Now Reading: Trump’s tariffs: Larger the US enterprise, bigger the stock hit

-

01

Trump’s tariffs: Larger the US enterprise, bigger the stock hit

Trump’s tariffs: Larger the US enterprise, bigger the stock hit

[ad_1]

MUMBAI: Stocks of firms with massive publicity to the US market are being bought aggressively by buyers as market gamers fears a few recession in the world’s largest financial system and slowdown in companies globally grows. Economists and market strategists consider that the excessive import tariffs by the US might immediate different international locations to retaliate with related measures, which in flip might result in a world slowdown in manufacturing, hurting virtually each nation.

In the Indian market, firms from sectors like auto & auto elements, metals, software program, pharma, textiles, and gems & jewelry have seen their stock costs slid sharply.

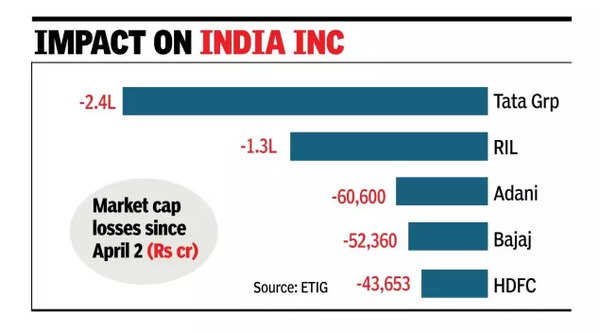

Among main conglomerates, Tata Group, with a big publicity to the US market, has seen its mixture market capitalisation dip the most since the new tariff proposals have been introduced late on April 2. The group’s market cap is down by about Rs 2.4 lakh crore to Rs 25.5 lakh crore. This is adopted by Mukesh Ambani-led Reliance Industries group, which has misplaced about Rs 1.3 lakh crore price of market worth.

Among Tata Group firms, flagship TCS’s market cap has fallen by about Rs 97,100 crore; Tata Motors, which has a big publicity to the US market by means of its worldwide arm JLR, has misplaced about Rs 33,800 crore price of market worth. The present selloff in IT exporters is principally on the again of fears {that a} slowdown in the US, which is the largest marketplace for software program exports, might hit their revenue and revenue. The largest market cap loss amongst firms has been in Reliance Industries (Rs 1.1 lakh crore).

Among metals firms, Tata Steel has misplaced practically Rs 31,300 crore price of market cap whereas Hindalco has misplaced about Rs 22,200 crore price of market worth. Metal shares are down on fears {that a} world recession or a slowdown would considerably curtail demand for metals, sector analysts mentioned. In Monday’s market, six of the 30 sensex constituents hit 52-week low ranges: Infosys, L&T, RIL, Tata Motors, TCS and Titan. And amongst BSE 100 constituents, as many as 22 shares hit 52-week low ranges.

[ad_2]