Now Reading: RBI forex income likely greater, set to push dividend payout to central government

-

01

RBI forex income likely greater, set to push dividend payout to central government

RBI forex income likely greater, set to push dividend payout to central government

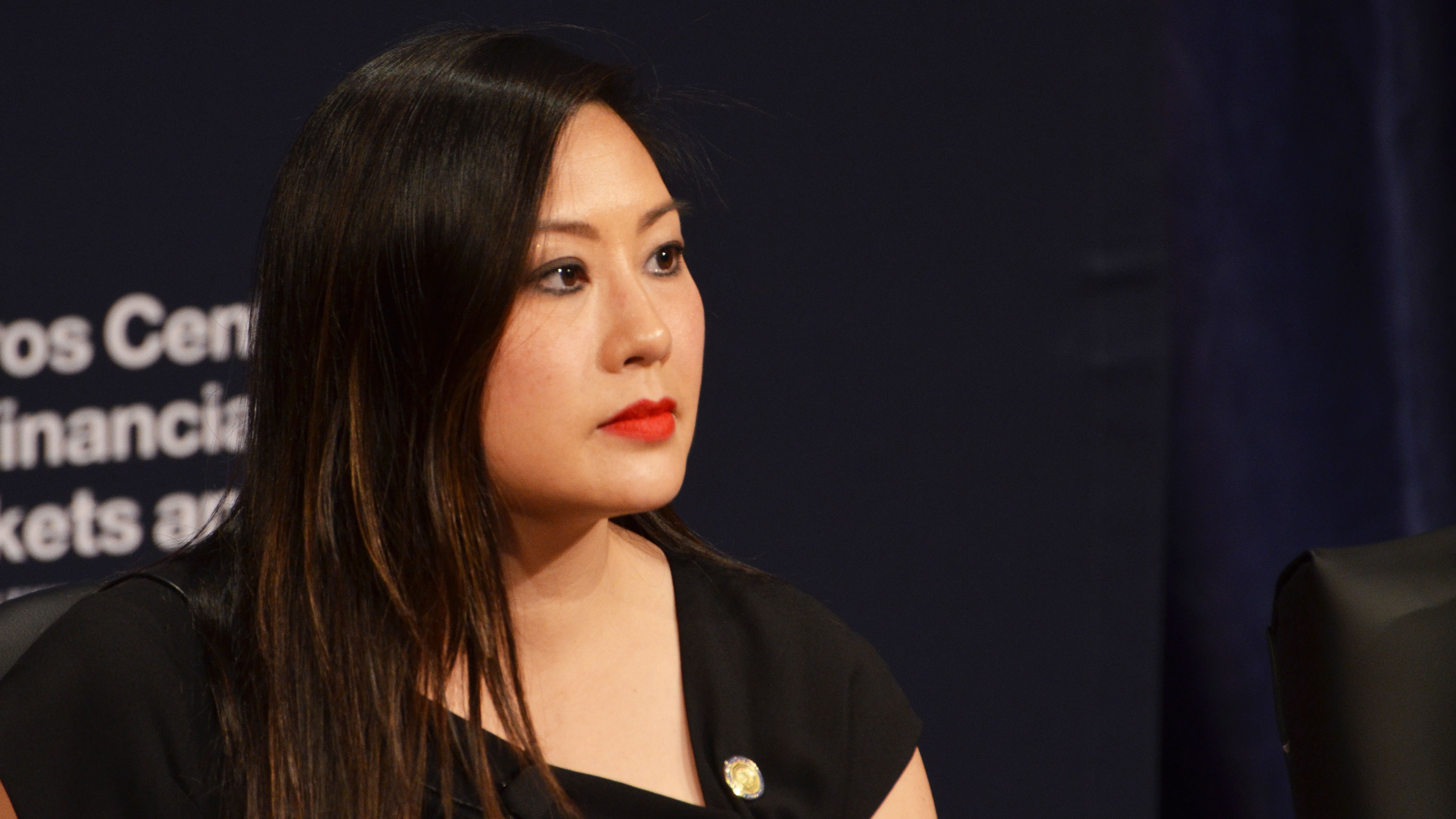

The central financial institution’s income from overseas alternate reserves deployment in FY25 seems greater than the earlier 12 months, influenced by sustained elevated US treasury yields all through a number of months, primarily based on latest RBI information quoted by the Economic Times.This income, stemming from curiosity earnings on overseas property, may contribute to a rise within the central financial institution’s dividend payout to the government, which is already anticipated to be greater this 12 months thanks to strong commissions from forex operations and curiosity income from government securities. However, analysts famous that precisely predicting the switch quantity might be difficult due to the complexity of provisioning workouts.During April-December 2024, curiosity earnings on RBI’s overseas foreign money property confirmed a 40 per cent improve to $17 billion in contrast to the earlier 12 months, as revealed within the central financial institution’s latest breakdown of invisibles information.Historical evaluation of RBI’s monetary statements signifies that forex deployment earnings represent below 15 per cent of complete income. Additional income streams embrace commissions from foreign money market administration by greenback transactions, returns on government securities holdings, and income from liquidity operations.“We expect the RBI dividend to be supported by forex intervention as gross dollar sales have been substantial. Other sources of income will be interest income on government security and foreign currency assets,” stated Gaura Sengupta, chief economist at IDFC First Bank. “On the expenditure side, how much provisioning is done can be a key variable,” he added.The central financial institution is anticipated to declare its FY25 surplus funds switch to the government in late May, following final 12 months’s Rs 2.1 lakh crore cost, which exceeded expectations twofold.As of March 28, 2025, RBI’s financial capital stands at 28.5 per cent, above the advisable vary of 20.4-25.4 per cent. Despite this, specialists counsel greater provisioning is likely to be mandatory due to steadiness sheet growth, pushed by the financial institution’s liquidity infusion into the banking system following two rate of interest reductions.