this text had been generated with the help from AI instruments and reviewed by our editorial workforce to make sure accuracy and adherence to our requirements. For extra data, see CoinDesk’s full AI Policy.

[ad_2]