Now Reading: What’s Next for Hyperliquid’s HYPE Token? What Wall Street and Analysts Are Saying

-

01

What’s Next for Hyperliquid’s HYPE Token? What Wall Street and Analysts Are Saying

What’s Next for Hyperliquid’s HYPE Token? What Wall Street and Analysts Are Saying

[ad_1]

Michael Saylor’s controversial bitcoin treasury technique is now not fringe — it’s being mimicked throughout company America. According to a latest Wall Street Journal report, firms have raised greater than $85 billion in 2025 to purchase cryptocurrencies for their company treasuries — greater than double the quantity raised in U.S. IPOs this yr.

Unlike in 2020, when MicroStrategy’s Saylor stood alone in promoting shares to purchase bitcoin, a brand new wave of firms — from toy producers to semiconductor companies — is executing comparable methods with institutional backing. Capital Group, Galaxy Digital, and D1 Capital are among the many companies pouring money into firms that increase funds to build up digital belongings immediately. The surge has prolonged past bitcoin to incorporate lesser-known tokens, typically with increased risk-reward profiles.

One of essentially the most distinguished examples is Hyperliquid Strategies Inc. (HSI), a public crypto treasury firm being fashioned to carry giant reserves of HYPE, the native token of the Hyperliquid blockchain.

How HSI Was Created: Atlas and Sonnet Join Forces

The HSI initiative was first disclosed on July 14, when Sonnet BioTherapeutics (SONN) introduced a reverse merger with Rorschach I LLC, a newly fashioned automobile backed by Atlas Merchant Capital, Paradigm, and different high-profile crypto traders. The deal will remodel Sonnet right into a platform for executing a company crypto treasury technique targeted not on bitcoin or ether — however on HYPE, the native token of the Hyperliquid blockchain.

Upon closing, the mixed entity will probably be renamed Hyperliquid Strategies Inc. (HSI) and proceed buying and selling on the Nasdaq Capital Market. HSI will initially maintain 12.6 million HYPE tokens, valued at $583 million on the time of signing, and will deploy a minimum of $305 million extra to accumulate extra HYPE on the open market. If absolutely executed, it will create one of many largest institutional reserves of a single altcoin ever disclosed.

According to Atlas CEO Bob Diamond, a former CEO of Barclays, who will chair the brand new firm, the chance is not only monetary — it's strategic. In his phrases, “We think HYPE is pretty special.” Diamond stated the staff believes Hyperliquid affords a differentiated providing within the digital asset house, and that HSI is uniquely positioned to make the most of it due to its mixture of crypto-native and conventional monetary management.

Matt Huang, co-founder of Paradigm, stated institutional demand for Hyperliquid has been rising, however famous that direct entry to the HYPE token continues to be restricted within the U.S.

While Sonnet will turn into an entirely owned subsidiary of HSI and proceed to handle its biotech applications, the corporate plans to divest non-core belongings. Existing traders will obtain contingent worth rights (CVRs) tied to Sonnet’s therapeutic portfolio.

The board of HSI will embody Bob Diamond and Eric Rosengren, the previous president of the Boston Federal Reserve, alongside incoming monetary management. The deal is backed by Galaxy Digital, Pantera Capital, D1 Capital, Republic Digital and 683 Capital, and is predicted to shut within the second half of 2025.

What Is Hyperliquid, and How Does the HYPE Token Work?

Hyperliquid is the title of a decentralized change (DEX) and a high-performance layer-1 blockchain launched in 2023. It was designed to supply the velocity and buying and selling expertise of centralized exchanges with the transparency and permissionless entry of decentralized finance (DeFi).

Its infrastructure consists of two core layers:

- HyperCore, which powers high-speed spot and perpetual futures buying and selling with on-chain order books —supporting over 200,000 orders per second.

- HyperEVM, a general-purpose good contract layer suitable with Ethereum, enabling builders to construct DeFi purposes that may work together with HyperCore’s liquidity.

HYPE is the native token of the Hyperliquid ecosystem. It is used for staking, governance, buying and selling incentives and because the core asset for worth seize throughout the community. As of the time of writing, HYPE is the fifteenth largest cryptocurrency by market capitalization and Hyperliquid has processed over $1 trillion in cumulative buying and selling quantity.

Analyst Commentary: Strong Fundamentals, Diverging Views

The surge in institutional consideration hasn’t settled the controversy round HYPE’s valuation — regardless of its sturdy rally earlier this quarter from a low of $37.41 to just about $50 (reached on July 14).

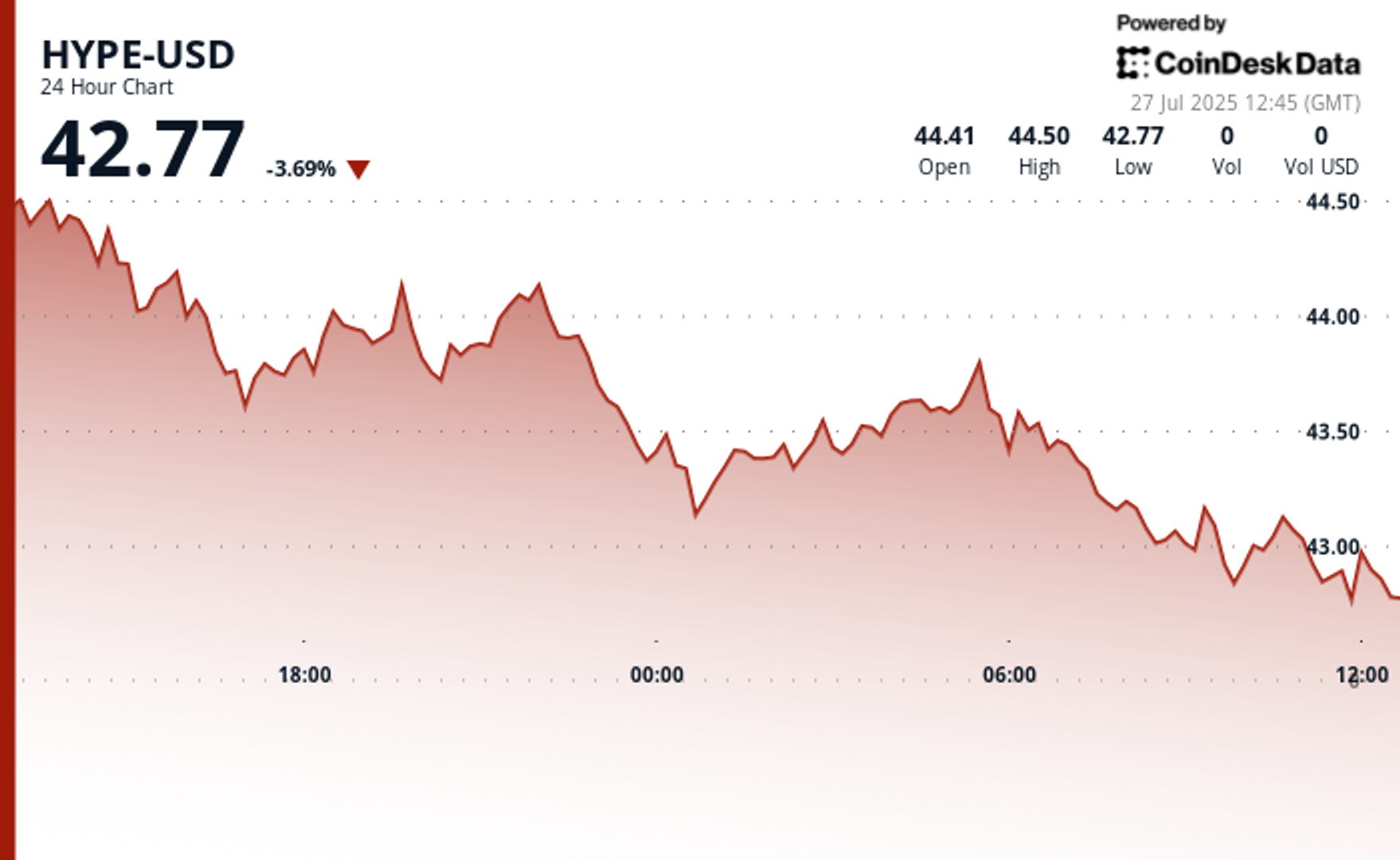

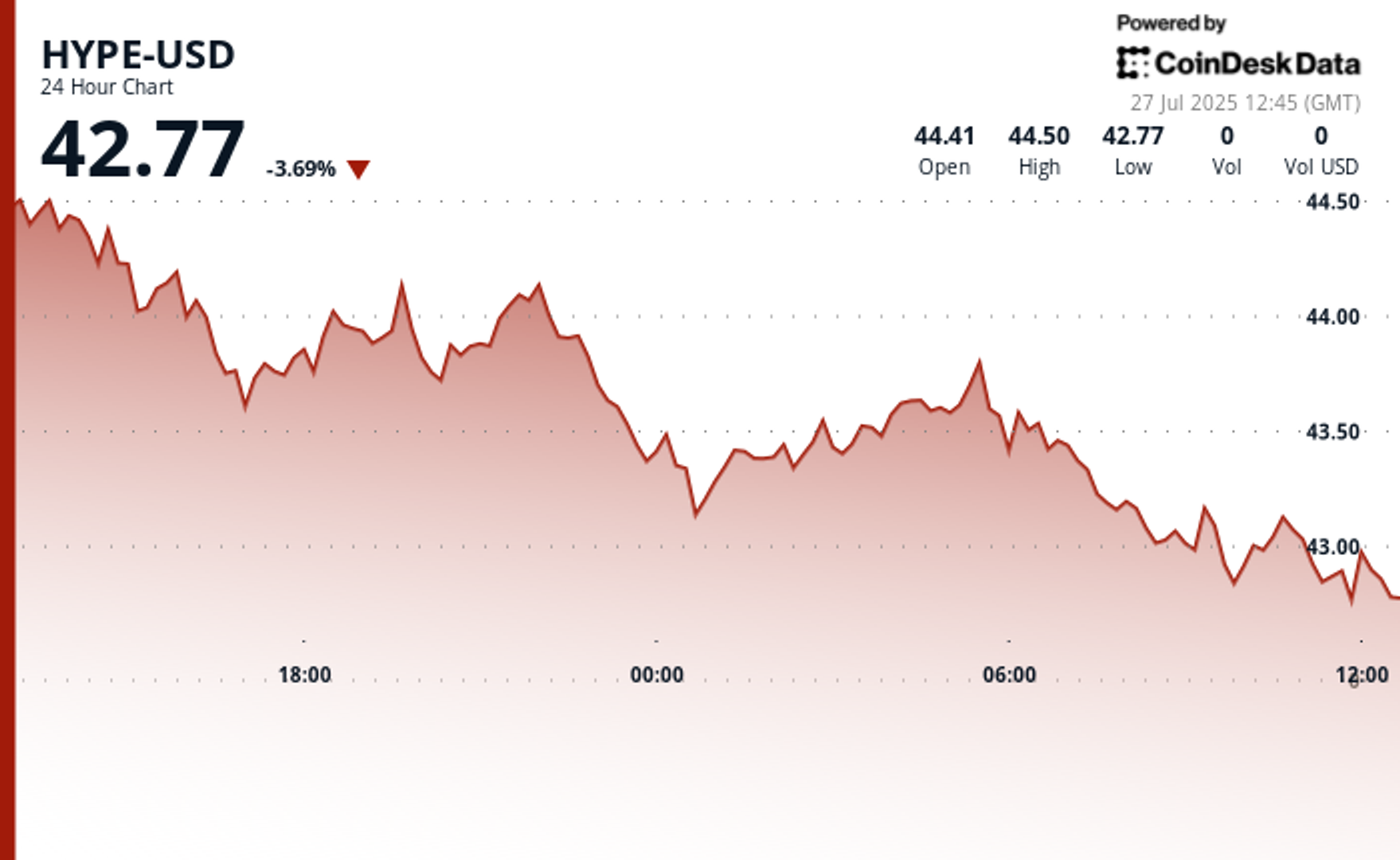

At the time of writing, in keeping with CoinDesk Data, HYPE is buying and selling at $42.77, down 3.69% prior to now 24-hour interval.

Crypto analyst “McKenna” recommended on Saturday that HYPE should still be undervalued based mostly on income metrics. He estimated that if the token have been buying and selling on the similar valuation a number of (often known as SWPE, or sales-weighted price-to-earnings) it reached throughout its final market peak, its present 30-day common income of $3.2 million would indicate a good worth of $77. His evaluation makes use of a ratio evaluating market cap to trailing platform income — a typical methodology in each fairness and token evaluation.

By distinction, “Altcoin Sherpa” signaled warning earlier at the moment. While he praised HYPE’s fundamentals — together with excessive consumer exercise, dependable tokenomics and sturdy staff execution — he said that the transfer from $9 to over $40 doubtless exhausted the short-term upside. He stated he was holding a small staking place for long-term publicity however was not actively accumulating extra at present costs. He recommended he’d wait for a extra substantial pullback earlier than growing his allocation.

The two views illustrate a key pressure: even with excessive revenues and institutional backing, tokens like HYPE can turn into overextended within the quick run — particularly when pushed by narrative momentum and speculative capital.

Institutional Altcoin Bets Are Just Getting Started

Whether HYPE continues climbing or cools from right here, the creation of Hyperliquid Strategies Inc (HSI) marks a turning level in how company crypto treasury methods are being executed. Unlike earlier fashions that targeted on bitcoin as a digital reserve asset, HSI is being constructed round a single altcoin that didn’t exist a yr in the past. With greater than $888 million in mixed token and money commitments, the construction resembles a thematic crypto fund — however with a public itemizing and institutional management.

If this method proves profitable, extra companies might observe — elevating capital not simply to carry crypto, however to take concentrated positions in tokens they consider will outline the following section of digital finance.

[ad_2]