Now Reading: India in crosshairs: Trump’s Russia oil tariffs- How it could make China great again

-

01

India in crosshairs: Trump’s Russia oil tariffs- How it could make China great again

India in crosshairs: Trump’s Russia oil tariffs- How it could make China great again

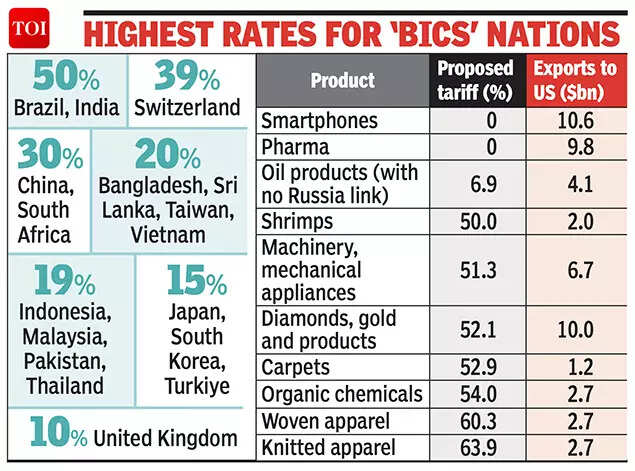

President Donald Trump has hit India with a 50% tariff on its exports to the US, punishing New Delhi for persevering with to purchase Russian crude. He accuses India of “funding Russia’s war machine” and vows extra penalties if Prime Minister Narendra Modi doesn’t halt oil imports from Moscow.This follows Trump’s prior 25% tariff on Indian items. A invoice looking for to levy as much as 500% tariffs on any nation shopping for Russian oil can also be advancing by means of Congress.Why it issues

- Trump’s stress could unravel 25 years of US-India strategic progress – and shift international oil flows towards China.

- India is America’s largest democratic accomplice in Asia, a linchpin in the Quad (with Japan and Australia), and a possible counterweight to China’s rise.

- But Trump’s tariff barrage dangers alienating New Delhi and pushing it nearer to Russia and China – the very actors US coverage seeks to isolate.

- The irony? Trump hasn’t penalized China, the biggest purchaser of Russian crude, which continues to import 2 million barrels/day – roughly the identical as India.

- By singling out India, the US palms Beijing a golden alternative: to snap up discounted Russian oil, develop its power safety, and tighten Eurasian partnerships.

- “India is now in a trap: because of Trump’s pressure, Modi will reduce India’s oil purchases from Russia, but he cannot publicly admit to doing so for fear of looking like he’s surrendering to Trump’s blackmail,” mentioned Ashley Tellis, Carnegie Endowment.

- The goal is Russia. The collateral injury is India. And the strategic beneficiary, many analysts agree, is China.

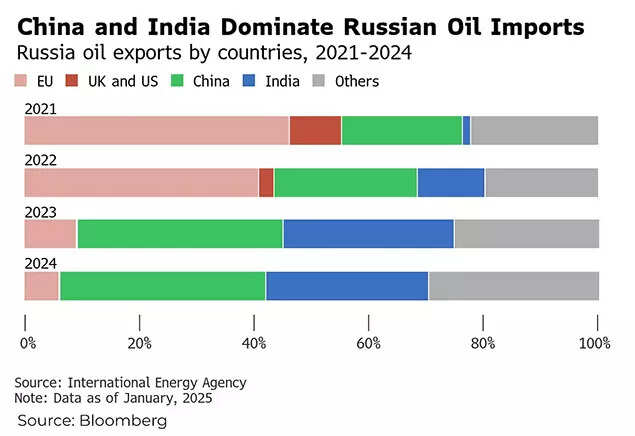

China and India dominate Russian oil imports

The massive image

- India pivoted to Russia in 2022 when the West shunned Moscow’s oil after the Ukraine invasion. Russian crude – notably the heavy, sulfurous Urals mix – was provided at steep reductions, and India pounced.

- From near-zero in 2021, India now imports practically 2 million barrels/day from Russia-about 35–40% of its whole crude imports, in line with the Economist. This transfer lowered India’s oil import invoice, helped hold inflation below management, and made native refiners immensely worthwhile.

- In a rustic nonetheless reliant on imported power to energy its development, it wasn’t simply shrewd-it was needed.

- Indian refiners convert it into diesel, jet gas, and gasoline – then export these merchandise globally at market costs.

- This “arbitrage model” has allowed India to chop its import invoice whereas fueling record-high income for home refiners.

- Until now, Washington and Brussels regarded the opposite means. India’s Russia ties have been chalked as much as “strategic autonomy.” That tolerance is gone.

- For three years, Western allies turned a blind eye. Now, Trump desires to flip the swap. “The White House is serious about pressuring India to go to zero,” one supply informed the Economist, suggesting that Washington could not cease at tariffs. It’s already contemplating slicing off any port, financial institution, or transport firm that facilitates India’s Russian oil offers from the US monetary system.

‘Ready to pay huge price’However, PM Modi has proven no urge for food for retreat. At a nationwide agricultural convention in New Delhi on August 7, Modi declared: “India will never compromise on the interests of its farmers, dairy farmers and fishermen… I am ready to personally pay the huge price.” The assertion, which was extensively interpreted as a response to Trump’s commerce calls for, reinforces Modi’s unwillingness to be seen as capitulating to Washington.

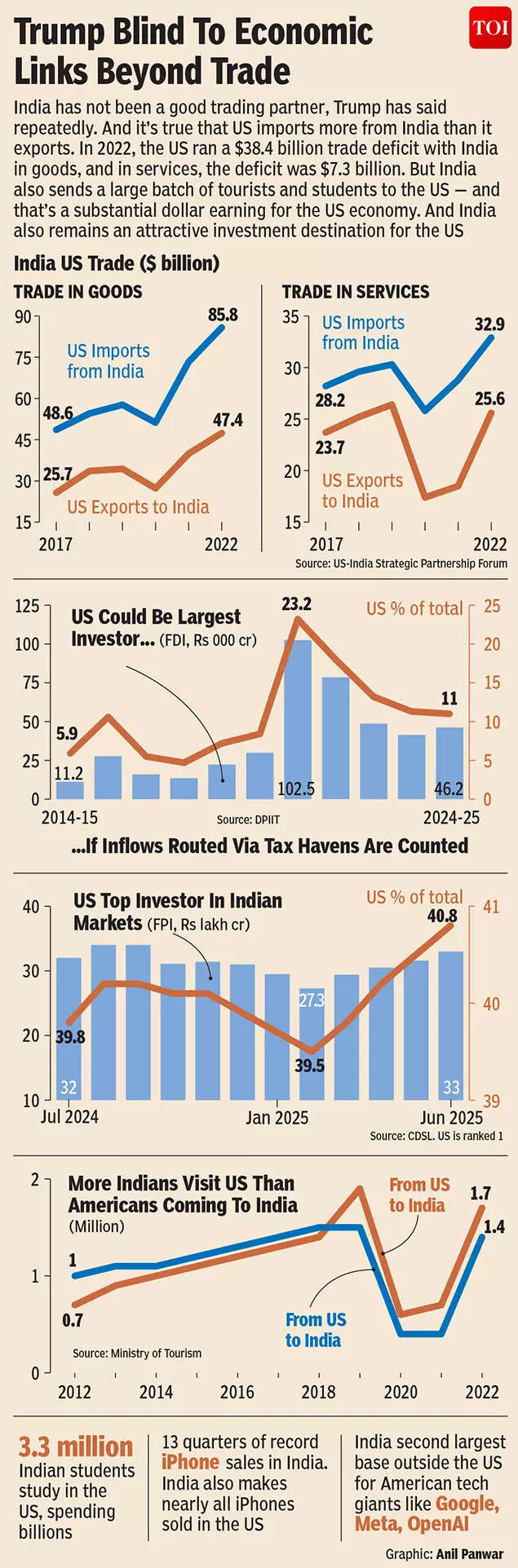

Trump blind to financial hyperlinks past commerce

This isn’t mere bravado. Trump’s tariffs are already biting. According to Bloomberg Economics, if new levies hit Indian electronics and pharmaceuticals-currently quickly exempt-the affect could slice 1.1% off India’s GDP. India’s $86.5 billion in exports to the U.S. are actually in danger, making it one of the vital closely sanctioned main economies in American commerce policy-tied solely with China.Trump’s unpredictable diplomacy has put even India’s allies in Washington on edge. “We are better off together than apart,” Atul Keshap, a former US diplomat and present head of the US-India Business Council, informed The New York Times. “The partnership forged by our elected leaders over the past 25 years is worth preserving.”But that partnership, many worry, is unraveling. And the timing could not be worse.Between the strains: India’s strategic drift towards BeijingModi is now anticipated to go to China later this month for the Shanghai Cooperation Organization (SCO) summit, his first journey there in seven years. Russian President Vladimir Putin can be in attendance. Chinese international minister Wang Yi is reportedly making ready a bilateral agenda for talks between Modi and Xi Jinping.This is not only symbolic diplomacy. Analysts warn that US- India ties are at their lowest level since Washington sanctioned New Delhi for its nuclear assessments in 1998. Ashley Tellis of the Carnegie Endowment known as it “a needless crisis” pushed by Trump’s private political wants.

Highest charges for ‘BICS’ nations

Meanwhile, Putin has already met Trump’s envoy Steve Witkoff 5 instances this yr, together with a three-hour assembly simply as Trump introduced the tariffs. The objective: discover a possible “grand bargain” to finish the conflict in Ukraine. As NYT reported, Trump’s calculus seems clear-force Russia to barter by isolating its patrons. But in turning up the warmth on India, he dangers pushing the world’s largest democracy into tighter alignment with Beijing and Moscow.Indeed, one senior Indian official informed Reuters that “India will gradually repair ties with the US,” however is now exploring deeper engagement with Russia, China, and the BRICS bloc.China’s silent coup in the oil market

- As India scrambles to seek out alternate options to Russian crude, China is doing the alternative: it’s quietly stockpiling.

- Chinese refiners have elevated their Russian orders in latest months, in line with the Economist, anticipating this precise second.

- With Indian refiners prone to cut back, the competitors for discounted Russian barrels will vanish-and China will reap the advantages.

- “Being less exposed to American sanctions, [Chinese refiners] would also continue to buy Russian crude-at a growing discount,” the Economist famous.

- This is not only about cheaper oil. It’s a geopolitical opening. Beijing is watching two of its regional rivals-Washington and New Delhi-clash, whereas it quietly tightens its grip on Russia’s most useful export.

- That, in essence, is Trump’s tariff paradox: in punishing India for its Russian oil ties, he could also be making China stronger.

- In Asia Times, Y Tony Yang known as it “a troubling paradox,” the place “rather than weakening China’s position, the tariffs appear to be generating economic headwinds at home, straining key alliances, and creating new opportunities for Beijing to expand its global influence.”

In attempting to punish one pal, Trump could also be rewarding two foes.The American priceWhile the White House boasts of rising tariff revenues-monthly collections tripled to $29 billion by July 2025, in line with Asia Times-the financial penalties are rising. Yale’s Budget Lab estimates that Trump’s tariffs will price American households a mean of $2,400 this yr. US GDP development has slowed to 1.2% in the primary half of 2025, down from 2.8% final yr.Manufacturing job development has stalled. In California alone, over 64,000 jobs in commerce and logistics are in danger, and the Port of Los Angeles is working at 70% capability.At the strategic stage, the implications are graver. Allies like Japan and South Korea have been granted tariff aid after tense negotiations. Only India faces the complete 50% levy. “It’s not pressure-it’s punishment,” mentioned one South Korean commerce analyst, quoted in Asia Times. “It creates space for China.”And China is losing no time. It’s expanded its Belt and Road infrastructure offers in Africa and Latin America and now leads the worldwide renewable power race. In 2024, China added 429 gigawatts of latest technology capacity-86% from renewables-while America centered on tariff enforcement.A self-inflicted wound

- Trump’s technique hinges on forcing India’s hand in hopes of ending a conflict. But it could backfire in one other.

- India is not only a purchaser of Russian oil; it’s a accomplice in the Indo-Pacific, a member of the Quad, a bulwark towards Chinese regional dominance. Weakening that partnership may win a short-term tactical victory-but on the danger of dropping the lengthy recreation.

- The irony is bitter. Trump as soon as known as India’s financial system “dead.” But it is the fastest-growing giant financial system in the world. Alienating it with tariffs whereas ignoring China’s bigger infractions sends a message that US coverage is much less about equity and extra about favoritism.

- Ajay Srivastava, a former commerce official on the Global Trade Research Initiative, a New Delhi-based suppose tank, informed the NYT: “US motion “will push India to reconsider its strategic alignment, deepening ties with Russia, China and many other countries.”

(With inputs from businesses)