Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Getty Photographs

Getty PhotographsInflation has hit the Financial institution of England’s goal for the primary time in virtually three years.

Costs rose at 2% within the yr to Could, down from 2.3% the month earlier than, official figures present.

The economic system is a key speaking level within the run-up to the overall election on 4 July, with the entire important events battling over how they’d preserve the price of residing beneath management.

The Conservatives stated their “troublesome choices” have been paying off, however Labour stated pressures on household funds have been “nonetheless acute”.

The drop in Could’s inflation determine was pushed by a slight fall in costs for meals and delicate drinks, and slower value rises for recreation and tradition and furnishings and family items.

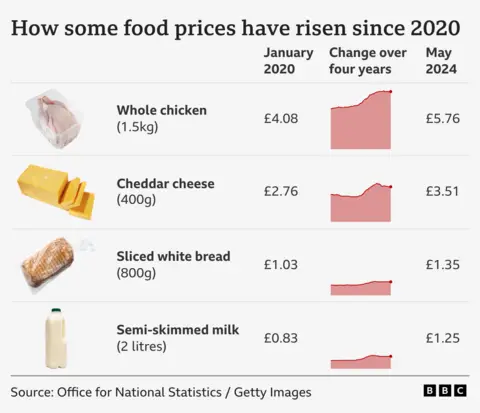

Nonetheless, petrol costs are rising once more, and meals costs are nonetheless 25% larger than originally of 2022.

The inflation determine comes forward of the Financial institution of England’s newest choice on UK rates of interest this Thursday.

The financial institution is anticipated to carry the speed at 5.25% – a 16-year excessive – for the seventh assembly in a row. Markets usually are not betting on a reduce till August.

Inflation has fallen steadily since October 2022, when Russia’s invasion of Ukraine triggered it to peak at 11.1% as meals and gasoline costs soared.

However tens of millions of households are nonetheless fighting the price of residing.

Despite the fact that inflation is falling, it doesn’t imply the costs of products and providers total are coming down, simply that they’re rising at a slower tempo.

The Financial institution of England has additionally put up rates of interest to attempt to dampen down shopper demand, driving up mortgage charges and rents.

Offical figures on renting – additionally launched on Wednesday – confirmed common rents paid to personal landlords within the UK rose by 8.7% within the yr to June.

In the meantime, even with the inflation price falling, mortgage charges stay stubbornly excessive as lenders look ahead to the Financial institution of England’s subsequent and subsequent strikes on rates of interest.

Gary Wildman, the proprietor of John Wildman & Sons butchers, advised the BBC he had seen value rises levelling out on the retailer he began together with his dad 31 years in the past in Rustington, West Sussex.

“Costs are in all probability 10 to fifteen% greater than they have been originally of Covid, however they’re stage now, positively,” he advised the BBC.

Nonetheless, he stated some merchandise resembling pork have been nonetheless going up whereas the store’s vitality payments have been larger than a number of years in the past.

“You do take successful to your margins,” he stated. “You’ll be able to’t move all prices on to clients or the purchasers would not are available.”

Could’s inflation determine is the final large official financial statistic earlier than the overall election and has sparked important debate among the many important events.

The Conservatives declare the figures again up their story of an financial turnaround – though the query for them politically is whether or not they get any credit score for the autumn.

Chancellor Jeremy Hunt stated the UK’s inflation price was now decrease than “practically all” main economies.

“That may not have occurred beneath Labour that refused to sentence the general public sector pay strikes, that will have meant inflationary pay rises, inflation lasting longer,” he added.

However Labour proceed to press issues about an ongoing price of residing disaster.

Rachel Reeves, Labour’s shadow chancellor, stated: “Not like Conservative ministers, I’m not going to say that the whole lot is all tremendous, that the price of residing disaster is over, as a result of I do know that pressures on household funds are nonetheless acute”.

Liberal Democrat Treasury spokeswoman Sarah Olney stated tens of millions of individuals would not be feeling any higher off.

“Rishi Sunak’s boasts will ring hole to numerous households seeing their mortgages skyrocket and agonising rises in buying costs in comparison with just some years in the past.”

UK inflation is now rising at its slowest tempo since July 2021.

It is usually decrease than within the eurozone and the US, the place charges have been 2.6% and three.3% in Could respectively.

Nonetheless, the UK will not be out of the woods but, with value rises within the providers sector nonetheless excessive.

Yael Selfin, chief economist at KPMG UK, stated providers inflation was nonetheless “uncomfortably excessive” and the Financial institution would want to see a continued fall earlier than reducing charges.

David Bharier, head of analysis at foyer group the British Chambers of Commerce, stated Could’s inflation determine supplied “extra weight for an rate of interest reduce within the coming months”.