Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Getty Photographs

Getty Photographs“Bear in mind when Labour elevated the state pension by solely 75p?” asks a Conservative video advert on Fb, contrasting this with the £3,700 enhance for the reason that Tories got here into authorities in 2010.

However that is deceptive, as a result of it compares an increase within the weekly quantity over a single 12 months with the rise within the annual worth over 14 years.

It is a message the Conservatives are pushing exhausting. BBC Confirm evaluation of the advert library information of Meta, Fb’s guardian firm, suggests they’ve run 975 variations of this single marketing campaign message – simply altering the title of the city or metropolis being focused – since 21 June 2024.

The video ends with the assertion: “Pensioners will at all times be higher off with the Conservatives – don’t danger all of it with Labour’s retirement tax”.

This can be a reference to a different declare about private tax allowances for pensioners.

Here is a breakdown of the claims within the much-promoted marketing campaign video.

The 75p enhance pertains to the rise within the weekly worth of the fundamental state pension – the older type of the pension at present being claimed by folks of their 70s and over – for a single individual enacted in Gordon Brown’s Funds in 2000.

This was in keeping with 1.1% Retail Value Index inflation in September 1999, used on the time to uprate the fundamental state pension.

That took the weekly worth of the fundamental state pension from £66.75 to £67.50, a rise of 75p.

This low uprating prompted an outcry and stress on the then Labour authorities to be extra beneficiant to pensioners.

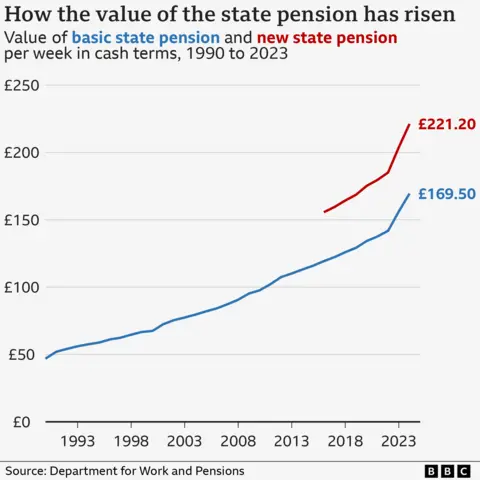

The present worth of the fundamental state pension is £169.50 per week. This works out at £8,814 per 12 months.

In 2010, when the Conservatives entered authorities, the worth of the fundamental state pension was £97.65 per week, or £5,078 per 12 months.

So between 2010 and 2024 the annual worth of the state pension rose by £3,736.

Which means of their Fb adverts the Conservatives are evaluating a rise within the weekly worth of the fundamental state pension in a single 12 months below the earlier Labour authorities with a rise within the annual fundamental state pension below the Conservatives over 14 years.

Though pension will increase had been decrease below Labour, the hole is just not as nice because the advert suggests. The common annual uprating of the fundamental state pension below Labour (between April 1998 and April 2010) was 3.5%, in comparison with the 4% common annual uprating below the Conservatives (between April 2011 and April 2024).

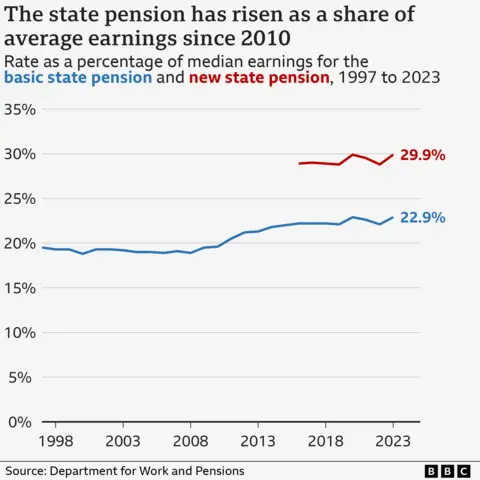

And the Conservatives have elevated the worth of the state pension relative to common earnings because of their post-2010 Triple Lock coverage.

This has ensured (besides in 2022-23 when it was quickly suspended) that the state pension has risen in keeping with common wages, Shopper Value Index inflation or 2.5%, whichever is highest.

In 2010 the fundamental state pension was price 19.6% of median common earnings. In 2023 that had risen to 22.9%.

The Tory Fb advert additionally references one thing referred to as “Labour’s retirement tax”, which misleadingly implies Labour is imposing an additional tax.

On the latest official Workplace for Funds Duty projections, some pensioners present solely on the state pension are probably heading in the right direction to pay revenue tax in 2027-28.

That is as a result of the annual worth of the brand new state pension in that 12 months (£12,578) is forecast to marginally overtake the tax-free private allowance (£12,570), which has been frozen by the Conservative authorities.

After the election was referred to as, the Conservatives introduced the “Triple Lock Plus” coverage – elevating the private allowance just for pensioners to £13,710 by 2027-28.

Labour haven’t mentioned but whether or not they may match it or not, however it could be disingenuous to indicate Labour is imposing an additional tax.

Moreover, evaluation by the previous Lib Dem pensions minister Steve Webb, who now works for the actuary agency LCP, means that round 2.5m pensioners (one in 5 of the overall) would nonetheless be paying revenue tax on their state pension even when the Triple Lock Plus had been launched.

That is as a result of many individuals obtain extra state pension funds because of their participation within the State Earnings Associated Pension Scheme (SERPS).

The worth of the state pension is determined by the purpose at which a person reached state pension age.

Those that reached this age earlier than 6 April 2016 are sometimes entitled to the flat-rate fundamental state pension of £169.50 per week in 2024-25, although many may even have some earnings-related state pension after constructing entitlements throughout their working life.

These reaching the state pension on or after 6 April 2016 are sometimes entitled to the flat-rate new state pension of £221.20 per week.