Now Reading: S&P 500 Enters Correction Territory, What Does This Mean For BTC?

-

01

S&P 500 Enters Correction Territory, What Does This Mean For BTC?

S&P 500 Enters Correction Territory, What Does This Mean For BTC?

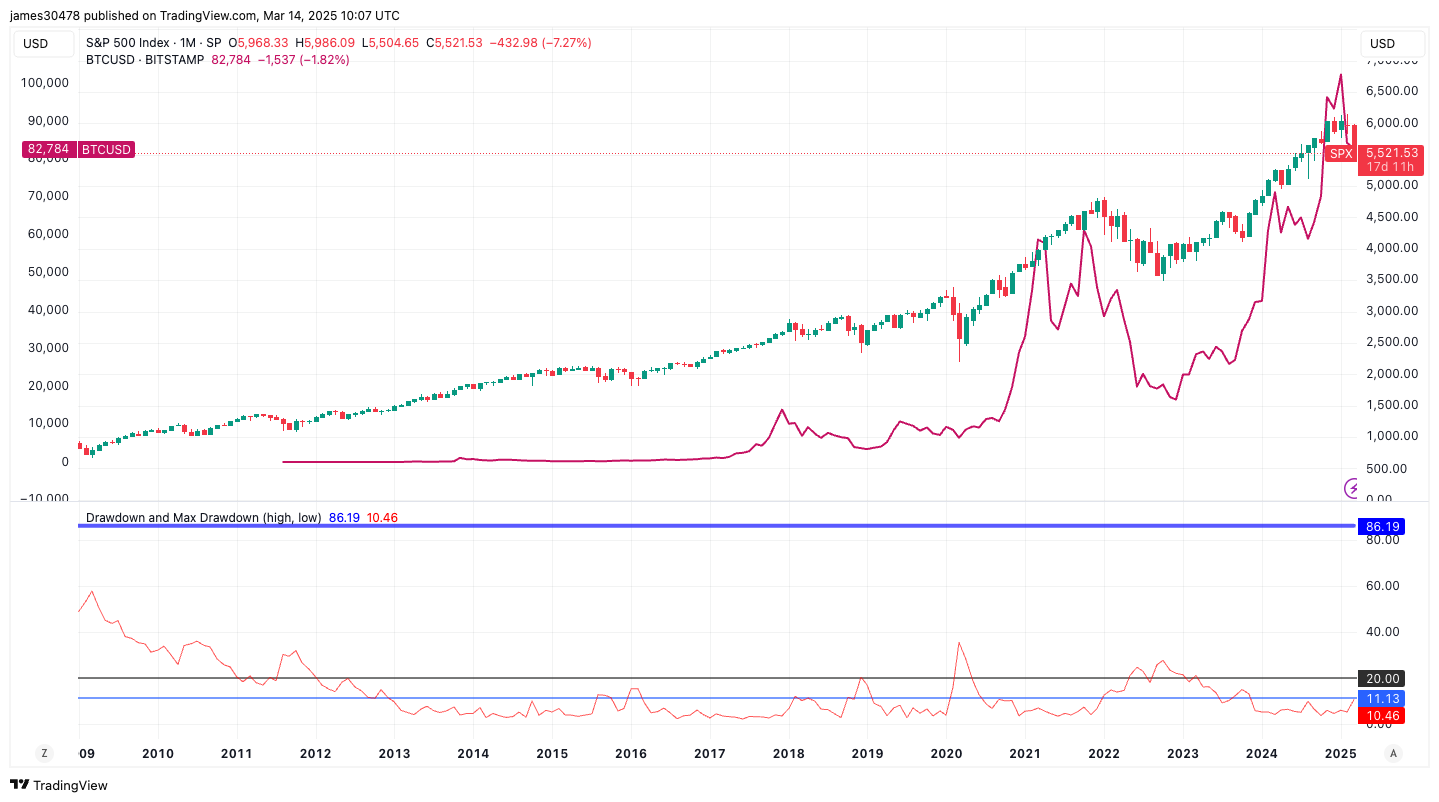

The S&P 500 has now entered correction territory, outlined as a ten% decline from its all-time excessive. An additional 10% drop would sign a bear market. But is it time to panic? Since Bitcoin’s creation in 2009, the S&P 500 has skilled a number of 20% corrections.

Following the 2008 international monetary disaster the index had plunged practically 60%. In 2019, amid bitcoin’s bear market, the S&P 500 declined by 20%, bitcoin fell as a lot as 85% from its all-time excessive. The covid-19 crash in March 2020 noticed the index drop virtually 40% with bitcoin shedding 60% of its worth. Most just lately in 2022, the index corrected by 25%, bitcoin bottomed out one month later after dropping by an extra 25% to a cycle low of $15,000.

Historically, 10% corrections within the S&P 500 have been frequent. Meanwhile, bitcoin has dropped 30% from its all-time excessive throughout this correction. Looking at previous bull market corrections, such declines are a standard incidence, with the latest 30% correction taking place in August 2024 throughout the yen carry commerce unwind.