Now Reading: XRP Climbs 4% as Fed Rate Cut Bets Hit 99% Probability

1

-

01

XRP Climbs 4% as Fed Rate Cut Bets Hit 99% Probability

XRP Climbs 4% as Fed Rate Cut Bets Hit 99% Probability

[ad_1]

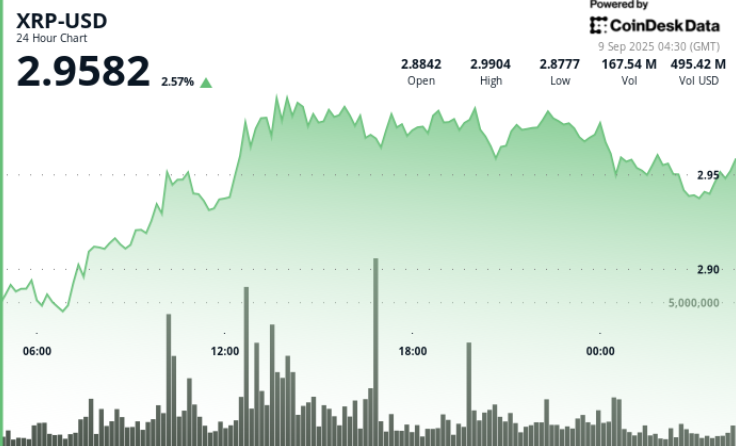

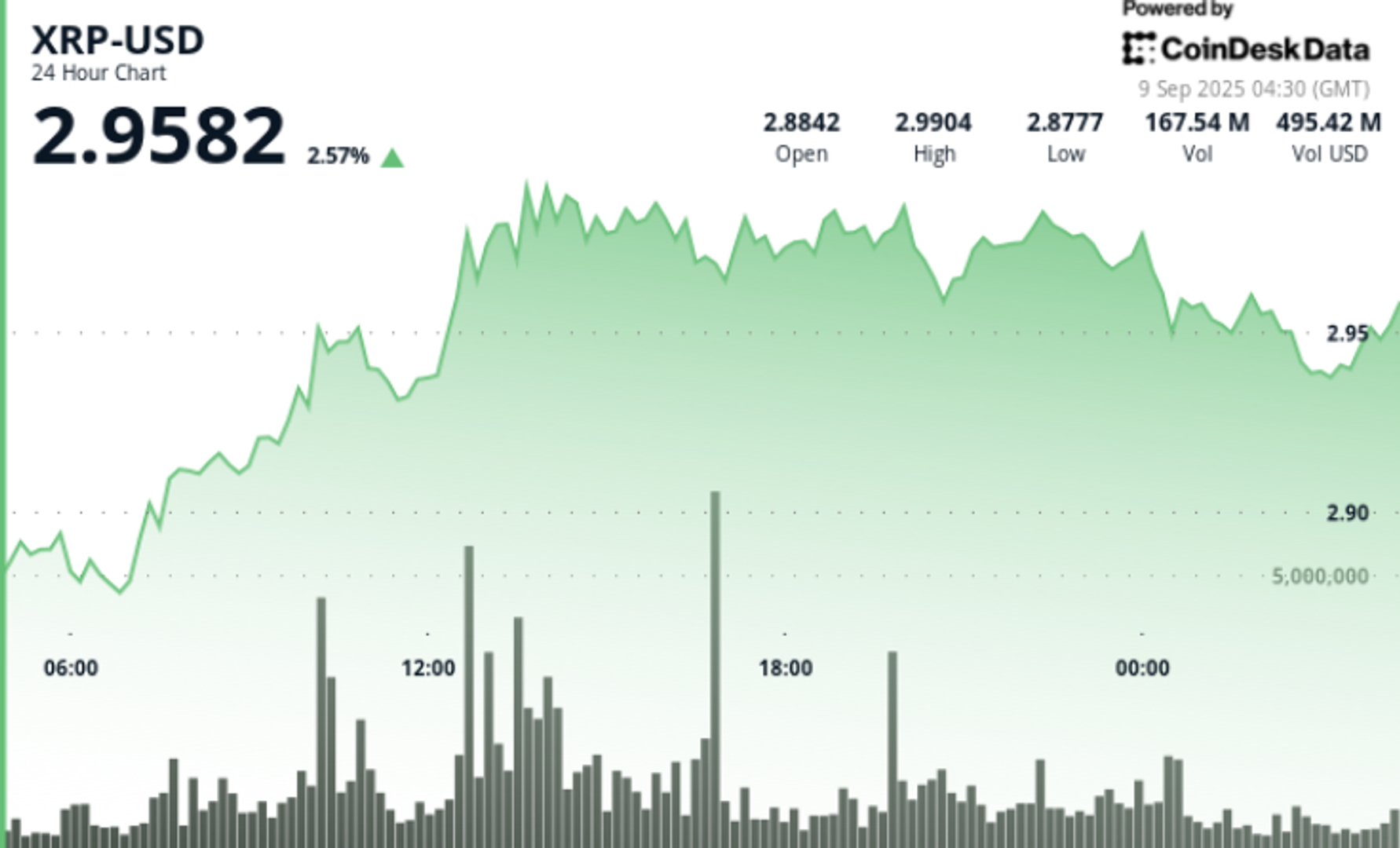

The digital asset rallied towards the $3.00 threshold on explosive quantity earlier than consolidating, as merchants positioned round upcoming macro catalysts and ETF rulings. Support has held agency above $2.88, however repeated failures close to $2.99 spotlight how institutional flows are dictating short-term ranges.

News Background

- Federal Reserve futures now suggest a 99% likelihood of a 25-bps lower on September 17, boosting crypto as a dollar-weakening commerce.

- Exchange reserves rose to a 12-month peak, signaling extra provide on exchanges even as whales accrued an estimated 10M XRP in quarter-hour through the breakout.

- Six spot XRP ETF purposes are pending SEC assessment in October, a structural catalyst merchants are monitoring.

Price Action Summary

- Session ran from September 8 04:00 to September 9 03:00.

- XRP superior from $2.89 to $2.995 intraday (+4%) earlier than closing at $2.95.

- Volume spiked to 159.63M at 13:00—almost 3x every day norms—confirming institutional participation.

- Support held a number of occasions at $2.88–$2.89, whereas $2.995–$3.00 was repeatedly rejected.

- Final hour noticed a grind greater: $2.94 → $2.95 (+0.34%) on 1.6M quantity, with greater lows exhibiting managed accumulation.

Technical Analysis

- Support: $2.88–$2.89 zone continues to draw consumers.

- Resistance: $2.995–$3.00 ceiling stays intact after a number of high-volume rejections.

- Momentum: RSI regular in mid-50s = neutral-to-bullish bias.

- MACD: Histogram converging towards bullish crossover, per accumulation.

- Pattern: Price compressing inside a consolidation channel below $3.00. A confirmed shut above $3.00–$3.05 might goal $3.30–$3.50.

What Traders Are Watching

- Ability to shut above $2.99–$3.00. Bulls desire a clear every day settlement above the zone to flip resistance into help.

- Fed assembly on Sept. 17. A 25-bps lower is totally priced; something bigger or delayed might alter crypto liquidity expectations sharply.

- Whale inflows. Roughly 340M tokens reportedly accrued in latest weeks. Traders are gauging whether or not this continues into ETF choice season.

- SEC’s October ETF rulings. Six purposes, together with from Grayscale and Bitwise, might remodel institutional entry and reprice XRP’s structural demand.

[ad_2]