Now Reading: Watch Out For Bull Trap in Bitcoin (BTC), XRP, Dogecoin as S&P 500 Prints Rising Wedge, U.S. Inflation Looms

-

01

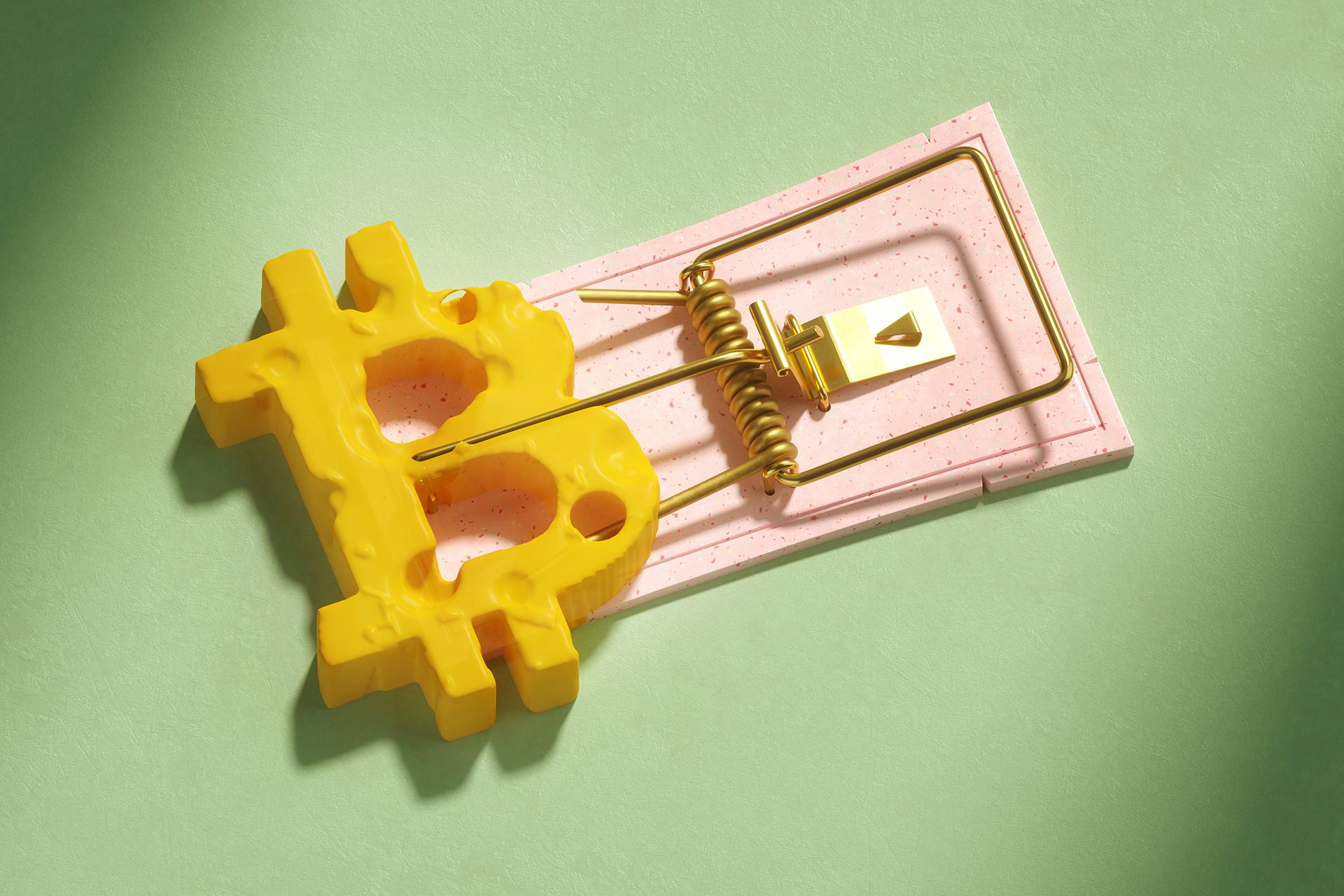

Watch Out For Bull Trap in Bitcoin (BTC), XRP, Dogecoin as S&P 500 Prints Rising Wedge, U.S. Inflation Looms

Watch Out For Bull Trap in Bitcoin (BTC), XRP, Dogecoin as S&P 500 Prints Rising Wedge, U.S. Inflation Looms

[ad_1]

This is a every day evaluation by CoinDesk analyst and Chartered Market Technician Omkar Godbole.

Major cryptocurrencies are trying bullish, with market chief bitcoin exhibiting a basic inverse head-and-shoulders breakout that might propel it towards $120,000.

But there is a catch. The every day chart for the S&P 500 E-Mini futures is displaying a bearish sample, indicating a possible sell-off that might weigh on the cryptocurrency market and entice bulls on the incorrect facet of the market.

S&P 500 hits document excessive with rising wedge

The E-mini futures have risen practically 5% to a document excessive of $6,542 since Aug. 1. The gradual ascent has taken the form of a rising wedge sample recognized by converging trendlines connecting July 31 and Aug. 15 highs and lows reached on Aug. 1 and Aug. 22.

The converging trendlines point out that bullish momentum is waning, growing the probability of a sell-off.

When requested to determine and analyze the sample on the S&P 500 futures, Google Gemini replied, “When a rising wedge, which is a bearish reversal pattern, appears after an extended rally to record highs, it significantly increases the probability of a sharp downside move. It suggests that buyers are exhausted and that the rally is running on fumes. The pattern indicates that the market is setting up for a major trend reversal rather than a simple pullback.”

Cryptocurrencies are recognized to carefully observe Wall Street sentiment, which signifies that a possible decline in the S&P 500 may weigh on bitcoin and different cryptocurrencies.

Inflation eyed

The odds of a breakdown in the S&P 500 may rise sharply if Thursday’s U.S. client worth index (CPI) prints hotter than anticipated. Such a end result, mixed with the latest labor market weak spot, could rekindle fears of stagflation—the worst-case situation for danger belongings—placing extra stress on equities and cryptocurrencies alike.

The median forecast for the U.S. Consumer Price Index (CPI) in August 2025 is a 2.9% year-over-year enhance (not seasonally adjusted), in response to FactSet. If this estimate holds true, it will likely be the very best annual rise since January 2025, when the CPI reached 3.0% and properly above the Fed’s 2% goal. Additionally, this 2.9% determine would surpass the trailing twelve-month common inflation fee of two.6%.

More importantly, the median estimate (year-over-year, not seasonally adjusted) for the core CPI, which excludes meals and vitality, is 3.1%.

BTC, ETH choices are already biased bearish

The 25-delta danger reversals tied to Deribit-lited bitcoin and ether choices had been adverse out to December expiry, in response to knowledge supply Amberdata. In different phrases, brief and near-dated BTC and ETH places traded at a premium to calls, reflecting a bias for draw back safety.

A put possibility protects the client from a decline in the worth of the underlying asset. A name offers an uneven bullish publicity. The 25-delta danger reversal includes the simultaneous buy of a put possibility and sale of a name, or vice versa.

According to Options Insights’ Founder, Imran Lakha, the put bias in BTC is probably going attributable to establishments inserting long-term hedges. Flows have continued to development decrease on the over-the-counter tech platform Paradigm.

“Flows again featured the [ETH] 26 Sep 4k put, lifted up to 73v,” Paradigm famous.

XRP is indecisive, DOGE seems north

While BTC’s inverse head-and-shoulders breakout suggests a powerful bullish course, XRP’s worth motion seems indecisive.

The payments-focused cryptocurrency stays locked in a descending triangle and continues to commerce throughout the Ichimoku cloud. Together, these indicators counsel a interval of consolidation and uncertainty.

A breakout from the triangle would possibly invite stronger shopping for stress, doubtlessly resulting in a re-test of $3.38, the swing excessive from Aug. 8. That mentioned, the descending triangle, by itself, is mostly thought-about a bearish sample. That’s as a result of the downward-sloping trendline connecting decrease highs signifies that sellers are progressively getting stronger and will quickly penetrate the horizontal assist stage.

Speaking of DOGE, it has retaken the bullish trendline from June lows, trapping sellers on the incorrect facet of the market. Additionally, costs have crossed into bullish territory above the Ichimoku cloud, which suggests scope for a check of the July excessive of 28.76 cents.

However, merchants nonetheless want to be careful for a possible rising wedge breakdown in S&P 500 futures, as a reversal there may cap positive aspects in DOGE and weigh on its worth momentum.

[ad_2]