Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

[ad_1]

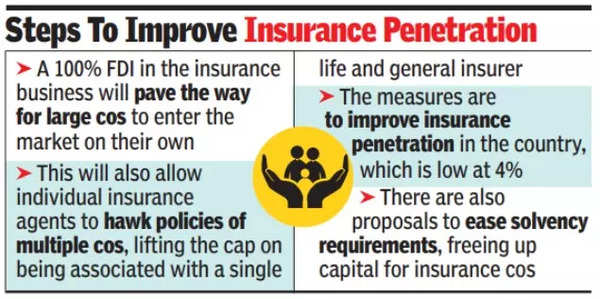

NEW DELHI: Authorities is all set to permit 100% overseas direct funding in insurance coverage enterprise, paving the best way for big firms to enter the market on their very own, whereas permitting particular person insurance coverage brokers to hawk insurance policies of a number of firms, lifting the cap on being related to just one life and basic insurer.

The dual measures are a part of the Insurance coverage Modification Invoice that’s proposed to be launched through the winter session of Parliament that kicks off later this month.

On August 19, TOI was the primary to report in regards to the proposed improve within the FDI ceiling, a suggestion which was publicly made by Insurance coverage Regulatory & Improvement Authority of India (Irdai) chief Debasish Panda earlier this month, linking it with “Insurance coverage For All by 2047”.

Whereas the present ceiling for insurance coverage firms is 74%, for intermediaries, the cap has already been eased. There are presently two dozen life insurance coverage firms, 26 basic insurers, six standalone medical health insurance outfits with Normal Insurance coverage Company being the only reinsurer.

To permit extra firms to underwrite insurance policies

The 2 proposals are a part of the technique to enhance the insurance coverage penetration within the nation, which is low at 4%, by permitting extra firms to underwrite insurance policies, whereas additionally unleashing brokers to promote covers, each life and basic. At present, brokers are already providing merchandise of a number of firms however as a substitute of doing it instantly, they have their partner or different members of the family to register as brokers for different firms.

The evaluation within the govt is that the big Indian gamers – starting from SBI, ICICI and HDFC Financial institution to the Tatas and the Birlas – are already entrenched and provided that life insurance coverage is a long-gestation, excessive funding enterprise, there is probably not too many home firms with deep pockets to speculate. Moreover, a number of the giant gamers similar to Allianz is parting methods with Indian associate Bajaj Finserv and should enter by itself.

Along with elevating the FDI ceiling different stipulations on administrators are additionally proposed to be eased, sources mentioned.

A number of different amendments are additionally deliberate. For example, Irdai has proposed amendments to permit for issuing composite licenses, a transfer that may profit the likes of state-owned Life Insurance coverage Company of India, which is eager on buying a medical health insurance outfit to broaden its product portfolio. If the proposal goes by way of, the identical firm can concern life and non-life covers.

Equally, there are proposals to ease the solvency necessities, releasing up capital for insurance coverage firms.

[ad_2]

Supply hyperlink