Now Reading: It is All About Nonfarm Payrolls as BTC Value Shrugs Off Eric Trump Endorsement

-

01

It is All About Nonfarm Payrolls as BTC Value Shrugs Off Eric Trump Endorsement

It is All About Nonfarm Payrolls as BTC Value Shrugs Off Eric Trump Endorsement

[ad_1]

By Omkar Godbole (All instances ET except indicated in any other case)

The crypto market stays directionless, with bitcoin (BTC) languishing beneath $100,000 earlier than the U.S. jobs report. It is stunning costs haven’t but crossed that threshold, particularly after President Donald Trump’s son, Eric, inspired the family-linked WLFI to put money into BTC in a submit on X on Thursday.

Sometimes, such endorsements throughout a bull run result in substantial good points. That that hasn’t materialized is an indication markets are not buoyed by speak alone and Trump must stroll the stroll. Early this week, the administration mentioned it is evaluating the feasibility of a strategic BTC reserve.

One other risk is that warning forward of nonfarm payrolls is capping the upside. If that is the case, a breakout could happen as soon as the information is out, particularly if the determine prints weaker than estimated, doubtlessly driving Treasury yields and the greenback index decrease.

Crypto e-newsletter service LondonCryptoClub recommends keeping track of revisions within the earlier figures. “Bloomberg Intelligence anticipating some massive draw back revisions suggesting the Labour market not as sturdy in 2024 as first appeared We nonetheless assume the market (and the Fed themselves) are massively below pricing the speed cuts that might want to come,” the e-newsletter service’s founders mentioned on X.

At press time, Volmex’s one-day bitcoin implied volatility index stood at an annualized 51%, suggesting a day by day worth swing of two.6%, or about $2,600. In different phrases, the determine may transfer the spot worth by $2,600 in both course. Notably, some merchants are shopping for put choices, bracing for potential draw back volatility ought to the information are available in sturdy.

In different information, the “Strategic Bitcoin Reserve” invoice handed the Home within the state of Utah and can now transfer to the Senate. Bloomberg ETF analyst James Seyffart reported that the U.S. SEC has acknowledged Grayscale’s Solana 19b-4 submitting. And VanEck predicted a $500 worth for SOL, greater than double its present worth of round $180.

Moreover, FOX reporter Eleanor Terrett shared that U.S. Home Monetary Providers Committee Chairman French Hill and Digital Belongings Subcommittee Chairman Bryan Steil have launched a stablecoin regulation dialogue draft, which proposes a two-year ban on stablecoins backed solely by self-issued digital belongings and mandates a Treasury examine on their dangers.

And at last, Berachain’s BERA token, which debuted yesterday, has already recorded a staggering perpetual buying and selling quantity of $4.8 billion, with its worth at present sitting at $7.60, a major drop from yesterday’s peak of $14. Keep alert!

What to Watch

- Crypto:

- Feb. 13: Begin of Kraken’s gradual delisting of the USDT, PYUSD, EURT, TUSD, UST stablecoins for EEA shoppers. The method ends March. 31.

- Feb. 18, 10:00 a.m.: FTX Digital Markets, the Bahamas-based subsidiary of FTX, will begin reimbursing collectors.

- Macro

- Feb. 7, 8:30 a.m.: U.S. Bureau of Labor Statistics (BLS) releases January’s Employment State of affairs report.

- Non Farm Payrolls Est. 170K vs. Prev. 256K

- Unemployment Charge Est. 4.1% vs. Prev. 4.1%

- Feb. 8, 8:30 p.m.: China’s Nationwide Bureau of Statistics (NBS) releases January’s Client Value Index (CPI) report.

- Inflation Charge MoM Prev. 0%

- Inflation Charge YoY Prev. 0.1%

- PPI YoY Prev. -2.3%

- Feb. 7, 8:30 a.m.: U.S. Bureau of Labor Statistics (BLS) releases January’s Employment State of affairs report.

- Earnings

- Feb. 10: Canaan (CAN), pre-market, $-0.08

- Feb. 11: HIVE Digital Applied sciences (HIVE), post-market, $-0.11

- Feb. 11: Exodus Motion (EXOD), post-market, $0.14 (2 ests.)

- Feb. 12: Hut 8 (HUT), pre-market, $0.04

- Feb. 12: IREN (IREN), post-market, $-0.01

- Feb. 12 (TBA): Metaplanet (TYO:3350)

- Feb. 12: Reddit (RDDT), post-market, $0.25

- Feb. 12: Robinhood Markets (HOOD), post-market, $0.41

- Feb. 13: Coinbase International (COIN), post-market, $1.61

Token Occasions

- Governance votes & calls

- OsmosisDAO is discussing a change to using taker charges collected in OSMO to burn 50% of collected charges.

- Threshold DAO is discussing the creation of a bond program to handle its stablecoin’s liquidity challenges.

- Sky DAO is voting on an an government proposal to decrease financial savings charges, sweep over 400K DAI in PauseProxy into the Surplus Buffer and allocate 3 million DAI for integration enhance funding, amongst different issues.

- Yearn DAO is discussing the elimination of the Protocol Guardian Position over considerations surrounding its use to override earlier democratic choices and potential authorized dangers.

- Feb. 7, 1 p.m.: Sweat Economic system (SWEAT) to maintain a token holders briefing discussing tokenomics, product roadmap and partnerships.

- Feb. 8, 1:08 p.m.: A dYdX Basis vote on granting the dYdX Operations subDAO signer market authority over the market map and get rid of income sharing for that operate is on observe to move.

- Feb. 10, 10:30 a.m.: OKX to maintain a listings AMA with Chief Advertising and marketing Officer Haider Rafique and Head of Product Advertising and marketing Matthew Osofisan.

- Unlocks

- Feb. 9: Motion (MOVE) to unlock 2.17% of circulating provide value $31.41 million.

- Feb. 10: Aptos (APT) to unlock 1.97% of circulating provide value $68.99 million.

- Feb. 12: Aethir (ATH) to unlock 10.21% of circulating provide value $22.72 million.

- Token Launches

- Feb. 7: Avalon Labs (AVL) to be listed on Bybit.

- Feb. 13: EthereumPoW (ETHW) and Polygon (MATIC) to not be supported at Deribit.

Conferences

CoinDesk’s Consensus to happen in Hong Kong on Feb. 18-20 and in Toronto on Could 14-16. Use code DAYBOOK and save 15% on passes.

Token Speak

By Shaurya Malwa

- BNB Chain speculators are playing with a random TST token after an academic video confirmed its creation.

- TST, or Take a look at Token, was issued on the BNB Chain utilizing the BEP-20 normal. It was not formally launched by Binance, however somewhat utilized in a token creation tutorial video by the BNB Chain group.

- The worth surged after the video was shared by Binance founder Changpeng Zhao on X as a result of customers took it to be an official Binance token though Zhao not has a proper function on the firm.

- Zhao deleted his repost of the video later.

- TST skyrocketed to a market cap of round $40 million shortly after Zhao’s submit, reaching buying and selling volumes of over $90 million at peak.

Derivatives Positioning

- Perpetual funding charges for BERA are deeply unfavourable, showcasing a robust bias for brief positions. SOL, BNB, SHIB and BCH even have unfavourable charges.

- QCP Capital famous demand for BTC places at $90K and $80K strikes expiring on Feb. 28 in an indication of persistent draw back worries.

- Block flows featured a BTC calendar unfold betting on costs staying beneath $120K by the tip of April, however ultimately rising previous $170K the tip of December. Plus, an outright lengthy within the $88K Feb expiry put crossed the tape.

- ETH flows featured an outright lengthy within the Feb. 14 expiry name on the $2,800 strike.

Market Actions:

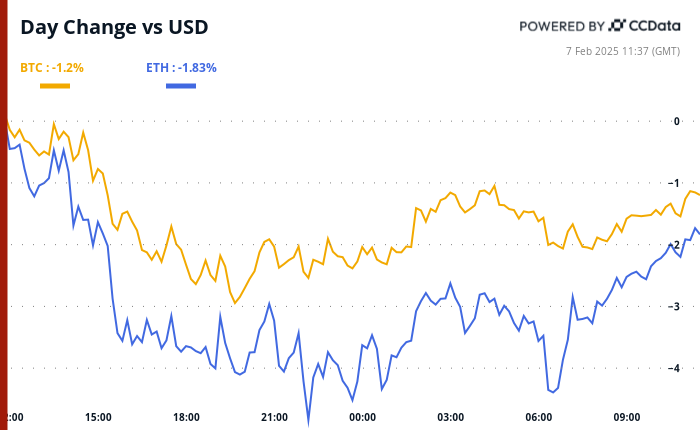

- BTC is up 1.24 % from 4 p.m. ET Thursday to $97,686.16 (24hrs: -1.07%)

- ETH is up 1.61% at $2,757.18 (24hrs: -1.75%)

- CoinDesk 20 is up 1.99% to three,215.42 (24hrs: -1.83%)

- CESR Composite Staking Charge is down 3 bps to three.06%

- BTC funding fee is at 0.0052% (5.72% annualized) on Binance

- DXY is up 0.08% at 107.78

- Gold is up 0.37% at $2,866.78/oz

- Silver is up 0.29% to $32.26/oz

- Nikkei 225 closed down 0.72% at 38,787.02

- Grasp Seng closed up 1.15% at 21,133.54

- FTSE is down 0.29% at 8,703.92

- Euro Stoxx 50 is down 0.15% at 5,348.71

- DJIA closed -0.28% to 44,747.63

- S&P 500 closed +0.36% at 6,083.57

- Nasdaq closed +0.51% at 19,791.99

- S&P/TSX Composite Index closed -0.14% at 25,534.49

- S&P 40 Latin America closed +1.87% at 2,437.08

- U.S. 10-year Treasury was unchanged at 4.44%

- E-mini S&P 500 futures are unchanged at 6,104.00

- E-mini Nasdaq-100 futures are unchanged at 21,855.75

- E-mini Dow Jones Industrial Common Index futures are unchanged at 21,853.00

Bitcoin Stats:

- BTC Dominance: 61.62 (-0.48%)

- Ethereum to bitcoin ratio: 0.02823 (1.40%)

- Hashrate (seven-day shifting common): 808 EH/s

- Hashprice (spot): $57.2

- Whole Charges: 5.17 BTC / $514,435

- CME Futures Open Curiosity: 163,140 BTC

- BTC priced in gold: 33.7 oz

- BTC vs gold market cap: 9.58%

Technical Evaluation

- Bitcoin appears to be crossing beneath the Ichimoku cloud utilized by merchants to gauge momentum and pattern energy.

- Crosses beneath the indicator are taken to symbolize a bearish shift in pattern.

Crypto Equities

- MicroStrategy (MSTR): closed on Thursday at $325.46 (-3.34%), up 0.63% at $327.50 in pre-market.

- Coinbase International (COIN): closed at $270.37 (-1.73%), up 0.75% at $272.39 in pre-market.

- Galaxy Digital Holdings (GLXY): closed at C$27.07 (-2.13%)

- MARA Holdings (MARA): closed at $16.80 (-1.35%), up 0.89% at $16.95 in pre-market.

- Riot Platforms (RIOT): closed at $11.61 (-1.11%), up 0.69% at $11.69 in pre-market.

- Core Scientific (CORZ): closed at $12.53 (-1.42%), up 0.32% at $12.57 in pre-market.

- CleanSpark (CLSK): closed at $10.38 (+0.68%), up 6.84% at 11.09 in pre-market.

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $22.76 (+1.34%), down 0.06% at $22.70 in pre-market.

- Semler Scientific (SMLR): closed at $49.92 (-3.61%), up 2.14% at $50.99 in pre-market.

- Exodus Motion (EXOD): closed at $48.01 (-6.52%), unchanged in pre-market.

ETF Flows

Spot BTC ETFs:

- Each day internet circulate: -$140.2 million

- Cumulative internet flows: $40.53 billion

- Whole BTC holdings ~ 1.174 million.

Spot ETH ETFs

- Each day internet circulate: $10.7 million

- Cumulative internet flows: $3.18 billion

- Whole ETH holdings ~ 3.783 million.

Supply: Farside Buyers

In a single day Flows

Chart of the Day

- The mixed market capitalization of high two stablecoins, USDT and USDC, continues to develop and is quick nearing $200 billion.

- The relentless rise represents an inflow of cash into the crypto market, hinting at bullish prospects.

Whereas You Have been Sleeping

- Bitcoin in a Mire, Gold Eyes sixth Straight Week of Features as Jobs Knowledge Looms (CoinDesk): With BTC struggling to search out its footing amid declining Bitcoin community exercise, immediately’s U.S. jobs knowledge will give some clues on what the Fed could do subsequent.

- Solana’s SOL Might Hit $520 by 2025-Finish, VanEck Says (CoinDesk): Funding agency VanEck expects the SOL worth to succeed in $520 by year-end. The forecast is predicated on rising demand for smart-contract platforms and an increasing U.S. M2 cash provide.

- Fed’s Waller Says Stablecoins Might Again Greenback’s Reserve Standing (Bloomberg): Whereas giving a speech in Washington, Fed Governor Christopher Waller expressed assist for stablecoins so long as applicable “regulatory rails” are in place to “be certain that the cash is there.”

- Trump’s Memecoin Copycats Spark Fears for Buyers (Monetary Occasions): In response to an FT evaluation, since Donald Trump and his spouse launched official memecoins, over 700 copycat tokens have flooded his official Solana pockets, prompting investor warnings.

- India’s Central Financial institution Cuts Charges for First Time in Practically 5 Years; Alerts Much less Restrictive Strategy (Reuters): The Reserve Financial institution of India (RBI) diminished its repo fee by 25 foundation factors whereas sustaining a impartial coverage stance in an try and stimulate a sluggish financial system amid decrease development expectations.

- Look to India, Japan for ‘High quality Alpha’ Amid Market Uncertainty, Investor Says (CNBC): In response to different funding agency PAG, it is laborious to search out alpha in China proper now as a result of a lackluster financial system and uncertainty over the impression of a commerce conflict with the U.S.

Within the Ether

[ad_2]