Now Reading: Riot Platforms Bucks Pattern of Weak January Bitcoin Manufacturing Figures

-

01

Riot Platforms Bucks Pattern of Weak January Bitcoin Manufacturing Figures

Riot Platforms Bucks Pattern of Weak January Bitcoin Manufacturing Figures

[ad_1]

Riot Platforms (RIOT) mined 527 Bitcoin (BTC) in January, marking its highest month-to-month manufacturing since December 2023 and reflecting a 2% enhance from the earlier month, in accordance with Farside knowledge.

Nonetheless, the broader bitcoin mining sector reported underwhelming manufacturing figures, with most main mining corporations experiencing month-over-month declines.

MARA Holdings (MARA) mined 750 BTC in January, representing a 13% decline from December. Equally, Cleanspark (CLSK) noticed a 6% lower, mining 626 BTC. Different mining corporations additionally reported unfavorable month-over-month manufacturing figures:

- IREN (IREN): 2% decline

- Core Scientific (CORZ): 13% decline

- Cipher Mining (CIFR): 7% decline

- Bitfarms (BITF): 5% decline

- Hut 8 (HUT): 31% decline

The widespread decline in bitcoin manufacturing could be attributed to the growing community problem, which each Riot and MARA’s CEOs cited as a key problem.

“In January, our manufacturing noticed a 12% month-over-month decline in blocks received, largely attributable to fluctuations in community problem and intermittent curtailment,” mentioned Fred Thiel, MARA’s chairman and CEO.

“Riot mined 527 Bitcoin in January, marking the second consecutive month of elevated manufacturing regardless of rising community problem,” mentioned Jason Les, CEO of Riot.

Bitcoin’s mining problem adjusts each 2,016 blocks to keep up a median block time of 10 minutes. The subsequent problem adjustment, set for Feb. 9, is projected to hit an all-time excessive, surpassing the earlier file of 108.11 trillion (T).

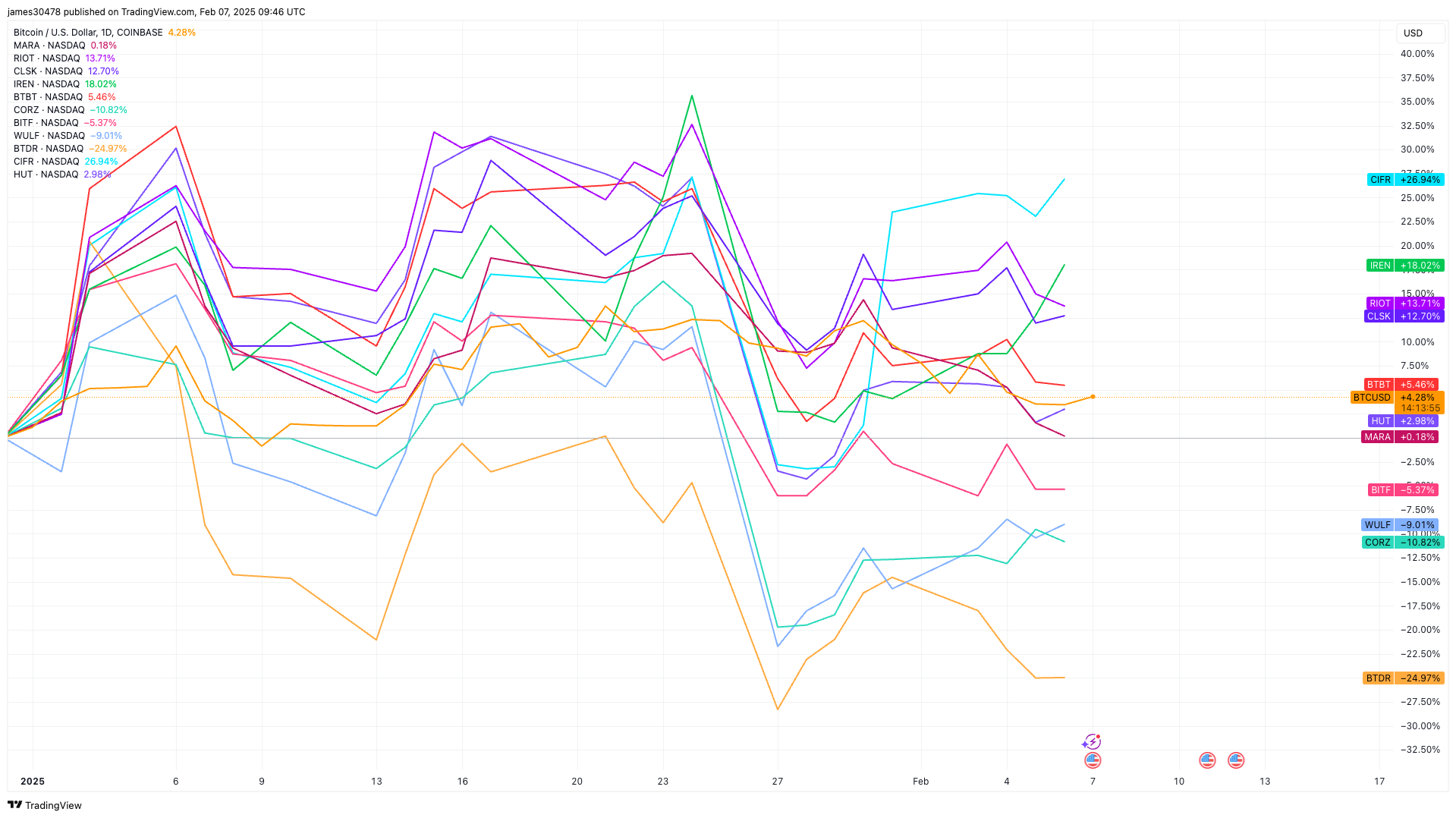

Mining Shares Efficiency Yr-to-Date

Bitcoin has risen 4% YTD, serving as a benchmark for mining shares. Amongst miners:

- Cipher Mining (CIFR) is the standout performer, up 27%

- IREN, RIOT, and CLSK have all posted double-digit good points

- Bitdeer Applied sciences (BTDR) is down 25%

- Core Scientific (CORZ) and TerraWulf (WULF) are each down roughly 10%.

Hive (HIVE), BTDR and WULF have but to report January manufacturing figures.

[ad_2]