Now Reading: U.S. Bitcoin ETFs Post Year’s 2nd-Biggest Outflows, More May Be on the Way

-

01

U.S. Bitcoin ETFs Post Year’s 2nd-Biggest Outflows, More May Be on the Way

U.S. Bitcoin ETFs Post Year’s 2nd-Biggest Outflows, More May Be on the Way

U.S. spot-listed bitcoin (BTC) exchange-traded funds (ETFs) skilled the second-biggest outflows of the 12 months on Monday, dropping $516.4 million, Farside knowledge exhibits.

The withdrawals, the ninth web outflow in 10 days, replicate a rising discomfort with the largest cryptocurrency, which has traded in a slender value vary between $94,000 and $100,000 for many of this month.

On Tuesday, bitcoin broke out of its three-month channel, falling beneath $90,000 and sliding to as little as $88,250.

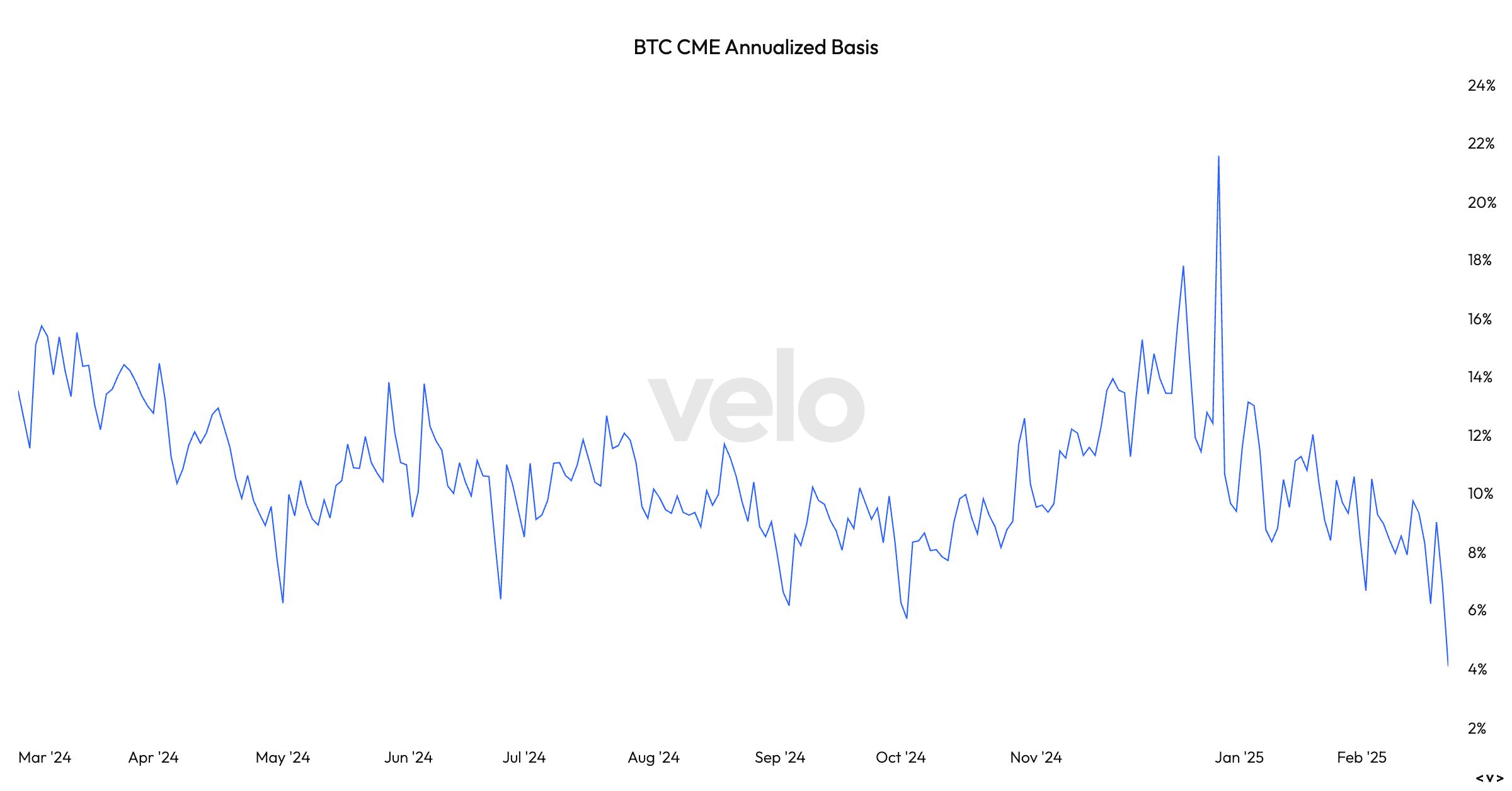

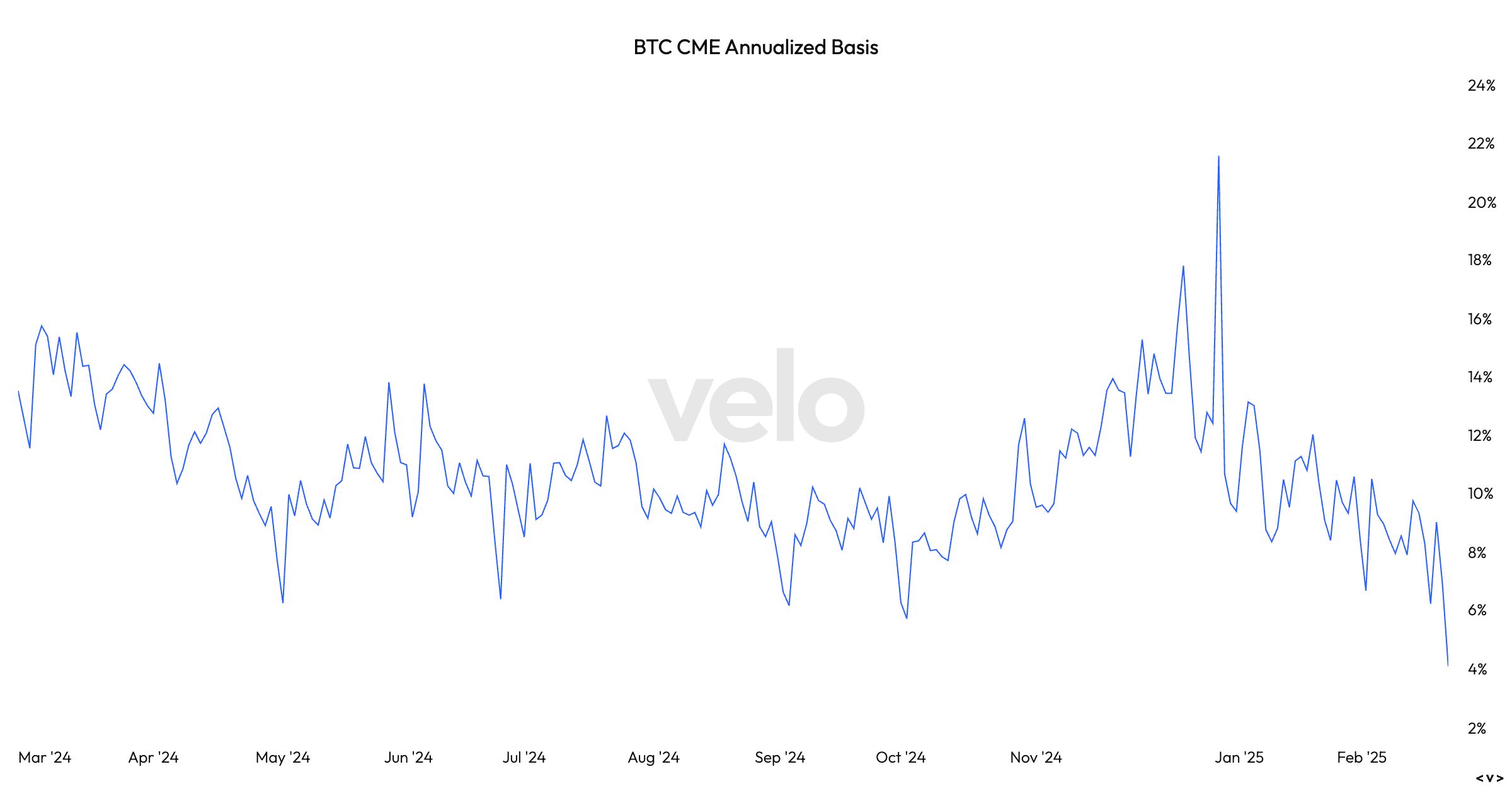

According to Velo knowledge, the bitcoin CME annualized foundation — the distinction between the spot value and futures — has dropped to 4%. This is the lowest since the ETFs began buying and selling in January 2024. This is often known as the cash-and-carry commerce, which is a market-neutral technique that seeks to revenue from the mispricing between the two markets.

The technique entails taking an extended place in the spot market and a brief place in the futures market. Velo knowledge exhibits a one-month futures ahead contract. Investors gather a premium between the unfold of the spot and futures pricing till the futures contract expiry date closes.

At the present stage, the foundation commerce is lower than the so-called risk-free fee, the yield on the U.S. 10-year Treasury of 5%. The distinction could persuade buyers to shut their positions in favor of the larger return. That may see additional outflows from the ETFs. Because this can be a impartial technique, buyers may also have to shut their quick place in the futures market.

Arthur Hayes, the co-founder of Bitmex, alludes to the foundation commerce unravelling in a submit on X.

“Lots of IBIT holders are hedge funds that went long ETF short CME future to earn a yield greater than where they fund, short term US treasuries,” he wrote. “If that basis drops as bitcoin falls, then these funds will sell IBIT and buy back CME futures. These funds are in profit, and given basis is close to UST yields they will unwind during US hours and realise their profit. $70,000 I see you mofo!”